Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

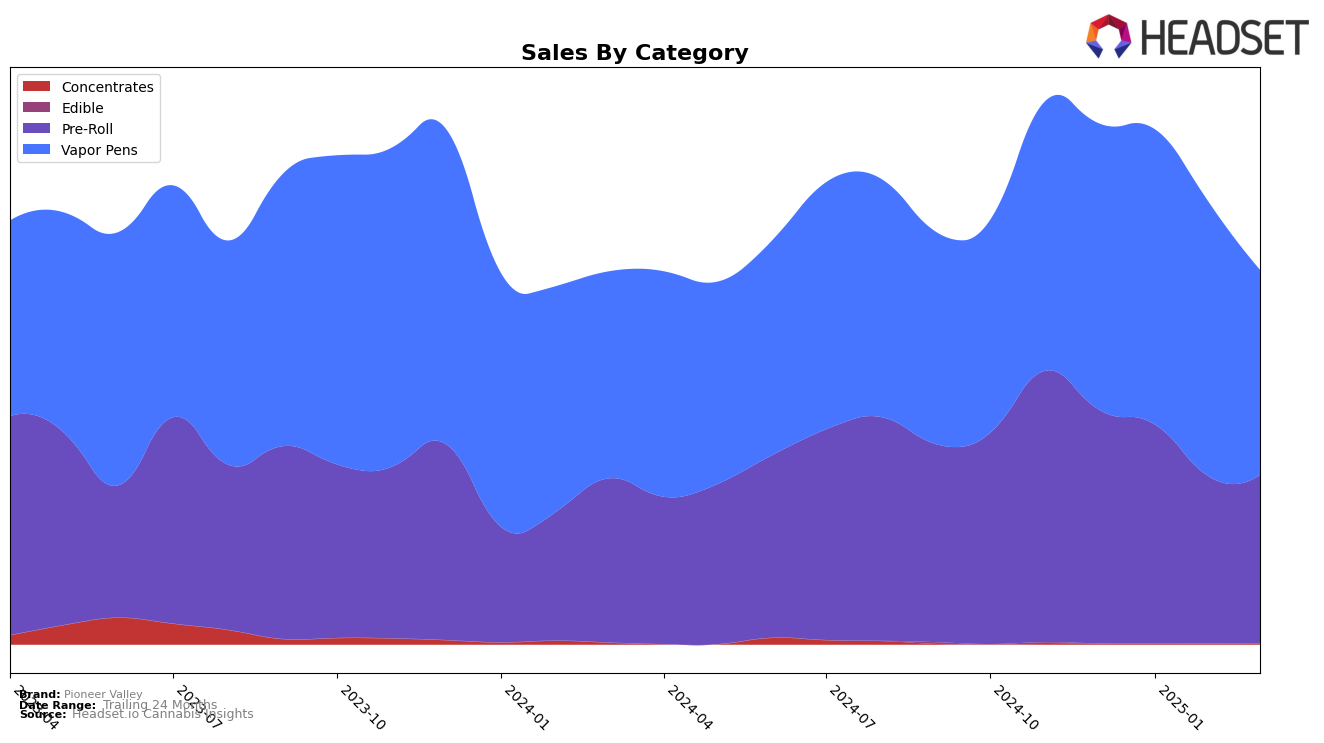

Pioneer Valley's performance in Massachusetts has seen notable fluctuations across various categories. In the Pre-Roll category, the brand experienced a decline in rankings from 15th in December 2024 to 23rd by March 2025, indicating a potential challenge in maintaining its competitive edge. This drop in rank was accompanied by a decrease in sales from $373,050 to $268,652 over the same period, suggesting a decrease in consumer demand or increased competition. Such a decline in rank, especially out of the top 20, could be a cause for concern if the trend continues, as it may reflect broader market dynamics or shifts in consumer preferences.

In contrast, Pioneer Valley's performance in the Vapor Pens category showed a slightly more stable trajectory, despite some variability. The brand improved its rank from 18th in December 2024 to 14th in January 2025, before experiencing a slight drop to 19th by March 2025. This fluctuation in ranking, coupled with a significant decrease in sales from $471,971 in January to $327,664 in March, suggests that while there was initial positive momentum, sustaining growth remains a challenge. The ability to climb to 14th position in January demonstrates potential, but the subsequent decline underscores the need for strategic adjustments to capture and retain market share in a competitive landscape.

Competitive Landscape

In the Massachusetts vapor pens category, Pioneer Valley has experienced notable fluctuations in its market ranking, reflecting a dynamic competitive landscape. Starting from December 2024, Pioneer Valley was ranked 18th, showing a promising upward movement to 14th in January 2025, before slipping to 16th in February and further down to 19th by March. This volatility is indicative of the intense competition from brands like Happy Valley, which maintained a relatively stable presence, albeit with a slight decline from 14th to 20th over the same period. Meanwhile, Papa's Herb demonstrated resilience by improving its rank from 19th to 17th by March, suggesting a steady sales performance. The competitive pressure is further highlighted by Nimbus, which, despite dropping out of the top 20 in February, rebounded to 18th in March. These shifts suggest that while Pioneer Valley has the potential to climb the ranks, maintaining a consistent upward trajectory will require strategic efforts to outperform these agile competitors.

Notable Products

In March 2025, the top-performing product from Pioneer Valley was the M80 Mango Super Silver Haze kief Infused Pre-Roll, maintaining its rank at number one from February with sales of 3,176 units. The M80 Tropical Trainwreck Infused Pre-Roll ranked second, consistent with its position in February. Firecrackers Grapeness Infused Pre-Roll experienced a slight improvement, moving up to third place from fourth in February. The M80 Grapeness kief Infused Pre-Roll dropped to fourth place, having previously held the same position in February. Guava OG M-80 Infused Pre-Roll remained stable at the fifth rank, showing consistent performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.