Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

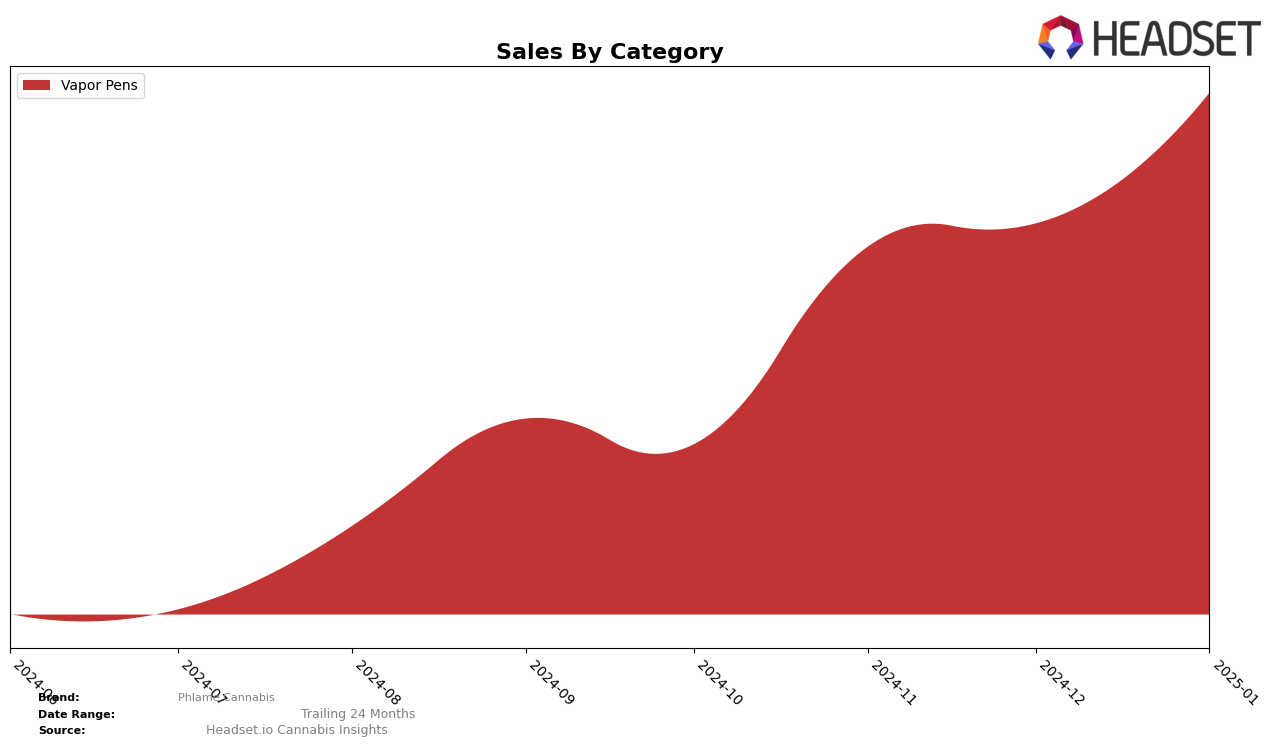

Phlame Cannabis has demonstrated notable improvement in the Vapor Pens category in Oregon. Starting from a rank of 54 in October 2024, the brand has climbed steadily to reach the 30th position by January 2025. This upward trajectory is underscored by a significant increase in sales from $45,333 in October to $138,801 in January, indicating a growing consumer preference and market penetration in this segment. The consistent movement into the top 30 brands suggests that Phlame Cannabis is effectively capturing market share and possibly benefiting from strategic initiatives or product innovations.

However, it is important to note that Phlame Cannabis did not appear in the top 30 rankings in any other states or categories during this period. This absence could be seen as a challenge or an area for potential growth, depending on the company's strategic focus and resource allocation. The brand's performance in Oregon could serve as a benchmark or a case study for entering or expanding in other markets. Future analysis could explore whether the brand's strategies in Oregon can be replicated or adapted to other states to achieve similar success.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Phlame Cannabis has shown a remarkable upward trajectory in recent months, climbing from a rank of 54 in October 2024 to 30 by January 2025. This significant improvement in rank coincides with a consistent increase in sales, reflecting a growing consumer preference for their products. In contrast, brands like Kaprikorn and Orchid Essentials have experienced a decline in their rankings, with Kaprikorn dropping from 24 to 33 and Orchid Essentials from 27 to 29 over the same period. Meanwhile, Sessions Supply Co. has seen a notable rise, moving from 49 to 28, indicating a competitive push that Phlame Cannabis must continue to monitor. The dynamic shifts in rankings and sales among these brands highlight the competitive pressures and opportunities within the Oregon vapor pen market, suggesting that Phlame Cannabis's strategic efforts are effectively capturing market share.

Notable Products

In January 2025, the top-performing product for Phlame Cannabis was Tally Mon Cured Resin Cartridge (1g) in the Vapor Pens category, climbing to the number one spot with sales reaching 1683 units. Following closely, God's Breath Cured Resin Cartridge (1g) secured the second position, marking its debut in the rankings. Dream Diesel Cured Resin Cartridge (1g) held a strong third place, experiencing a slight drop from its top position in December 2024. Pound Town Cured Resin Cartridge (1g) re-entered the rankings at fourth place after being unranked in December. Ghost Vapor Cured Resin Cartridge (1g) made its first appearance in the rankings at number five, indicating a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.