Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

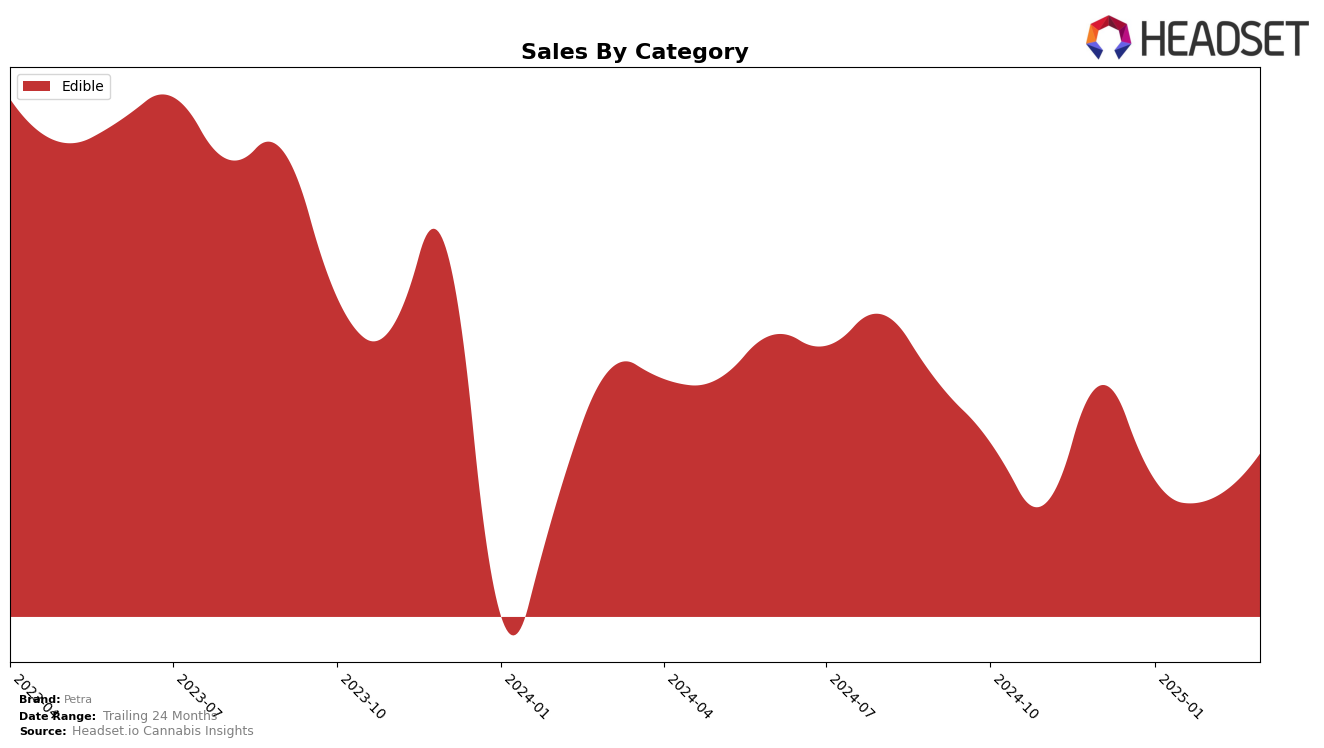

Petra's performance in the California edibles market remains relatively stable, consistently ranking within the top 20 from December 2024 to March 2025. Despite a slight dip in sales during January and February, Petra managed to recover by March. In contrast, the brand's presence in Michigan also shows consistency, maintaining a rank around the mid-20s, with sales indicating a similar recovery pattern from a dip in January. However, in Massachusetts, Petra's ranking was not within the top 30 for February and March, signaling potential challenges in gaining traction in that market.

In Illinois, Petra's edibles have shown a gradual upward movement, improving its rank from 62 in December 2024 to 56 in March 2025, suggesting a positive trend in consumer acceptance. Meanwhile, Ohio presents a slightly different picture, where Petra's rank fluctuated between 35 and 38 over the same period, indicating a more volatile market presence. The absence of rankings in Massachusetts for the latter months could be a concern for Petra, as it suggests a need for strategic adjustments to penetrate the market effectively. Overall, Petra's performance varies significantly across states, with some markets showing promise and others requiring more focused efforts.

Competitive Landscape

In the competitive landscape of the California edible market, Petra has maintained a relatively stable position, with its rank fluctuating slightly between 18th and 19th place from December 2024 to March 2025. This stability contrasts with the dynamic movements of competitors such as Gold Flora, which made a significant leap from 54th to 18th place during the same period, indicating a rapid increase in market presence and sales. Meanwhile, Clsics consistently held a higher rank than Petra, maintaining positions between 15th and 17th, suggesting a steady consumer preference. Happy Fruit and Big Pete's Treats showed more volatility, with Happy Fruit dropping to 21st in March 2025 and Big Pete's Treats re-entering the top 20. These shifts highlight the competitive pressure Petra faces, particularly from rapidly ascending brands like Gold Flora, which could impact Petra's sales if the trend continues. Petra's consistent ranking suggests a loyal customer base, but the brand may need to innovate or adjust strategies to counteract the rising competition and maintain or improve its market position.

Notable Products

In March 2025, Petra's Moroccan Mints 40-Pack (100mg) maintained its top position as the best-selling product, with sales reaching 12,090 units. The THC/CBN 2:1 Blackberry Mints 40-Pack (100mg THC, 40mg CBN) consistently held the second rank for the fourth consecutive month. Tart Cherry Mints 20-Pack (100mg) saw an improvement, climbing to third place from its previous fifth position, indicating a resurgence in popularity. The THC/CBN 2:1 Blackberry Mints 40-Pack (80mg THC, 40mg CBN) remained steady at the fourth rank, showing stable demand. Meanwhile, Tart Cherry Mints 40-Pack (100mg) dropped to fifth place, continuing a downward trend from its second-place ranking in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.