Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

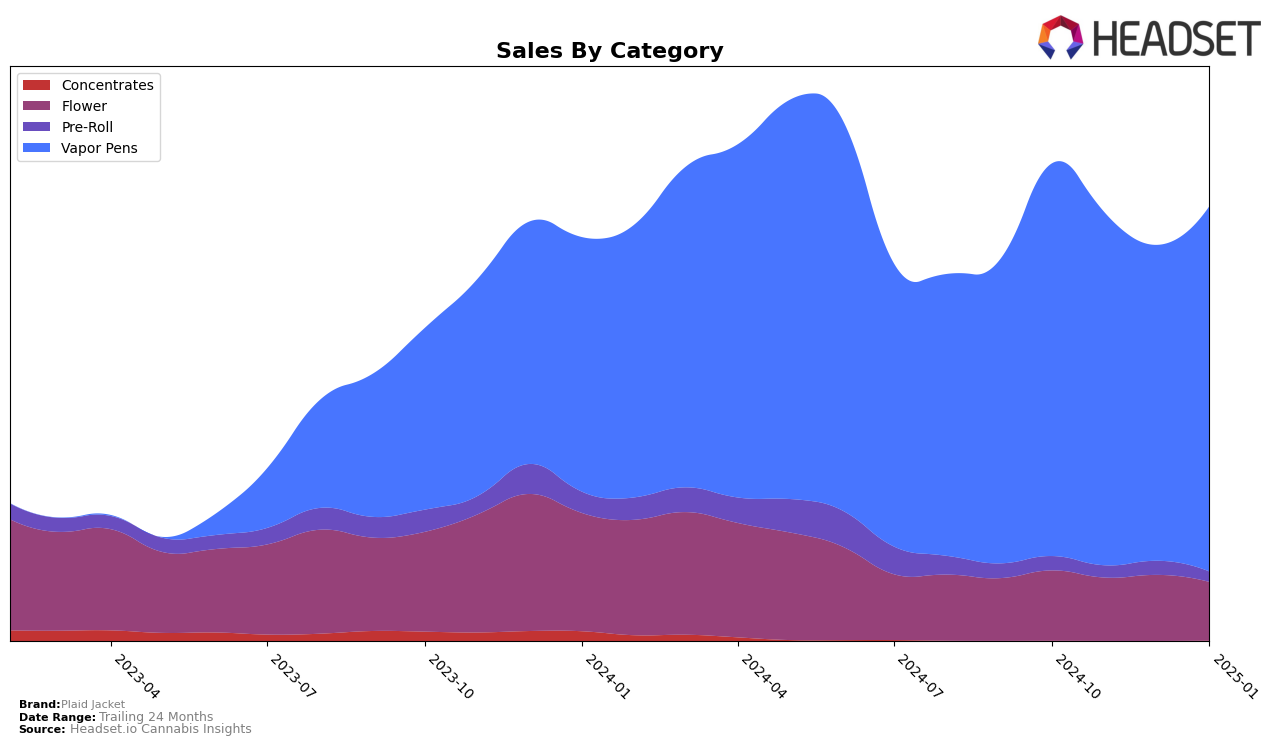

Plaid Jacket has shown varied performance across different product categories in Washington. In the Flower category, the brand maintained a presence within the top 30, although it experienced fluctuations in its ranking, moving from 22nd in October 2024 to 27th by January 2025. This indicates a slight decline in competitive standing. Interestingly, the Vapor Pens category has been a stronghold for Plaid Jacket, consistently holding the 5th position over the same period, suggesting stable consumer demand and brand loyalty in this segment. The Pre-Roll category, however, paints a different picture, with the brand not making it into the top 30, highlighting areas for potential improvement or strategic reassessment.

In terms of sales, Plaid Jacket's Flower category saw a decrease from $298,170 in October 2024 to $248,583 in January 2025, reflecting the ranking drop and hinting at possible market pressures or increased competition. On the other hand, while the Vapor Pens category showed a slight dip in sales from October to December, it rebounded in January, aligning with its steady ranking. This resilience could be attributed to effective marketing strategies or product innovation keeping consumer interest high. The Pre-Roll category's absence from the top rankings suggests it may not be a primary focus for the brand, or it could indicate an opportunity for growth if market conditions are favorable.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Plaid Jacket consistently maintained its position at rank 5 from October 2024 to January 2025. Despite a steady rank, Plaid Jacket experienced a noticeable fluctuation in sales, with a decline from October to December 2024, followed by a recovery in January 2025. This stability in rank amidst sales volatility suggests a resilient brand presence, but highlights potential challenges in market share growth. In contrast, Micro Bar held a firm grip on the 4th rank throughout the same period, with relatively stable sales, indicating stronger market retention. Meanwhile, EZ Vape and Snickle Fritz showed upward mobility, improving their ranks from 9th to 6th and 11th to 7th respectively, suggesting an aggressive competitive push that could pose a threat to Plaid Jacket's market position if the trend continues.

Notable Products

In January 2025, the top-performing product from Plaid Jacket was the Super Boof Melted Diamonds HTE Cartridge (1g) in the Vapor Pens category, maintaining its number 1 rank from December 2024 with sales of 2,867 units. The Zero Gravity BHO Cured Resin Cartridge (1g) climbed to the 2nd position, recovering from its absence in December 2024. The Super Boof Melted Diamonds HTE Disposable (1g) entered the rankings at 3rd place, showcasing a strong debut. Ethiopian Sky Cuddler Kush Diamonds & HTE Disposable (1g) also made its first appearance at 4th place. Lastly, the Perfect Pair BHO Cured Resin Disposable (1g) reappeared in the rankings at 5th place, having last been ranked in October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.