Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

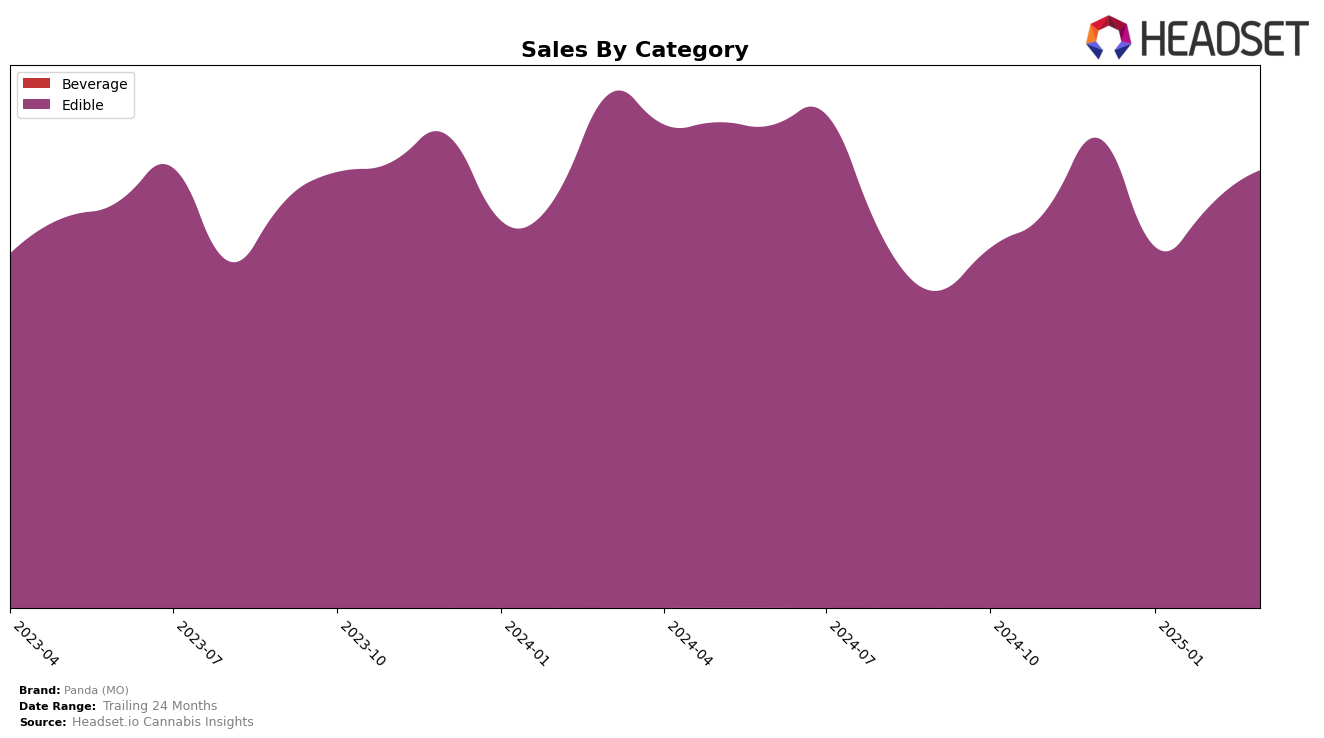

Panda (MO) has demonstrated consistent performance in the Edible category within Missouri, maintaining a steady rank of 6th place from December 2024 through March 2025. This stability in ranking suggests a strong foothold in the Missouri market, despite fluctuations in monthly sales figures. For instance, while the brand experienced a dip in sales from December to January, they managed to recover in the subsequent months, indicating resilience and effective market strategies. However, it is important to note that Panda (MO) did not appear in the top 30 brands in other categories, which could be a potential area for growth or diversification.

In terms of geographic presence, Panda (MO) is currently focused on Missouri, as no data is available for other states or provinces. This concentration might be strategic, allowing the brand to consolidate resources and strengthen its market share in a single location. Nonetheless, the absence of rankings in other states suggests that Panda (MO) has yet to expand its reach beyond Missouri, which could limit its growth potential. Observing how Panda (MO) navigates these dynamics in the coming months will be crucial for understanding its long-term strategy and potential for scalability.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Missouri, Panda (MO) maintains a steady position, consistently ranking 6th from December 2024 through March 2025. Despite its stable rank, Panda (MO) faces significant competition from brands like Wana and Good Day Farm, which hold higher ranks at 5th and 3rd respectively. Notably, Zen Cannabis has shown a remarkable upward trend, improving its rank from 14th in December 2024 to 7th by February 2025, indicating a potential threat to Panda (MO) if this trajectory continues. Meanwhile, Illicit / Illicit Gardens remains stable at 8th, posing less immediate pressure. Panda (MO)'s sales figures show fluctuations, with a notable dip in January 2025, but a recovery by March 2025, suggesting resilience amidst competitive pressures. This analysis highlights the importance for Panda (MO) to strategize effectively to maintain its position and potentially improve its rank in the Missouri edible market.

Notable Products

In March 2025, the top-performing product from Panda (MO) was the THC/CBN 1:1 Snoozeberry Fruit Gummies 20-Pack, maintaining its number one rank from February with notable sales of 3903 units. The CBD/THC 2:1 Indica Blueberry Bliss Gummies 20-Pack held steady at the second position, showing consistent performance with 3030 units sold. Mixed Berry FECO Gummies 20-Pack (500mg) climbed to the third rank, improving from fourth place in February. Sativa Mango Punch Feco Fruit Gummies 20-Pack rose from fifth in January to fourth in March, demonstrating an upward trend in popularity. Lastly, the Mixed Berry FECO Gummies 20-Pack (100mg) entered the rankings at fifth place for March, indicating a new entrant gaining traction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.