Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

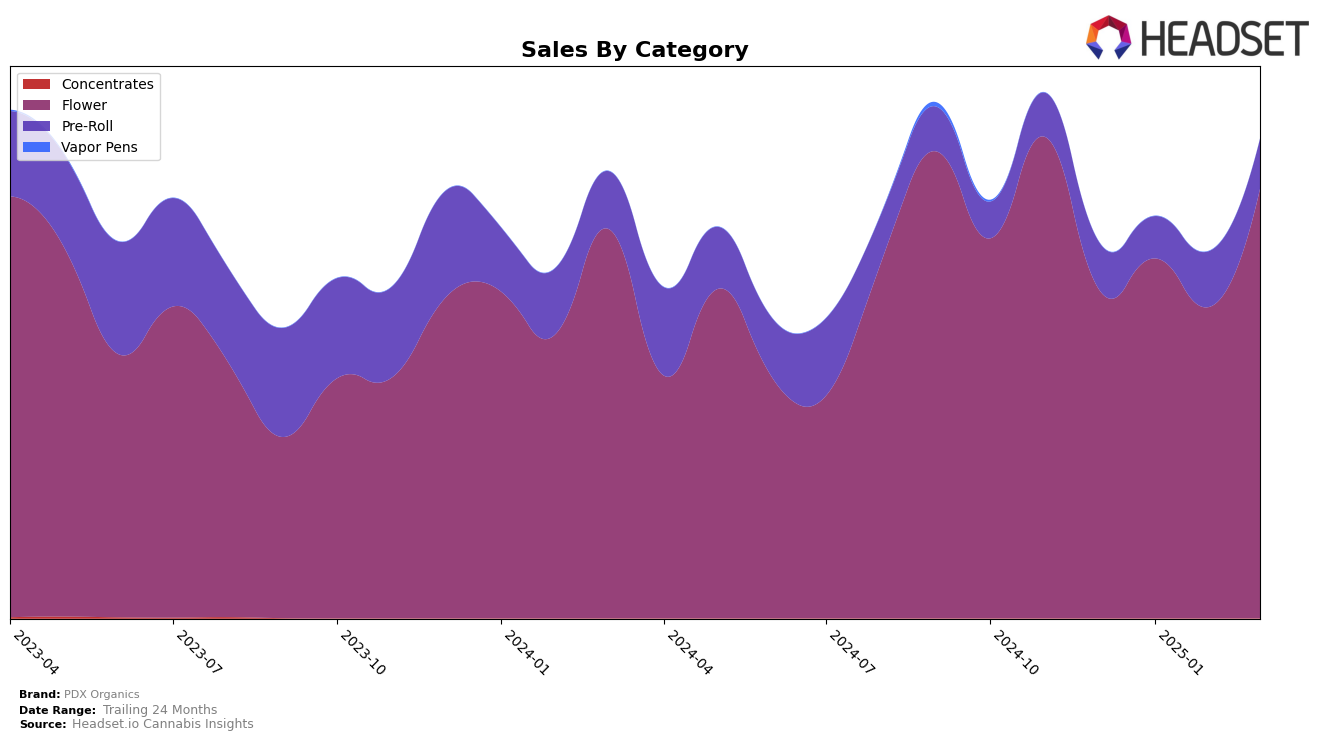

PDX Organics has shown a notable trend in the Oregon market, particularly in the Flower category. Over the past few months, the brand has climbed the rankings from 22nd place in December 2024 to 13th place by March 2025. This upward trajectory is supported by a significant increase in sales, reaching $355,809 in March. The consistent improvement in rank suggests a growing consumer preference for PDX Organics' Flower products, which could be attributed to product quality or effective distribution strategies. However, the brand's absence in the top 30 in other states or provinces indicates potential areas for growth and market penetration.

In contrast, the Pre-Roll category presents a different picture for PDX Organics in Oregon. Despite experiencing fluctuations in rankings, moving from 54th in December to 57th in March, there was a relative increase in sales in February. The brand's inability to consistently maintain a top 30 position in this category suggests challenges in capturing market share or competition from other brands. This inconsistency could be a result of varying consumer preferences or competitive pricing strategies from rivals. The absence from the top 30 in other states for both categories could indicate a concentration of efforts in Oregon or a need to explore new markets for expansion.

Competitive Landscape

In the competitive landscape of the Oregon flower market, PDX Organics has shown a notable upward trajectory in rankings from December 2024 to March 2025. Starting from a rank of 22 in December, PDX Organics climbed to 13 by March, indicating a significant improvement in market positioning. This upward movement is particularly impressive given the performance of competitors like Eugreen Farms, which saw a decline from rank 7 in January to 15 in March, and Deep Creek Gardens, which fluctuated but ultimately improved to 12 in March. Meanwhile, Cultivated Industries maintained a relatively stable position, ending March at rank 14. Despite not being in the top 20 initially, PDX Organics' March sales surpassed those of Eugreen Farms, showcasing a robust growth trend that could potentially disrupt the current market dynamics if sustained.

Notable Products

In March 2025, the top-performing product from PDX Organics was Platinum Candy Mintz (Bulk) in the Flower category, maintaining its position as the number one ranked product from January 2025. Following it, Apple Jelly (Bulk) secured the second spot in March, marking its debut in the rankings. Blue Dream (Bulk) and Orange Julius (Bulk) took the third and fourth positions, respectively, both entering the rankings for the first time. Trop Cherry Gas (Bulk), which held the top rank in February, dropped to fifth place in March with sales figures of 1000.0. This shift indicates a dynamic change in consumer preferences within the Flower category over recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.