Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

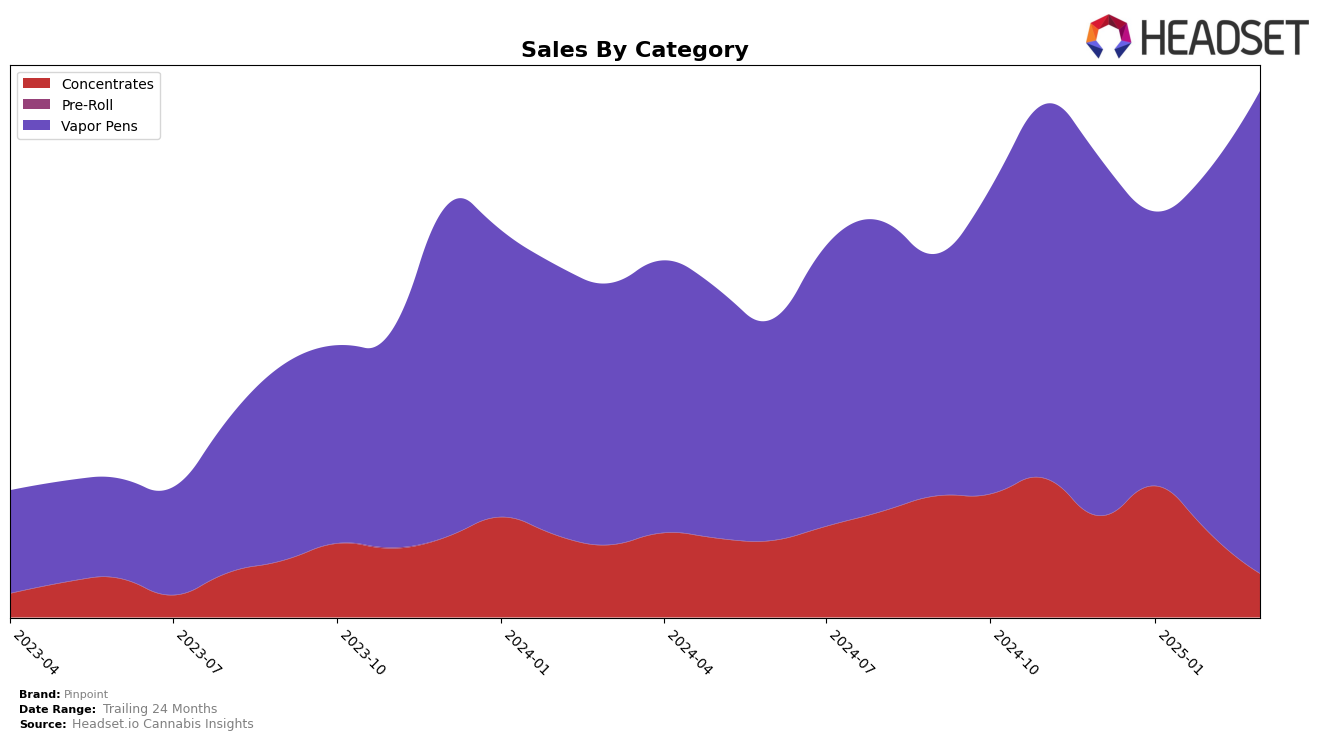

Pinpoint has shown interesting dynamics in its performance across different categories and states. In the state of Missouri, the brand has experienced fluctuations in the Concentrates category. Starting from a rank of 10 in December 2024, Pinpoint improved to 5 in January 2025 but then fell back to 10 in February and further down to 16 in March. This indicates a volatile position in the Concentrates market, which could suggest either a competitive landscape or inconsistent consumer demand. The notable drop in sales from January to March could be a point of concern for the brand's strategy in this category.

In contrast, Pinpoint's performance in the Vapor Pens category in Missouri has been more positive. While they started at rank 16 in December 2024, they climbed to rank 8 in February 2025 and further improved to rank 5 by March. This upward trajectory suggests a strengthening position and possibly an increased consumer preference or effective marketing strategies in this category. The sales figures support this trend, with a notable increase from February to March, indicating growing popularity or successful product offerings in the Vapor Pens segment. This positive movement in ranks and sales could be a promising sign for the brand's future performance in this category.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Pinpoint has shown a remarkable upward trajectory in both rank and sales over the past few months. Starting from a rank of 16 in December 2024, Pinpoint has climbed to the 5th position by March 2025, indicating a significant improvement in market presence. This surge is particularly notable when compared to Platinum Vape, which has seen a slight decline from 3rd to 4th place, and Good Day Farm, which has dropped from 4th to 6th place. Meanwhile, Illicit / Illicit Gardens has experienced a dramatic rise from 15th to 3rd, showcasing a competitive edge. Despite these shifts, Pinpoint's consistent sales growth, especially from February to March 2025, positions it as a strong contender in the market, outpacing Galactic, which has fallen from 5th to 7th place. This positive trend for Pinpoint suggests a growing consumer preference and a strengthening brand reputation in the Missouri vapor pen category.

Notable Products

In March 2025, Northern Lights Distillate Cartridge (1g) emerged as the top-performing product for Pinpoint, maintaining its leading position from February with sales reaching 4,103 units. Banana Runtz Distillate Cartridge (1g) climbed to the second spot, showing a significant recovery from its fifth place in January, with sales of 3,857 units. Durban Poison Distillate Cartridge (1g) improved its rank to third, continuing its upward trend from February. Rainbow Belts Distillate Cartridge (1g), despite a strong start in January, slipped to fourth place. Clementine Distillate Cartridge (1g) consistently held the fifth position, marking a steady performance across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.