Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

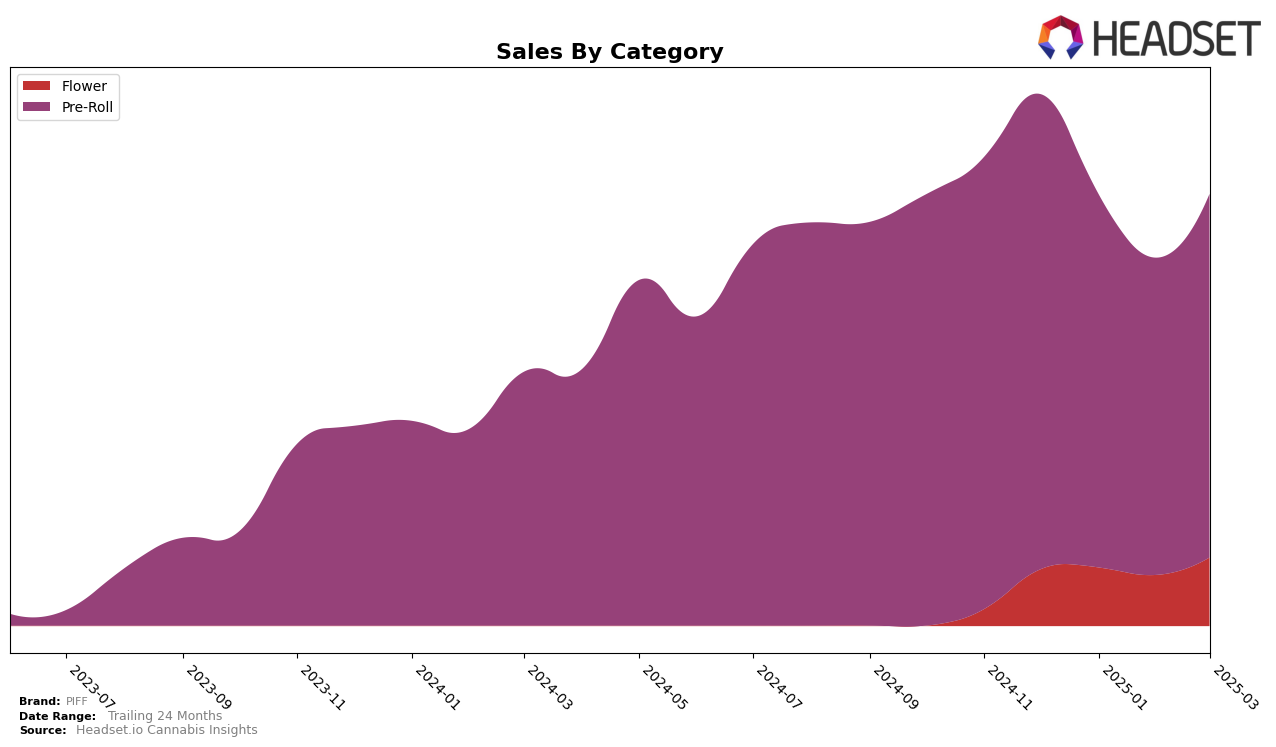

PIFF's performance across different categories and provinces reveals some interesting trends. In Alberta, PIFF's presence in the Flower category was not strong enough to make it to the top 30 brands from December 2024 through March 2025, which suggests room for improvement in this category. However, PIFF maintained a steady position in the Pre-Roll category, ranking consistently between 9th and 11th place during the same period. This stability indicates a solid foothold in the Pre-Roll market despite some fluctuations in sales figures. The data suggests that while PIFF's Flower category presence needs bolstering, their Pre-Roll offerings are resonating well with consumers in Alberta.

In Ontario, PIFF shows a more promising trajectory in the Flower category, where it improved its ranking from 55th in December 2024 to 50th by March 2025. This upward movement, albeit gradual, may suggest a growing recognition or acceptance of PIFF's Flower products in the Ontario market. Meanwhile, in the Pre-Roll category, PIFF consistently ranked within the top 15, reaching as high as 11th place in March 2025. The brand's ability to maintain and slightly improve its position in this competitive category underscores its strength and potential for further growth in Ontario. Overall, PIFF's performance in Ontario showcases a positive trend, especially in the Pre-Roll category, while hinting at potential for growth in their Flower offerings.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, PIFF has shown a resilient performance amidst fluctuating ranks and sales figures. From December 2024 to March 2025, PIFF's rank has seen a slight improvement, moving from 12th to 11th position. This upward trend is notable when compared to competitors like Good Supply, which has consistently maintained the 14th position, and Pure Sunfarms, which experienced a decline from 10th to 12th place. Despite a dip in sales in January 2025, PIFF managed to recover by March 2025, surpassing Pure Sunfarms in rank. Meanwhile, MTL Cannabis and Carmel have shown stronger sales figures, with MTL Cannabis initially holding the 6th position and Carmel rebounding to 9th by March 2025. This competitive analysis highlights PIFF's potential for growth and the importance of strategic positioning to climb higher in the ranks amidst strong competitors.

Notable Products

In March 2025, the top-performing product for PIFF was the Maui Wowie Pre-Roll 2-Pack (2g), maintaining its number one rank for four consecutive months with sales of 68,910 units. The Cali Kush Pre-Roll 2-Pack (2g) also consistently held the second position, showing stable demand. The Juicy Blunt (1g) and Dutchy Blunt (1g) remained in the third and fourth ranks, respectively, with sales figures indicating a slight increase for Dutchy Blunt. The Cali Kush Milled (7g) in the Flower category continued to rank fifth, but it saw a notable sales increase compared to previous months. Overall, the rankings for these top products have remained steady since December 2024, reflecting consistent consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.