Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

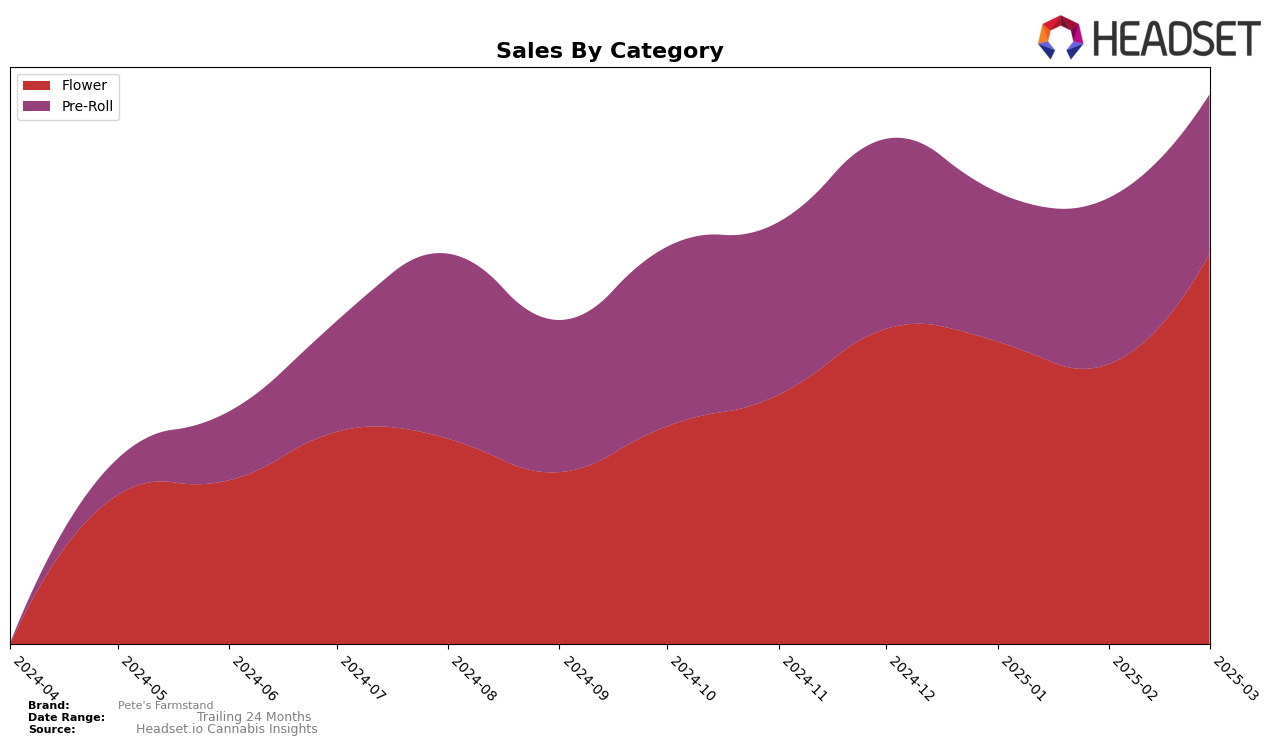

In the state of New Jersey, Pete's Farmstand has demonstrated notable performance in the Flower category. The brand showed an upward trajectory, moving from the 11th spot in December 2024 to the 8th position by March 2025. This improvement in ranking is accompanied by a significant increase in sales, indicating a strengthening market presence. However, it is worth noting that while the brand maintained its position within the top 10 throughout the first quarter of 2025, their sales experienced a dip in January and February before rebounding in March. This fluctuation suggests potential seasonal variations or promotional strategies impacting consumer demand.

In the Pre-Roll category, Pete's Farmstand has consistently held a strong position in New Jersey, ranking 8th in December 2024 and March 2025, with a slight improvement to 7th in February 2025. This stability in the rankings highlights the brand's solid foothold in the Pre-Roll market. Despite this consistency, sales figures reveal a decline from December to January, followed by a recovery in February and March. This pattern suggests potential market dynamics at play, such as shifts in consumer preferences or competitive pressures. The ability to maintain a top 10 rank while navigating these challenges underscores Pete's Farmstand's resilience and adaptability in the competitive New Jersey cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Pete's Farmstand has shown a promising upward trajectory in terms of rank and sales. From December 2024 to March 2025, Pete's Farmstand improved its rank from 11th to 8th, indicating a positive reception in the market. This upward movement is particularly noteworthy given the competitive pressure from brands like Triple Seven (777), which fluctuated between 10th and 13th place, and Clade9, which consistently maintained a position within the top 10. Despite these competitors, Pete's Farmstand's sales saw a significant increase in March 2025, surpassing its earlier performance and suggesting a strengthening brand presence. While Crops and (the) Essence remained strong contenders, Pete's Farmstand's ability to climb the ranks amidst such competition highlights its growing appeal and market share in New Jersey's Flower category.

Notable Products

In March 2025, Pete's Farmstand's top-performing product was Mendo OG Pre-Roll (1g) in the Pre-Roll category, which ascended to the number one rank, achieving sales of 6301 units. Peanut Butter Trix Pre-Roll (1g) followed closely in second place, maintaining a strong presence from the previous month. Heir Heads Pre-Roll (1g) made a notable leap to third place after not being ranked in February. Z Pie Pre-Roll (1g) entered the rankings at fourth place, while Paloma Spritz Pre-Roll (1g) dropped to fifth place from its previous fourth position in February. Overall, March saw a reshuffling in the rankings, with Mendo OG Pre-Roll (1g) emerging as the leader.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.