Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

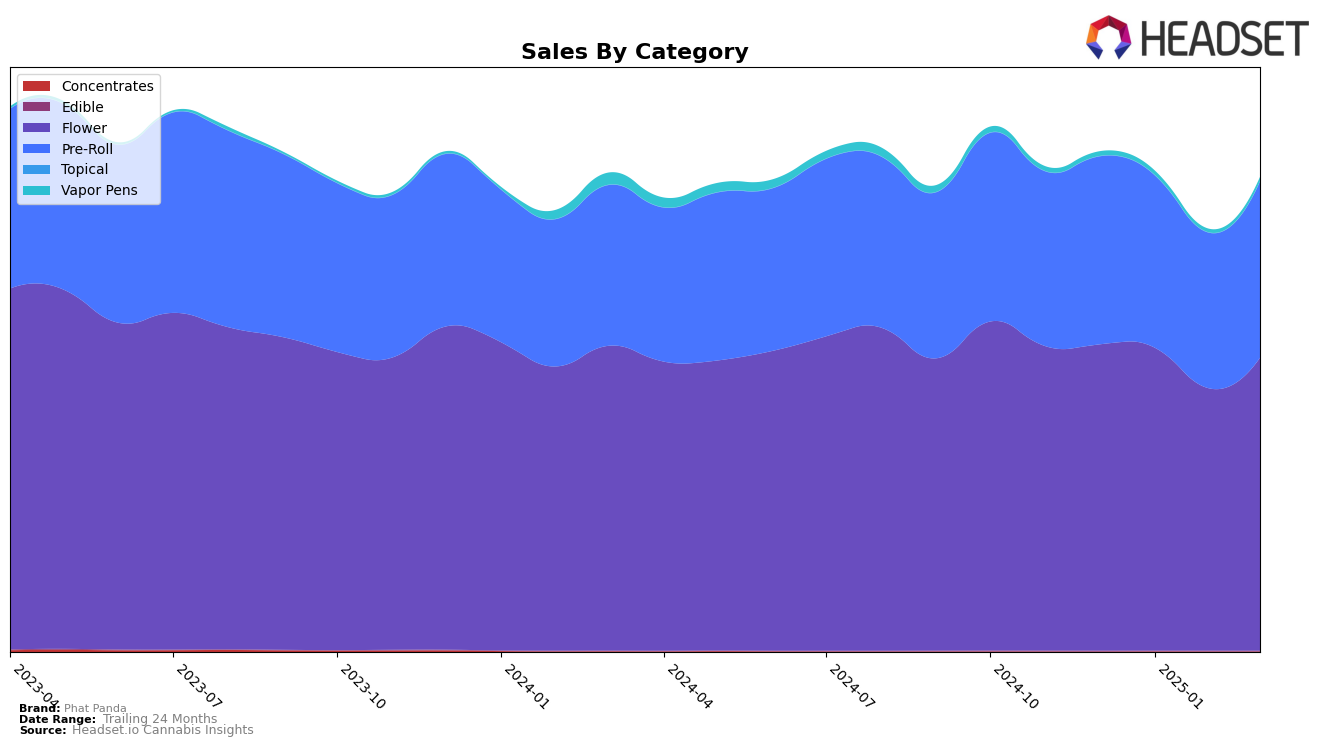

Phat Panda has demonstrated consistent dominance in the cannabis market, particularly in the state of Washington. Within the Flower category, Phat Panda has maintained the top ranking from December 2024 through March 2025, showcasing its strong market presence and consumer preference. Despite a slight dip in sales during February, the brand quickly rebounded in March, indicating resilience and effective market strategies. This unwavering performance in Flower suggests that Phat Panda has successfully captured consumer loyalty in Washington, a key market for cannabis products.

In the Pre-Roll category, Phat Panda mirrors its Flower success by holding the number one rank consistently over the same period in Washington. While there was a noticeable decline in sales from December to February, the brand experienced a recovery in March, which is indicative of strategic adjustments or seasonal demand fluctuations. The absence of Phat Panda in the top 30 rankings for other states or provinces in these categories highlights a potential area for growth or a strategic focus on maintaining dominance in Washington. This concentrated regional success could serve as a foundation for future expansion strategies.

Competitive Landscape

In the competitive landscape of the Washington flower market, Phat Panda has consistently maintained its position as the top-ranking brand from December 2024 through March 2025. Despite a slight dip in sales in February 2025, Phat Panda's dominance remains unchallenged, with sales figures significantly higher than its competitors. Notably, Legends holds the second position consistently, yet its sales are less than half of Phat Panda's, indicating a substantial lead for Phat Panda. Meanwhile, Artizen Cannabis fluctuates between the third and fifth positions, showing variability in its market presence. This stability in rank and sales for Phat Panda suggests a strong brand loyalty and market strategy, positioning it as a formidable leader in the Washington flower category.

Notable Products

In March 2025, the top-performing product from Phat Panda was OG Chem Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank consistently for four months, with a notable sales figure of 30,549. Bangers - Golden Pineapple Pre-Roll 2-Pack (1g) also held steady at the second spot throughout this period. Platinum - Trophy Wife Pre-Roll (1g) climbed to the third position in March, up from fourth in January, showing a positive trend in its sales performance. The Platinum Line - Trophy Wife Pre-Roll 28-Pack (28g) followed a similar upward trajectory, moving from fifth in January to fourth in March. Meanwhile, Platinum - Golden Pineapple (3.5g) saw a slight drop, falling to fifth place in March after holding the third spot in January and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.