Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

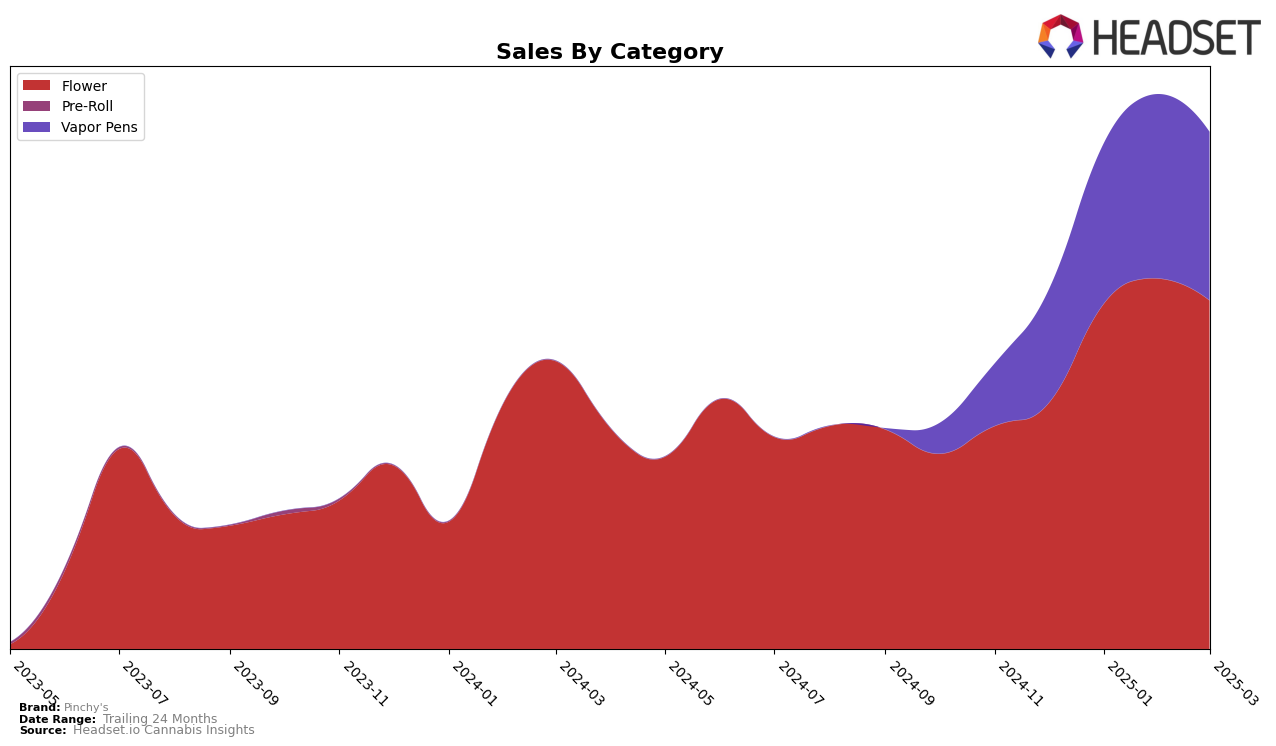

Pinchy's has demonstrated notable performance in the Missouri cannabis market, particularly within the Flower category. Over the course of four months, Pinchy's has shown a positive trend, moving from the 26th position in December 2024 to reaching as high as 14th in February 2025 before settling at 16th in March. This upward trajectory indicates a strengthening presence and growing consumer preference for their Flower products. The significant increase in sales from December to February further underscores this momentum. However, in the Vapor Pens category, while Pinchy's managed to improve its rank from 30th to 24th by January 2025, it maintained the same position through March, suggesting a plateau in market penetration or competition challenges in this segment.

In terms of category performance, Pinchy's has managed to secure a foothold in both the Flower and Vapor Pens categories in Missouri. The brand's ability to rise in the Flower category rankings highlights its competitive edge and potential for further growth in this segment. The consistent ranking in the Vapor Pens category, however, indicates that while Pinchy's is present, there might be opportunities for strategic initiatives to further boost its market position. The absence of Pinchy's from the top 30 in any other state or category suggests that their current focus and success are primarily within Missouri, providing a concentrated market strategy that could serve as a foundation for future expansion efforts.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Pinchy's has demonstrated a notable upward trajectory in brand ranking over the past few months. Starting from a rank outside the top 20 in December 2024, Pinchy's surged to 17th in January 2025, peaking at 14th in February before settling at 16th in March. This upward movement is indicative of a strong market performance and strategic positioning. In comparison, Buoyant Bob maintained a consistently higher rank, peaking at 10th in February, which suggests a robust sales strategy. Meanwhile, Proper Cannabis experienced a decline, dropping from 14th in December to 18th by March, indicating potential challenges in maintaining market share. C4 / Carroll County Cannabis Co. showed a stable performance, hovering around the mid-teens, while Robust made a significant leap from 22nd to 15th, highlighting a successful growth strategy. These dynamics suggest that while Pinchy's is gaining traction, it faces stiff competition from established brands that are also vying for market leadership in Missouri's flower category.

Notable Products

In March 2025, the top-performing product from Pinchy's was the Blue Dream Distillate Full Spectrum Cartridge 1g in the Vapor Pens category, climbing to the number one spot with sales of 1938 units. This product showed an impressive rise from the third position in February. The Grandaddy Purple Distillate Full Spectrum Cartridge 1g held the second position, maintaining a strong performance despite dropping from the top spot in January. Super Lemon Haze Distillate Cartridge 1g made a notable debut at the third position, while Pineapple Express Distillate Full Spectrum Cartridge 1g entered the rankings at fourth. OG Kush Distillate Cartridge 1g rounded out the top five, slipping from fourth to fifth place compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.