Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

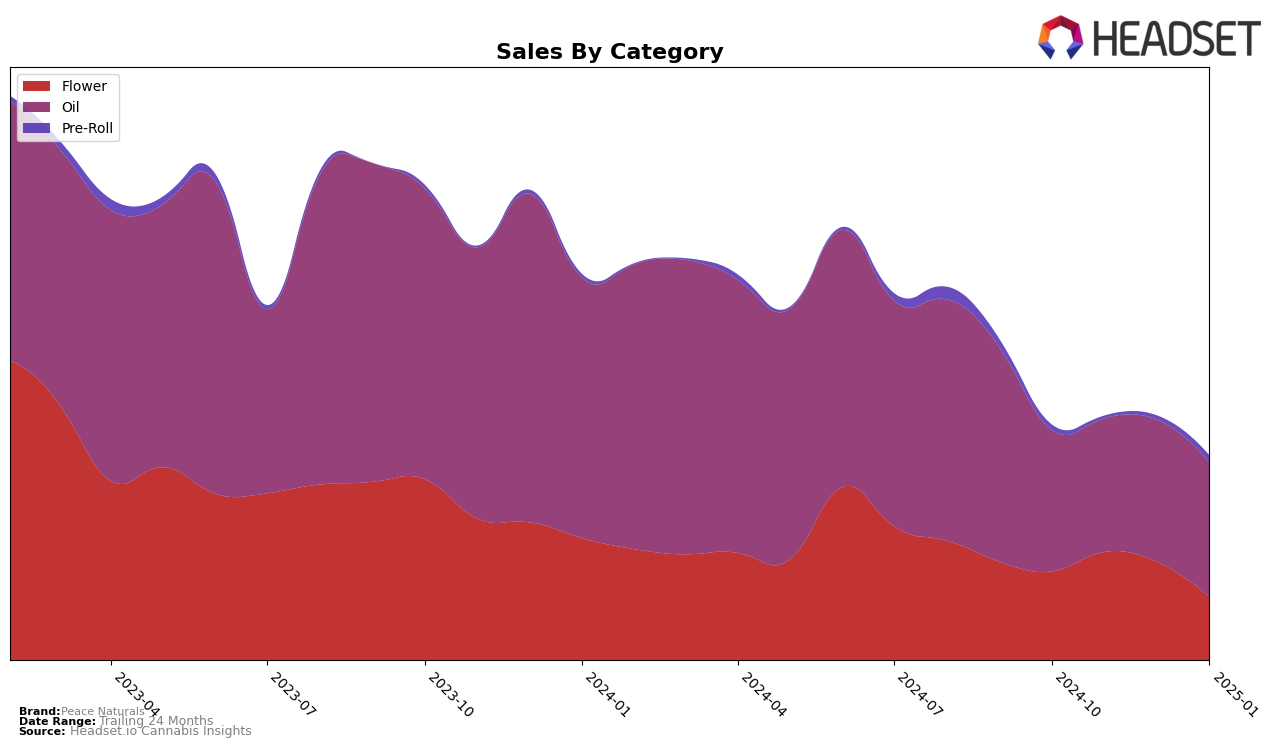

Peace Naturals has demonstrated a notable performance in the Oil category across different provinces. In Alberta, the brand saw an improvement in its ranking, moving from 12th place in October 2024 to 11th in January 2025. This upward trajectory is indicative of growing consumer preference or strategic market maneuvers by the brand. In contrast, the brand's presence in Ontario has been less consistent. Despite maintaining a steady 20th rank in October and November, Peace Naturals slipped to 22nd in December, and its absence from the top 30 in January suggests a significant decline in market competitiveness or consumer demand during that period.

The sales data for Peace Naturals further highlights these trends. In Alberta, there was a positive movement in sales from October to January, with sales figures rising from approximately $10,092 to $10,988, supporting the brand's improved ranking. Meanwhile, in Ontario, sales figures show a consistent decline from October to December, which aligns with the drop in rankings. The absence of data for January in Ontario might suggest a further decline, emphasizing the challenges Peace Naturals faces in maintaining its market position in this province. These insights provide a glimpse into the brand's varying performance across regions, hinting at underlying factors that can be explored for a more comprehensive understanding.

Competitive Landscape

In the Alberta oil category, Peace Naturals has demonstrated a notable fluctuation in its market position over the past few months. Starting at rank 12 in October 2024, Peace Naturals was absent from the top 20 in November and December, indicating a temporary dip in visibility and sales. However, by January 2025, it rebounded to rank 11, suggesting a recovery in market presence. This fluctuation is significant when compared to competitors like Solei and Five Founders, both of which maintained consistent ranks of 11 and 10 respectively during the same period. Meanwhile, Twd. consistently outperformed Peace Naturals, holding ranks between 7 and 9. The data suggests that while Peace Naturals experienced a temporary setback, its ability to climb back up in January indicates potential resilience and a positive trend that could be leveraged for future strategic planning.

Notable Products

In January 2025, Peace Naturals' top-performing product was CBD Peppermint 75 Oil (25ml) in the Oil category, maintaining its consistent first-place ranking from previous months despite a sales drop to 646 units. Blueberry (3.5g) in the Flower category improved its position from third to second place, reflecting a steady increase in popularity. Blue Dream (3.5g), also in the Flower category, experienced a slight decline, moving from second to third place. GMO Cookies Pre-Roll 3-Pack (1.5g) re-entered the rankings in fourth place, showing a resurgence in sales. CBD 25 Peppermint Oil (25ml) maintained its fifth-place position from December, indicating stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.