Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

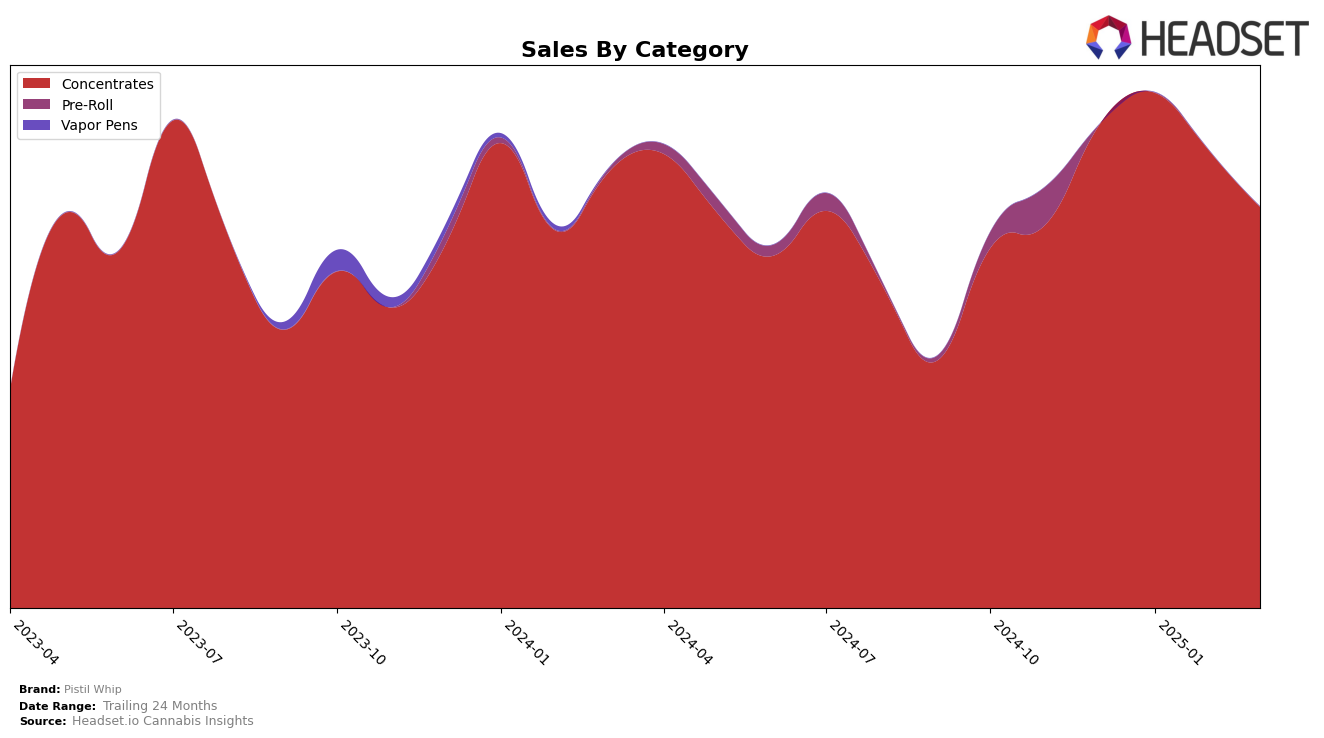

Pistil Whip has shown varied performance across different states and categories, with notable movements in the Concentrates category in California. Over the months from December 2024 to March 2025, Pistil Whip's rank in this category fluctuated, starting at 15th place in December, improving to 13th in January, and then slightly declining to 18th by March. This suggests a competitive market environment where Pistil Whip is maintaining a strong presence but facing challenges to consistently climb the ranks. Their sales figures in California reflect this trend, with a peak in January before experiencing a decline in subsequent months. This indicates that while Pistil Whip is a significant player, there is room for growth and stabilization in their ranking within the Concentrates category.

Interestingly, Pistil Whip's presence in other states or categories isn't highlighted in the top 30 rankings, which could be seen as either a limitation or an opportunity depending on the market dynamics. The absence of rankings in other states or categories suggests that Pistil Whip may not yet have a substantial foothold outside of California, or in categories other than Concentrates. This could imply a strategic focus on the California market or a potential area for expansion to increase their market share. The data points to a brand that has a strong concentration in specific niches but may benefit from diversification to enhance its overall market performance.

Competitive Landscape

In the competitive landscape of the California concentrates market, Pistil Whip has experienced notable shifts in its ranking and sales performance from December 2024 to March 2025. Initially holding a strong position at rank 15 in December 2024, Pistil Whip improved to rank 13 in January 2025, showcasing its competitive edge. However, by March 2025, the brand saw a decline to rank 18, indicating increased competition and potential challenges in maintaining its market share. During this period, competitors such as Emerald Bay Extracts demonstrated a consistent upward trend, moving from rank 22 in December 2024 to rank 16 by March 2025, suggesting a successful strategy in capturing consumer interest. Similarly, Greenline Organics maintained a steady climb, reaching rank 17 in March 2025. These shifts highlight the dynamic nature of the market and underscore the importance for Pistil Whip to innovate and adapt to sustain its competitive position amidst rising contenders.

Notable Products

In March 2025, the top-performing product for Pistil Whip was Garlic Juice Live Rosin Badder (1g) in the Concentrates category, securing the number one rank with notable sales of 474 units. Bridesmaid Live Rosin Badder (1g) followed closely, ranking second, while Guava Bellini Live Rosin Badder (1g) held the third position. Donny Father Live Rosin Badder (1g) improved its rank from fifth in February to fourth in March. Papaya x Strawguava #7 Live Rosin Badder (1g) entered the top five for the first time, securing the fifth position. These changes indicate a dynamic shift in product popularity within the Concentrates category from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.