Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

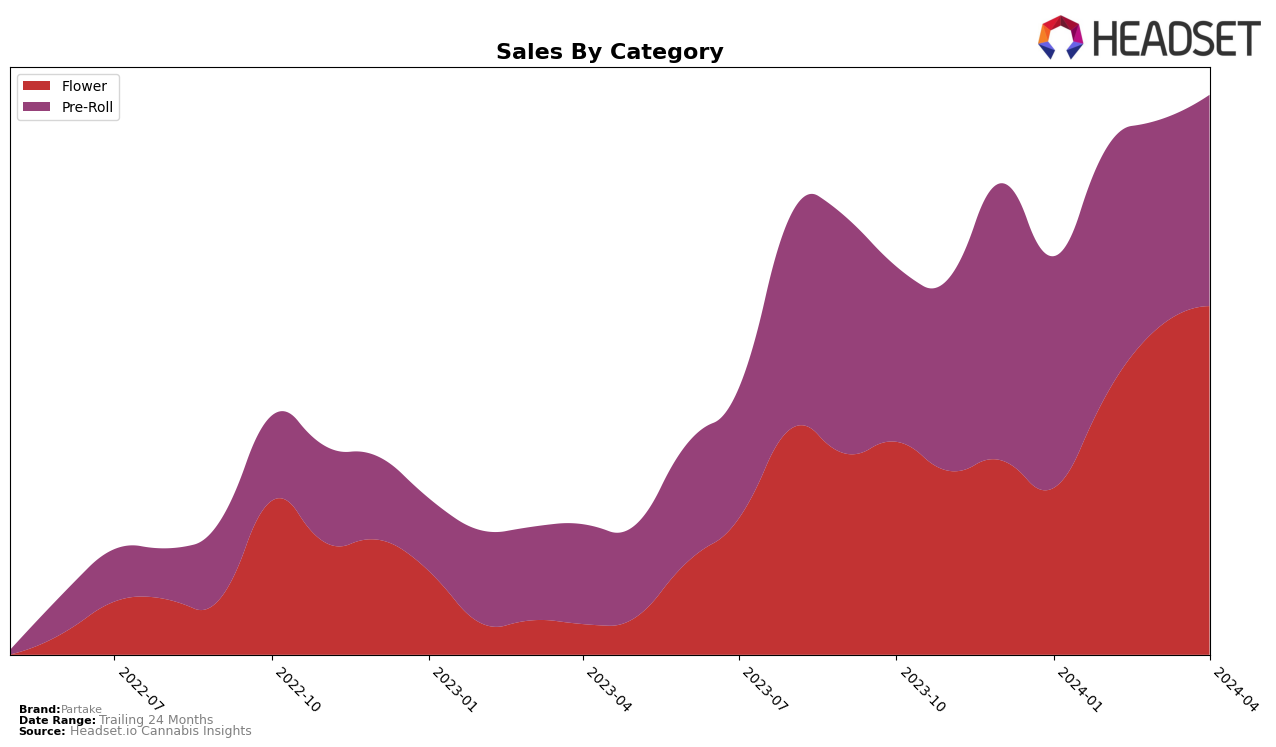

In the Alberta market, Partake has shown a notable performance across different cannabis categories, particularly in Flower and Pre-Roll. For the Flower category, Partake has demonstrated a positive trajectory, moving from a rank of 47 in January 2024 to 27 by April 2024. This upward movement indicates a growing preference for Partake's Flower offerings among consumers in Alberta, with sales increasing from 110,053 in January to 232,535 by April. However, the story is slightly different in the Pre-Roll category, where the brand maintained a stable rank at the beginning of the year (31 in January and February) but then slipped to rank 41 in March and April. This shift suggests a potential challenge for Partake in maintaining its market position within the Pre-Roll category, despite a modest increase in sales from January to February.

Comparing the performance across categories, it's evident that while Partake is gaining ground in the Flower category, it faces challenges in the Pre-Roll segment within the Alberta market. The difference in ranking movements highlights the brand's varying success rates across categories, suggesting that consumer preferences for Partake products are not uniform. This discrepancy in performance also points to the competitive nature of the cannabis market in Alberta, where brand positioning can significantly impact sales and market share. The absence of Partake from the top 30 brands in any other state or province for the months in question either indicates a focused market strategy on Alberta or a need to expand its footprint and consumer base in other regions. This analysis underscores the importance of category-specific strategies for cannabis brands looking to capture and retain market share in a highly competitive environment.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Partake has shown a notable upward trajectory in its rankings over the recent months, moving from not being in the top 20 in January 2024 to securing the 27th position by April 2024. This rise in rank is indicative of a significant increase in sales, suggesting an improving market position relative to its competitors. Noteworthy competitors include Virtue Cannabis, Dab Bods, and Next Friday, which have also shown fluctuations in their rankings but remained within closer proximity to the top 20 throughout the same period. Particularly, Next Friday experienced a notable peak in March, ranking 21st, before seeing a slight decline. The directional trend for Partake suggests a growing consumer interest and market share, despite the competitive pressures from these established brands, which either held a steady position or experienced more variability in their rankings and sales.

Notable Products

In April 2024, Partake's top-selling product was the Orange Squeeze Pre-Roll 3-Pack (1.5g) within the Pre-Roll category, maintaining its number one rank from the previous two months with notable sales of 2711 units. Following closely, the Apricot Frost Pre-Roll 3-Pack (1.5g) also held steady in its position, ranking second across the board since January 2024. The Punch Mints Pre-Roll 3-Pack (1.5g) secured the third spot consistently from February to April, demonstrating stable preference among consumers. Breaking into the top rankings, Apricot Frost (7g) from the Flower category made a significant entrance in April, landing at the fourth position. Lastly, Unicorn Poop (7g), another Flower category product, has shown a slight improvement, moving up to rank fifth in April from its previous lower positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.