May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

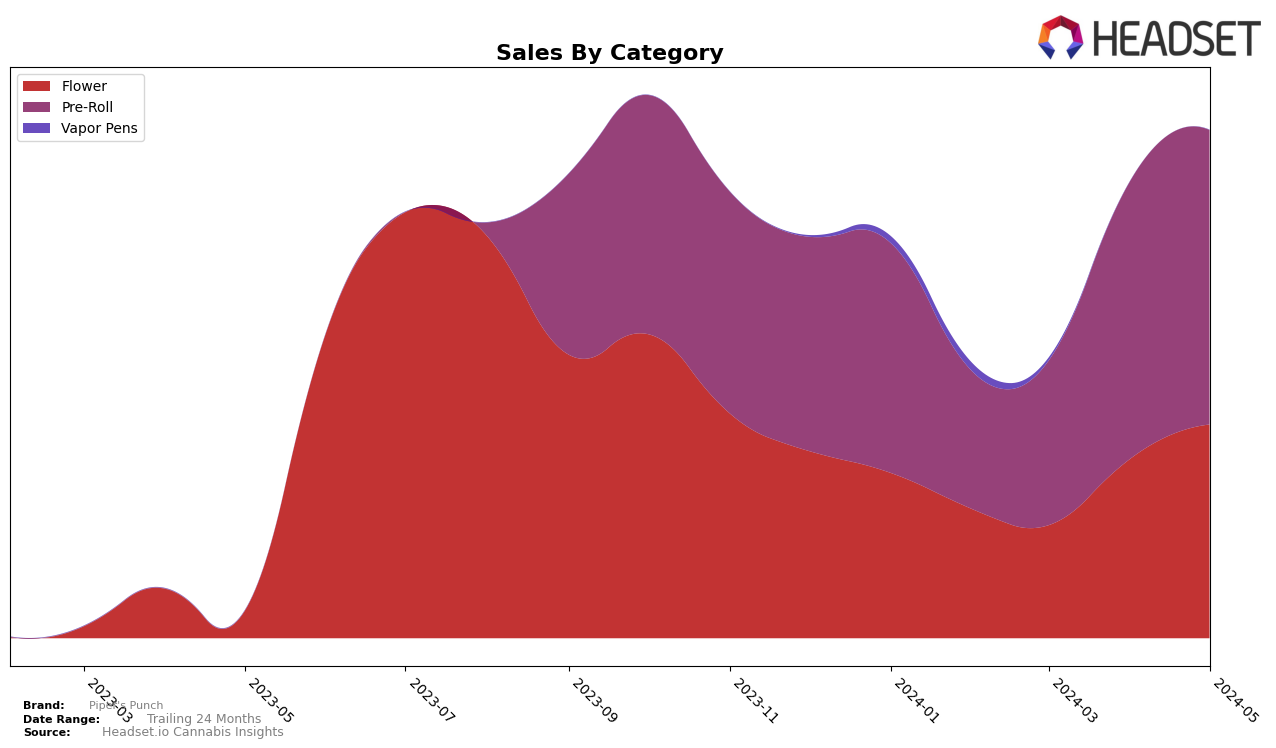

Piper's Punch has shown varied performance across different states and categories in recent months. In Ontario, the brand struggled to make a significant impact in the Flower category, failing to break into the top 30 until May 2024, where it ranked 81st. However, in the Pre-Roll category, Piper's Punch displayed a more promising trajectory, climbing from 86th in February to 65th by May. This upward movement in the Pre-Roll segment indicates growing consumer interest and suggests potential for further growth in the coming months.

In Saskatchewan, Piper's Punch has demonstrated more consistent performance. The Flower category saw a steady rise, with the brand moving from 61st in February to 38th by April and maintaining that position into May. The Pre-Roll category also showed positive trends, with Piper's Punch entering the top 30 in March and holding the 30th spot through April and May. Notably, the absence of a ranking in the top 30 for the Flower category in February highlights a previous struggle, but the subsequent gains indicate effective market penetration and brand recognition in Saskatchewan.

Competitive Landscape

In the Ontario pre-roll category, Piper's Punch has shown a remarkable upward trend in rank and sales over the past few months. Starting from a rank of 86 in February 2024, Piper's Punch has climbed steadily to reach the 65th position by May 2024. This positive trajectory is indicative of a strong market presence and growing consumer preference. In comparison, Bold has experienced a slight decline in rank, moving from 58th to 66th over the same period, while Hiway has also dropped from 48th to 61st. Meanwhile, VOLO and GREAZY have shown mixed results, with VOLO improving from 72nd to 67th and GREAZY making a significant leap from 81st to 64th. These shifts highlight Piper's Punch's competitive edge and potential for continued growth in the Ontario pre-roll market.

Notable Products

For May-2024, the top-performing product for Piper's Punch remains the Tangria & Dankonade Pre-Roll 14-Pack (7g) in the Pre-Roll category, with sales figures reaching $3889. The second spot is consistently held by Dank N' Stormy Milled (7g) in the Flower category. Tangria Milled (7g), also in the Flower category, maintains its third position. The Tangria & Dank 'n Stormy Combo Pre-Roll 14-Pack (7g) continues to rank fourth. Mangoreefa Milled (7g) in the Flower category, which entered the rankings in March-2024, holds steady at fifth place, despite fluctuating sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.