Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

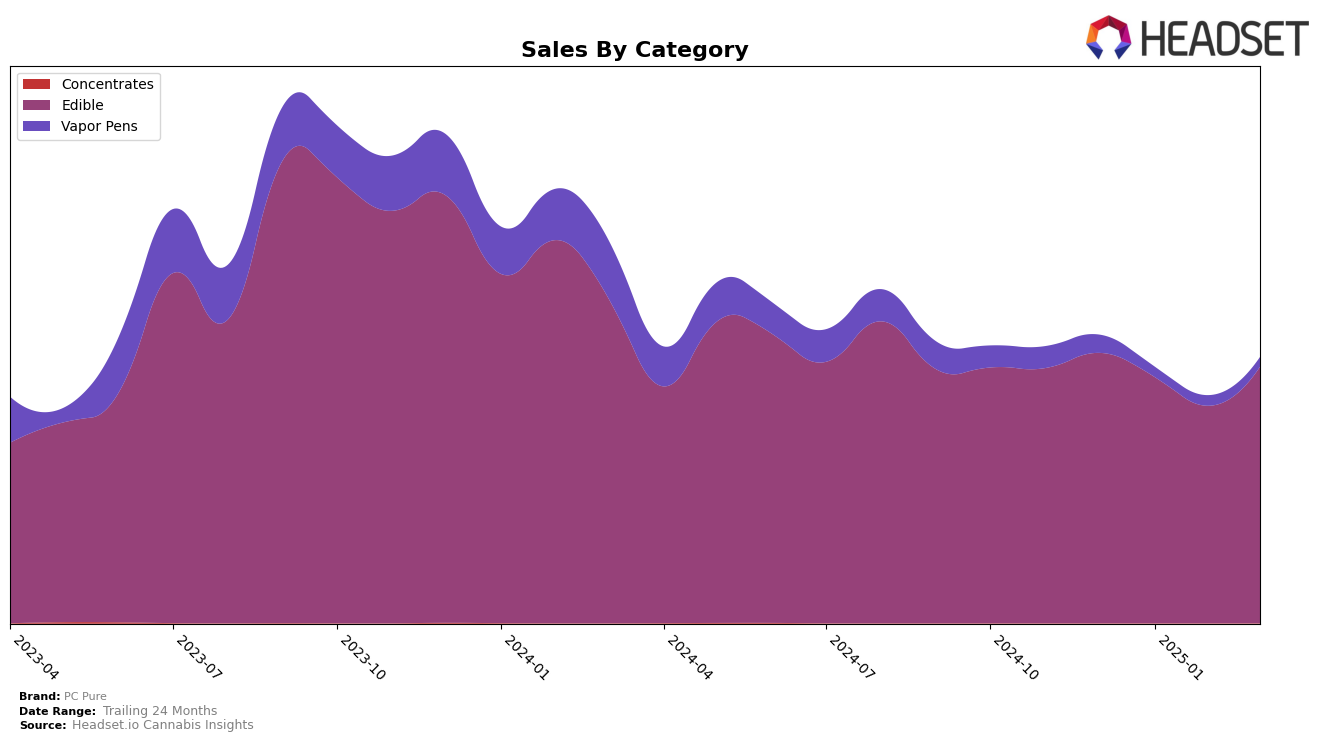

PC Pure has shown a consistent presence in the Edible category within Michigan. Over the months from December 2024 to March 2025, the brand maintained a steady ranking, beginning at 18th place and slightly improving to 17th in March. This indicates a stable market position, suggesting that while their sales might have experienced some fluctuations, their relative performance compared to competitors has been stable. Notably, the brand did not drop out of the top 30, which can be seen as a positive indication of their resilience in a competitive market.

Despite the consistent ranking, PC Pure's sales figures in Michigan's Edible category showed a downward trend from December 2024 to February 2025, before experiencing a recovery in March 2025. This movement suggests that while the brand has managed to hold its ranking, there are underlying challenges in maintaining or increasing sales volume. The ability to recover sales after a dip highlights potential strategic adjustments or market responses that could be explored further. However, without additional data from other states or categories, it's unclear if this trend is isolated to Michigan or indicative of a broader pattern for PC Pure.

Competitive Landscape

In the competitive landscape of the edible category in Michigan, PC Pure has shown a consistent presence, maintaining its rank at 18th place for December 2024 through February 2025, before slightly improving to 17th place in March 2025. This steady performance is notable given the dynamic shifts among its competitors. For instance, Mojo (Edibles) demonstrated a strong upward trajectory, climbing from 19th in January 2025 to 15th by March 2025, indicating a robust increase in sales. Meanwhile, Cannalicious Labs also improved its rank from 20th in December 2024 to 16th in March 2025, suggesting a competitive edge over PC Pure. On the other hand, Lost Farm experienced a decline, dropping from 14th place in December 2024 to 18th by March 2025, which aligns with PC Pure's slight rank improvement. This competitive analysis highlights the importance for PC Pure to strategize effectively to maintain and improve its market position amidst the fluctuating dynamics of the Michigan edibles market.

Notable Products

In March 2025, Michigan Cherry Gummies 20-Pack (200mg) emerged as the top-performing product for PC Pure, climbing from third place in the previous two months to secure the number one spot with sales reaching 7593 units. Sativa Strawberry Kiwi Gummies 10-Pack (200mg) also saw a significant improvement, moving up from fifth place in February to second place, with sales recorded at 7038 units. Michigan Cherry Gummies 10-Pack (200mg) dropped to third place in March, despite previously holding the top rank in December and January. Pineapple Gummies 10-Pack (200mg) entered the top five for the first time, securing the fourth position. Orange Sherbet Gummies 20-Pack (200mg) rounded out the top five, marking its debut on the list with solid sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.