Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

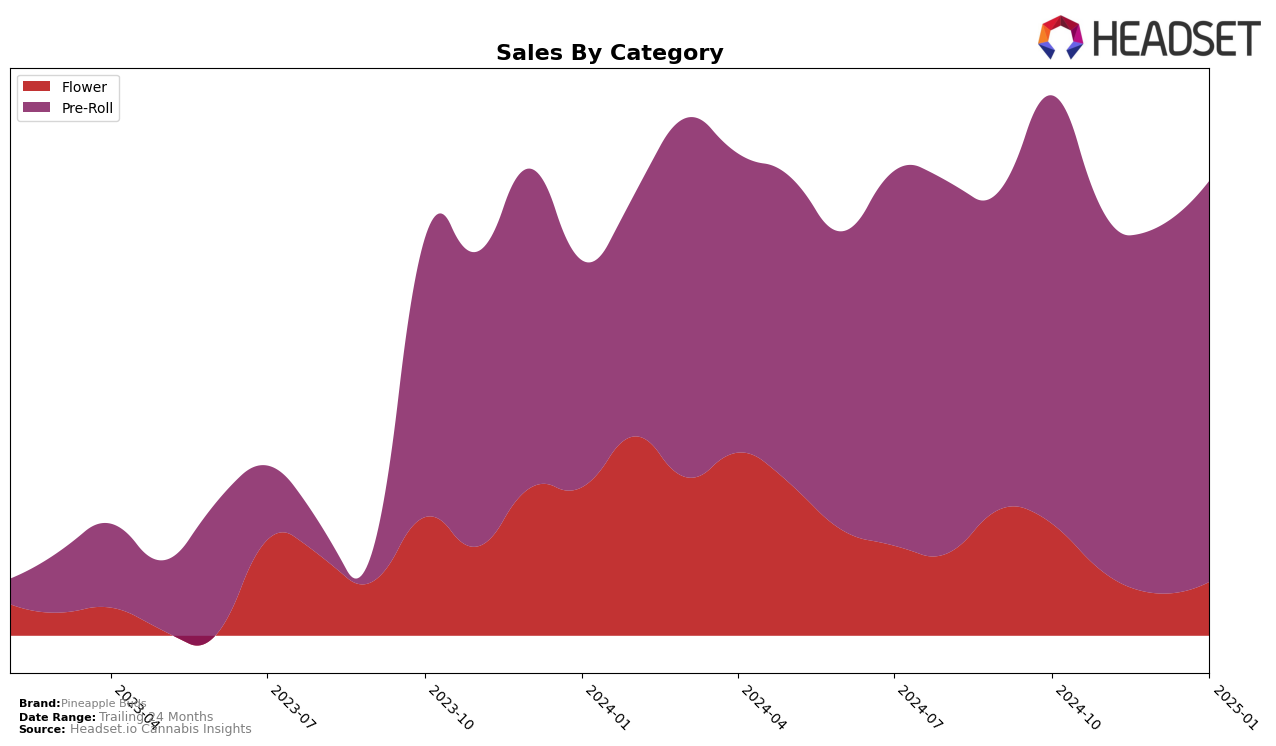

In the British Columbia market, Pineapple Buds has shown varying performance across different product categories. In the Flower category, the brand has struggled to break into the top 30, with rankings hovering in the low 90s and high 80s over the past few months. This indicates a challenging competitive landscape in the Flower market for Pineapple Buds. Conversely, in the Pre-Roll category, Pineapple Buds has demonstrated a stronger presence, consistently ranking in the low 30s and even reaching the 26th position by January 2025. The steady improvement in rankings within the Pre-Roll category suggests a growing consumer preference for their products in this segment, which could be a strategic area for the brand to focus on moving forward.

Despite the challenges in the Flower category, Pineapple Buds has managed to maintain a relatively stable sales volume in the Pre-Roll segment. Notably, sales in the Pre-Roll category increased from 231,352 in October 2024 to 259,061 by January 2025, reflecting a positive trend in consumer demand for their offerings. The brand's ability to maintain and slightly improve its position in the Pre-Roll category, despite not breaking into the top 30 overall, highlights their potential to capitalize on this segment. This performance indicates that while there are hurdles in certain categories, Pineapple Buds has opportunities to leverage its strengths in others, which could be key to enhancing its market presence in British Columbia.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Pineapple Buds has shown a notable improvement in its rank from December 2024 to January 2025, moving from 34th to 26th position. This upward trend indicates a positive shift in consumer preference or marketing effectiveness. In contrast, The Original Fraser Valley Weed Co. also saw a significant improvement, jumping from 31st to 25th, suggesting a competitive edge in the market. Meanwhile, Common Ground experienced a slight decline from 20th to 22nd, which could signal an opportunity for Pineapple Buds to capture more market share. DEBUNK also saw a drop in rank, moving from 22nd to 27th, aligning with a decrease in sales, which might benefit Pineapple Buds if they continue their upward trajectory. Despite these fluctuations, Pineapple Buds' consistent improvement in rank suggests a strengthening position in the market, potentially driven by strategic initiatives or product enhancements.

Notable Products

In January 2025, the top-performing product for Pineapple Buds was Volcanic Haze Pre-Roll 3-Pack (1.5g), reclaiming the first position from the previous month with sales of 2614 units. Purple Gushers Pre-Roll 10-Pack (5g) slipped to the second position after leading in December 2024. Lava Roll Infused Pre-Roll 3-Pack (1.5g) debuted strongly in third place, showing a promising entry into the rankings. Pineapple Haze Pre-Roll 10-Pack (5g) experienced a drop to fourth place, continuing its decline from October 2024. Tropical Cyclones Pre-Roll 7-Pack (3.5g) rounded out the top five, marking an upward movement from its position in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.