Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

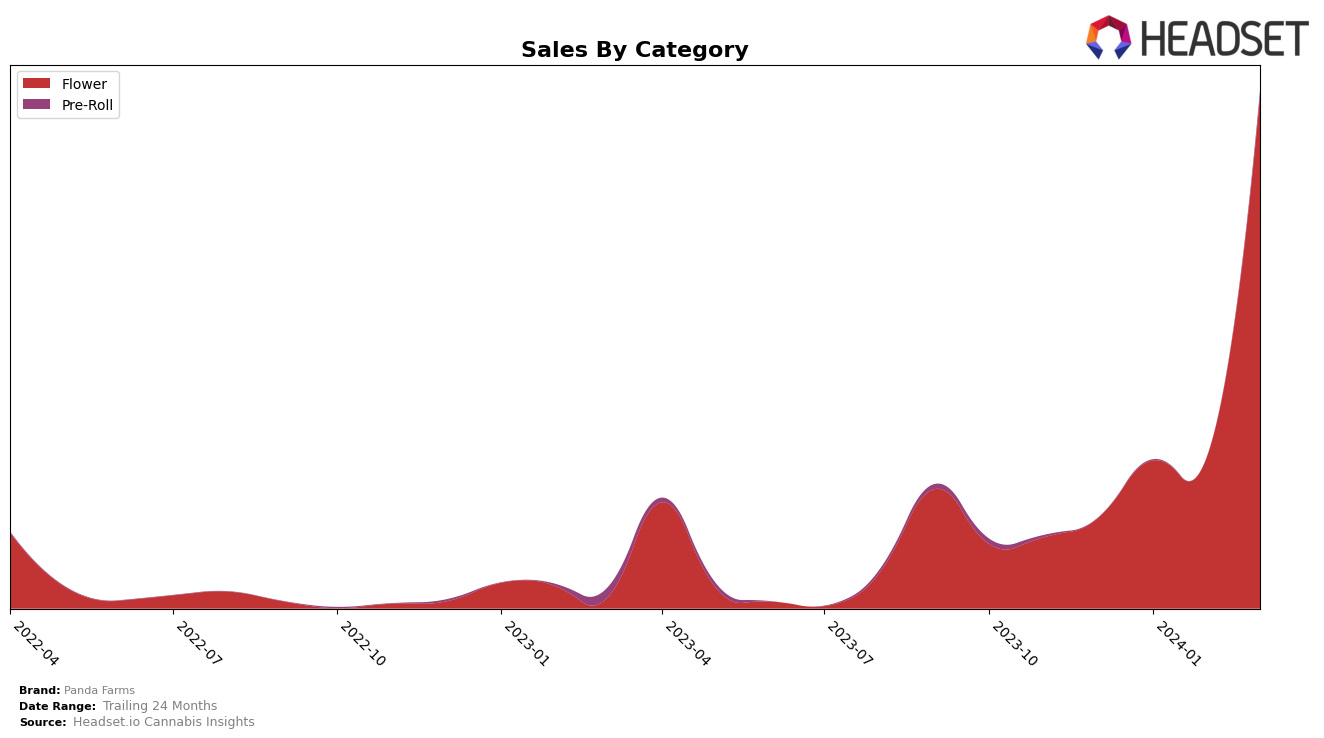

In Oregon, Panda Farms has shown a notable presence in the Flower category, marking its entry into the competitive landscape. The brand managed to secure a position in the top 30 rankings by March 2024, a significant achievement indicating a positive reception and growing consumer interest within the state. This upward trajectory is underscored by their sales figures, which reached $215,978 in March 2024 alone. The absence of ranking data for December 2023 through February 2024 suggests that Panda Farms was not among the top 30 brands in those months, highlighting a remarkable turnaround in their market performance and visibility in a short span.

The journey of Panda Farms in Oregon's cannabis market is a testament to the brand's strategic movements and potential to capture consumer attention. The lack of data for the preceding months before March 2024 could be viewed as a period of growth and adjustment for the brand, culminating in its successful ranking within the Flower category. This performance is especially significant given the competitive nature of the Oregon cannabis market, where numerous brands vie for a spot in the coveted top 30 rankings. While specific sales details and rankings for the months leading up to March are not disclosed, the singular sales detail for March 2024 provides a glimpse into the brand's promising trajectory and market acceptance.

Competitive Landscape

In the competitive landscape of the Oregon flower cannabis market, Panda Farms made a notable entry in March 2024, securing the 30th rank. This debut is significant amidst fluctuating dynamics among competitors. Derby's Farm, despite a strong performance in earlier months, saw a decline to the 40th position by March 2024, indicating a potential opportunity for Panda Farms to capture market share. Conversely, Gnome Grown Organics demonstrated resilience and growth, moving up to the 22nd position by February 2024 before slightly dropping to 28th in March, showcasing robust competition. Decibel Farms also showed an upward trajectory, breaking into the top 30 by February and maintaining a close 29th rank in March. The market's dynamics, characterized by these shifts among leading brands, underscore a competitive environment where Panda Farms' recent entry and positioning could either leverage the declining performance of some brands or face challenges from those gaining momentum.

Notable Products

In March 2024, Panda Farms saw Bubba Fett (Bulk) from the Flower category as its top-selling product, with a significant sales volume of 3417 units, marking its position at the top of the rankings. Following closely, Hash Burger (Bulk), also from the Flower category, secured the second position with its consistent performance over the past months. Notably, Watermelon Zkittlez Pre-Roll (1g) made a remarkable entry into the rankings, landing directly in the third spot, indicating a strong consumer preference for Pre-Roll products. The rankings for March also introduced Hash Burger (3.5g) and Super Boof (Bulk) in the fourth and fifth positions, respectively, showcasing a diversified interest across different product forms within the Flower category. This month's data highlights a dynamic market with Bubba Fett (Bulk) leading the sales and new entries signaling changing consumer trends.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.