Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

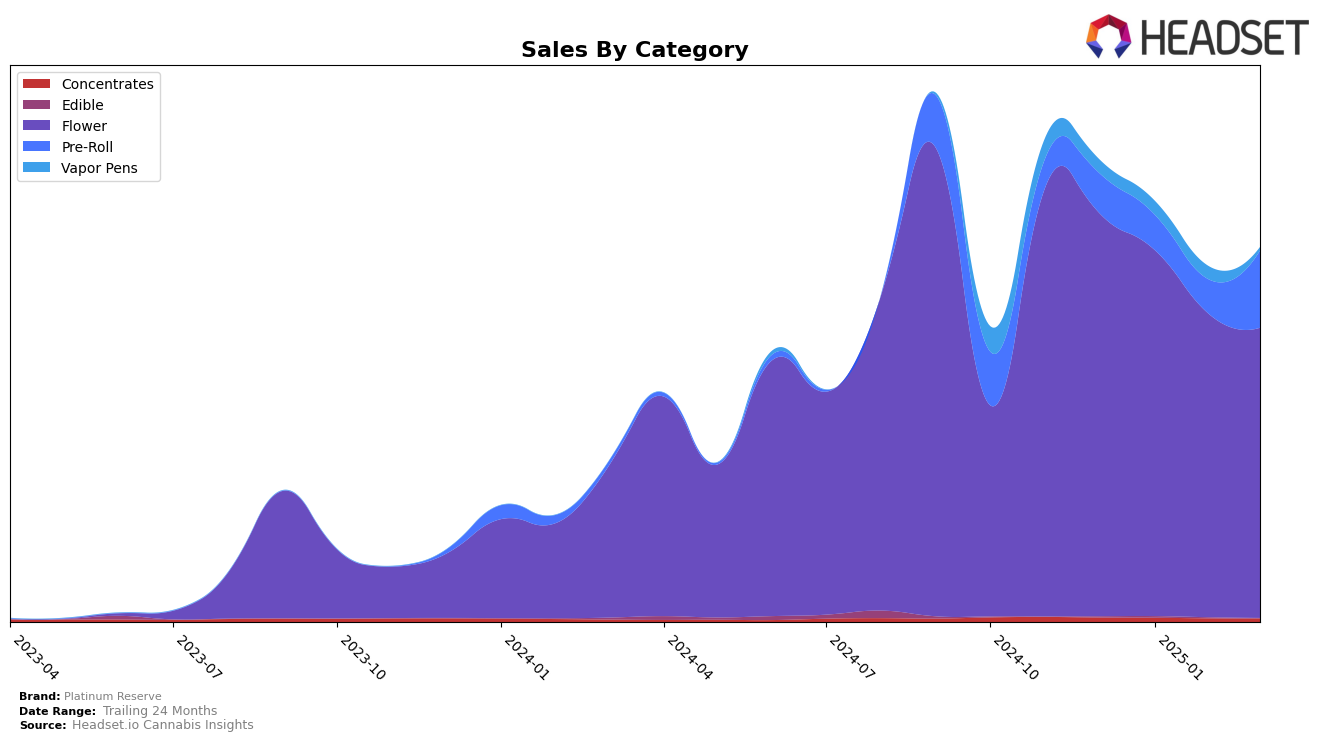

In the state of New York, Platinum Reserve has demonstrated a mixed performance across various product categories. In the Flower category, the brand maintained a presence in the top 20 throughout the first quarter of 2025, though it experienced a notable decline from 9th place in January to 18th place by March. This downward trend is coupled with a decrease in sales, which dropped from over $755,000 in January to approximately $588,000 by March. In contrast, the Pre-Roll category showed a positive trajectory, with the brand moving up from 49th place in December to 32nd place in March, indicating a stronger market presence and increased consumer interest in this segment.

However, the Vapor Pens category tells a different story for Platinum Reserve in New York. Despite a slight improvement in rankings from 71st in December to 63rd in February, the brand did not secure a position in the top 30 by March, highlighting a challenge in gaining significant traction in this segment. This absence from the top 30 suggests that while there is some level of consistent sales, it may not be sufficient to compete with leading brands in this category. Such disparities in performance across categories emphasize the importance of strategic focus and potential market adaptations for Platinum Reserve as it navigates the competitive landscape in New York.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Platinum Reserve has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 10th in December 2024, Platinum Reserve saw a decline to 18th by March 2025. This downward trend contrasts with the performance of competitors such as Electraleaf, which maintained a steady rank at 16th from February to March 2025, and 7 SEAZ, which improved its rank significantly from 46th in December 2024 to 19th in March 2025. Meanwhile, Hepworth showed a rise in rank from 24th in December 2024 to 13th in January 2025, before stabilizing around the 17th position by March 2025. Despite the competitive pressure, Platinum Reserve's sales figures, although declining, still remain robust compared to some competitors, indicating potential for recovery with strategic marketing and product differentiation.

Notable Products

For March 2025, the top-performing product from Platinum Reserve is Mango Haze (3.5g) in the Flower category, which climbed to the number one rank with sales reaching 3758 units. Strawberry Cough (3.5g), also in the Flower category, dropped to the second position after leading in February 2025. Sour Cheese (3.5g) emerged as a new entrant in the rankings, securing the third spot. Jack Herer Pre-Roll 5-Pack (2.5g) and Northern Lights Pre-Roll 5-Pack (2.5g) occupied the fourth and fifth positions, respectively, marking their debut in the rankings. Notably, Mango Haze (3.5g) showed a consistent upward trend, moving from second place in February to first in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.