Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

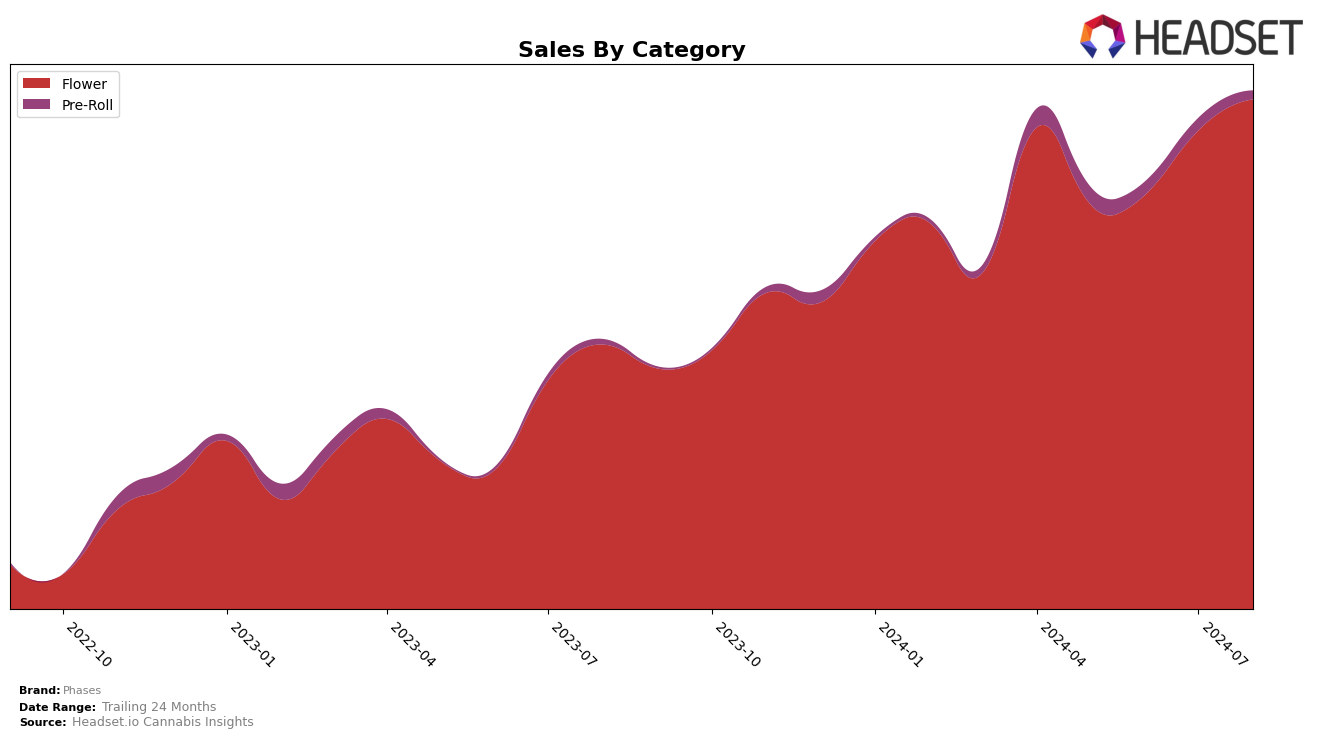

Phases has shown notable improvement in the Flower category across California. Starting from a rank of 49 in May 2024, the brand climbed to 28 by August 2024. This upward trajectory indicates a strong market presence and increasing consumer preference over the summer months. The significant jump from 31 to 28 between July and August, in particular, suggests that Phases is gaining momentum and could potentially break into the top 20 if this trend continues. However, it is important to note that despite this progress, Phases was not within the top 30 brands in other states or categories during this period, which highlights areas for potential growth and market expansion.

The steady performance in California is further underscored by the increase in sales figures, which rose from $630,433 in May to $792,505 in August. This consistent growth in sales aligns with the brand’s improving rank, reflecting a robust demand for Phases' Flower products. While the brand has made significant strides in California, its absence from the top 30 in other states and categories suggests that Phases has yet to replicate this success elsewhere. This presents both a challenge and an opportunity for the brand to leverage its strengths in California to explore and penetrate new markets.

Competitive Landscape

In the competitive California Flower category, Phases has shown a notable upward trend in rank and sales over the past few months, moving from 49th in May 2024 to 28th in August 2024. This improvement is significant when compared to competitors like Decibel Gardens and Mr. Zips, who also saw rank improvements but not as pronounced. For instance, Decibel Gardens moved from 37th to 29th, while Mr. Zips climbed from 57th to 30th. Meanwhile, A Golden State and Delighted have shown more stability in their ranks, with A Golden State consistently staying within the top 30 and Delighted experiencing a slight decline from 19th to 27th. Phases' consistent rise in rank and sales indicates a growing market presence and consumer preference, positioning it as a strong contender in the California Flower market.

Notable Products

In August 2024, Super Berry Crush (3.5g) reclaimed its position as the top-performing product for Phases, having previously been ranked second in June and July. Dream Catcher (3.5g) moved down to second place after holding the top spot for the previous two months, with notable sales of 2868 units. Super Berry Crush (7g) debuted in third place, indicating a strong market entry. Retrograde - Cherry Runtz (3.5g) maintained steady performance, consistently ranking fourth from June to August. Phases x Vibration - Hawaiian Headband (3.5g) saw a slight dip, moving from fourth in July to fifth in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.