Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

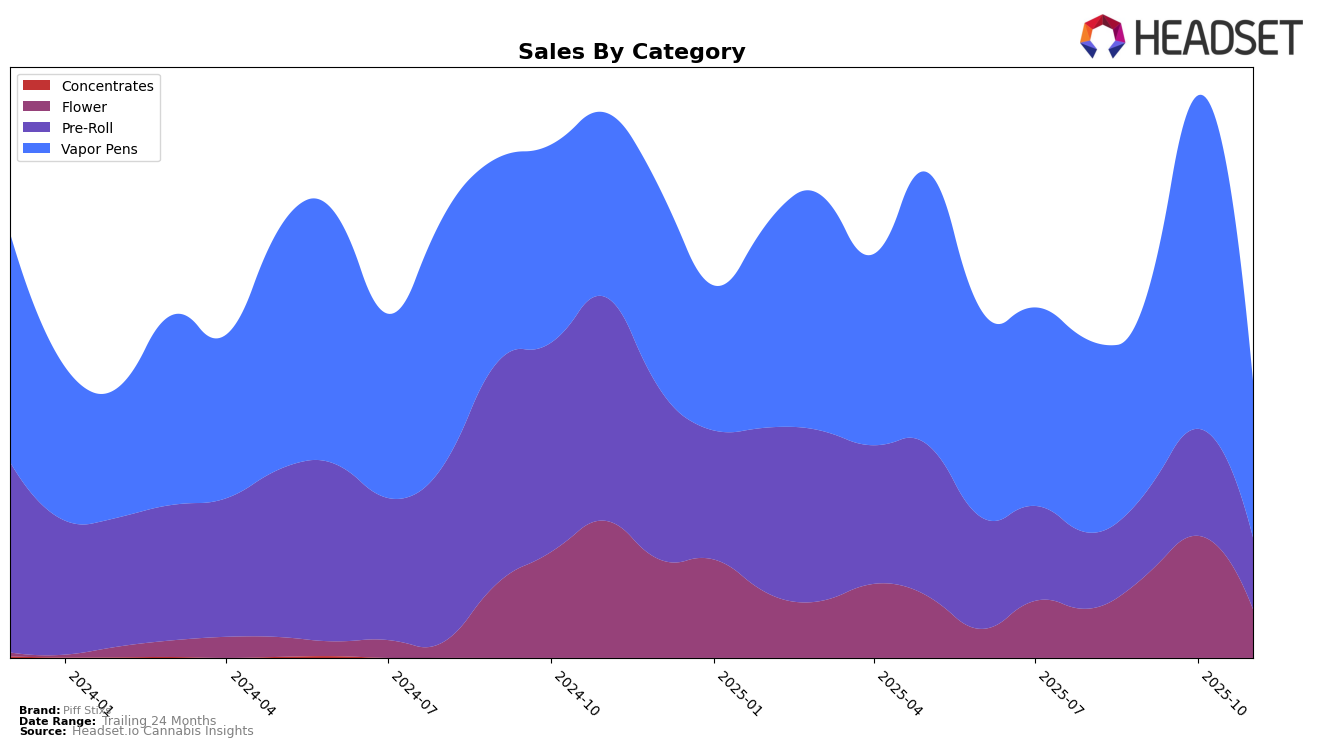

Piff Stixs has shown varying performance across different categories in Oregon. In the Flower category, the brand experienced a notable fluctuation in its rankings over the months. Starting at rank 99 in August, Piff Stixs improved significantly to 40 by October, only to fall back to 77 in November. This indicates a volatile presence in the Flower market, with a peak in October that was not sustained. On the other hand, their performance in the Pre-Roll category was more stable, maintaining a position within the top 40, peaking at rank 24 in October. The Vapor Pens category saw Piff Stixs achieve strong results, consistently placing within the top 25, and reaching a high of 17 in October before slipping slightly to 25 in November.

The sales data for Piff Stixs in Oregon reveals some interesting trends. While the Flower category saw a drop in sales from October to November, the Pre-Roll category had a steady performance, with sales peaking in October and then slightly decreasing in November. The Vapor Pens category, however, demonstrated a significant surge in sales in October, suggesting a strong consumer preference during that period. Despite the drop in rankings and sales in November, the brand's ability to maintain a presence in the top 25 for Vapor Pens is noteworthy. The absence of Piff Stixs from the top 30 in some months, particularly in the Flower category, highlights areas where the brand might need to focus on improving its market strategies to regain ground.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Piff Stixs has experienced notable fluctuations in its market positioning from August to November 2025. Initially ranked 24th in August, Piff Stixs saw a significant improvement in September, climbing to 17th place, which coincided with a substantial increase in sales. However, by November, the brand's rank slipped back to 25th, indicating challenges in maintaining its earlier momentum. In comparison, Rogue Gold maintained a more stable position, consistently ranking 23rd from September to November, despite a downward trend in sales. Meanwhile, Mana Extracts demonstrated resilience by improving its rank from 28th in August to 24th in November, suggesting a positive trajectory in market presence. The fluctuating dynamics among these brands highlight the competitive pressures Piff Stixs faces, emphasizing the need for strategic initiatives to sustain and enhance its market share in Oregon's vapor pen category.

Notable Products

In November 2025, the top-performing product for Piff Stixs was the Jifflez x Piff Fuel x Green Ribbon Pre-Roll 12-Pack (7.2g) in the Pre-Roll category, securing the number one rank with sales reaching 848 units. Following closely, the Grape Gas Cured Resin Cartridge (2g) from the Vapor Pens category held the second position. The Donny Burger Liquid Diamonds Disposable (0.5g) also performed well, ranking third among Vapor Pens. Notably, the King Louie XII Distillate Cartridge (1g) and Purple Tangie x Kush Berry Rosin Sugar Sauce Double Sided Disposable (2g) secured the fourth and fifth positions, respectively, in the same category. Compared to previous months, these products have consistently maintained strong sales figures, with no significant fluctuations in their rankings, indicating steady consumer demand.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.