Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

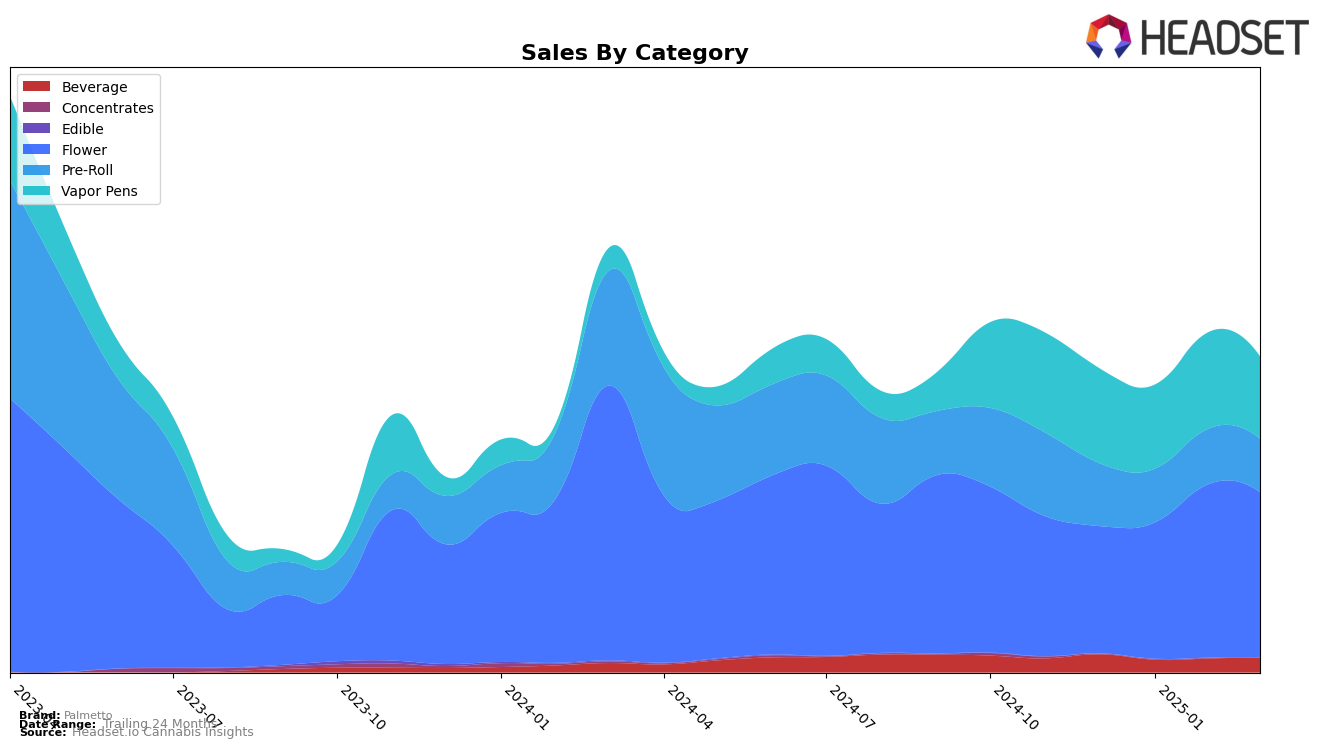

Palmetto has shown mixed performance across different categories and provinces in recent months. In Alberta, the brand's Flower category has seen a significant improvement in rankings, moving from 97th in December 2024 to 62nd by March 2025. This upward trajectory is mirrored in their Vapor Pens category, where they climbed from 64th to 51st over the same period. However, despite these gains, Palmetto is still not within the top 30 brands in these categories in Alberta, indicating room for further growth. In British Columbia, Palmetto's Flower category maintained a strong presence, improving its rank from 25th to 20th, while their Vapor Pens saw a slight decline from 20th to 26th, suggesting a need for strategic adjustments in the latter category.

In Ontario, Palmetto's performance in the Beverage category has been noteworthy, climbing from 20th to 15th place, suggesting a strengthening position in this market segment. The Flower category also improved from 68th to 57th, but the Pre-Roll category did not make it into the top 30 in December 2024, only appearing from January 2025 onwards, indicating a late but emerging presence. Meanwhile, in Saskatchewan, Palmetto's Flower category showed resilience, maintaining a position within the top 30, despite missing a ranking in January 2025. The Pre-Roll category, however, did not sustain a top 30 position past December 2024, suggesting challenges in maintaining market traction in this segment.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Palmetto has demonstrated a notable upward trend in brand rank from December 2024 to March 2025. Starting at rank 25 in December, Palmetto climbed to 18 by February, before slightly dropping to 20 in March. This upward movement in rank is indicative of a positive reception in the market, especially when compared to competitors like Tweed, which saw a decline from rank 12 in December to 19 in March. Similarly, Highly Dutch and MTL Cannabis experienced a downward trend, with Highly Dutch falling from 16 to 22 and MTL Cannabis from 15 to 21 over the same period. Meanwhile, Woody Nelson maintained a relatively stable position, only slipping from 13 to 18. Palmetto's sales trajectory, with a peak in February, suggests a strong market presence and potential for continued growth, contrasting with the declining sales of its competitors, which may be struggling to maintain consumer interest.

Notable Products

In March 2025, the top-performing product for Palmetto was Orange Vanilla Cream Soda (10mg THC, 355ml) in the Beverage category, maintaining its number one rank for four consecutive months, with sales reaching 7218 units. The Strawberry Cough Pre-Roll 10-Pack (4g) held steady in the second position, consistently performing well since December 2024. Strawberry Cough (3.5g) emerged in March 2025 to claim the third spot in the Flower category, marking its debut in the rankings. The Pink Vanilla Cream Soda (10mg THC, 355ml) slipped to fourth place from its previous third-place position, while the Strawberry & Kiwi 3-in-1 Distillate Disposable (1g) remained stable at fifth place. This data highlights a strong preference for beverage products, with notable stability in pre-roll sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.