Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

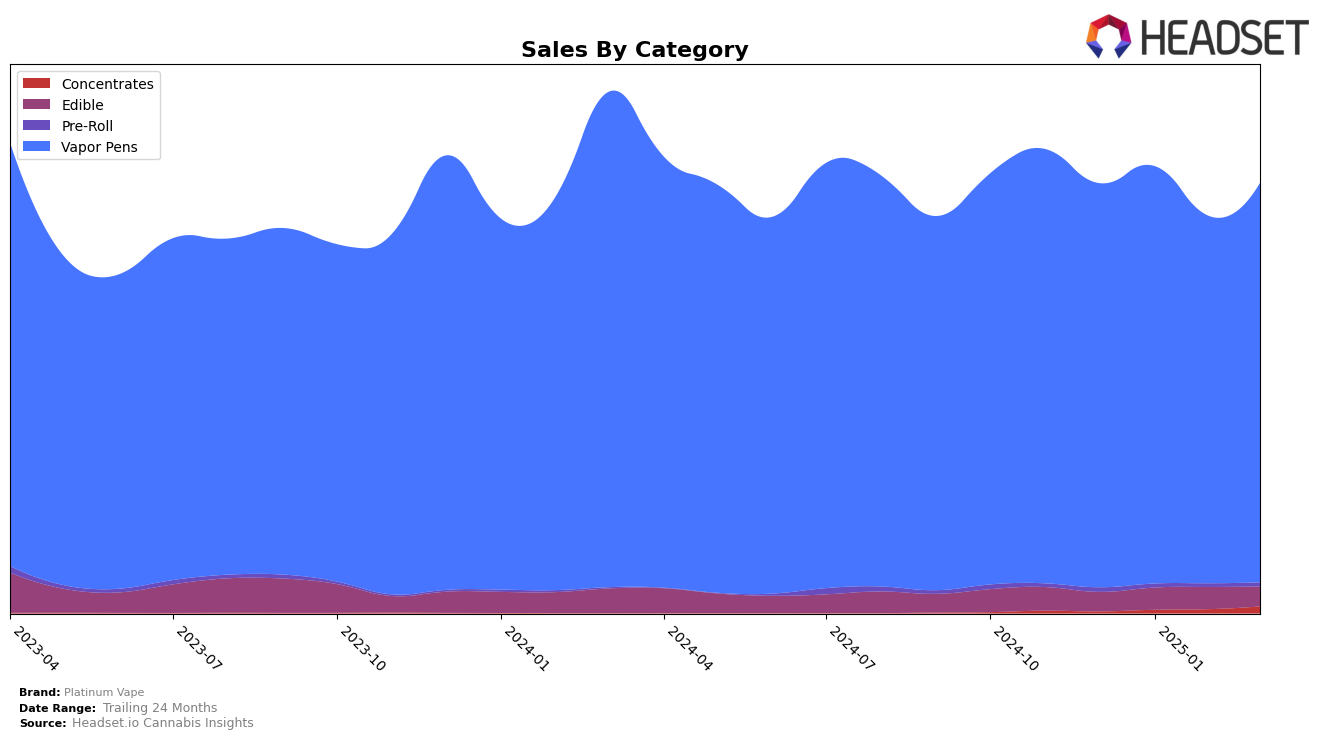

Platinum Vape's performance across various states and categories shows a mixed bag of results, reflecting both challenges and opportunities. In California, the brand's ranking in the Vapor Pens category has remained outside the top 30, fluctuating slightly from 73rd to 74th place over the months, indicating a struggle to gain significant traction in this competitive market. Meanwhile, in Michigan, Platinum Vape has seen a more favorable position in the Vapor Pens category, maintaining a strong presence with rankings between 4th and 6th place. This consistent performance suggests a solid market presence and consumer preference in Michigan, contrasting with the brand's challenges in California.

In Michigan, the Edible category also shows promising results, with Platinum Vape climbing from 35th to 27th place in January and maintaining a position within the top 30 for subsequent months, before dropping slightly to 33rd in March. This indicates a growing acceptance and potential for expansion in the edibles market. In Missouri, the brand has maintained a strong foothold in the Vapor Pens category, consistently ranking 3rd before a slight dip to 4th in March, which still underscores its strong market presence. In Ontario, a notable upward trend is observed in the Vapor Pens category, where Platinum Vape improved its ranking from 28th to 14th over the months, suggesting increasing brand recognition and consumer interest in this Canadian province.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Platinum Vape has seen some fluctuations in its ranking over the past few months. Starting at 6th place in December 2024, Platinum Vape climbed to 4th place in January and February 2025, before returning to 6th place in March 2025. This movement reflects a dynamic market where competitors like Drip (MI) and Breeze Canna have also experienced shifts in their rankings. Notably, Breeze Canna started strong in December 2024 at 3rd place but dropped to 5th in January and February 2025, before rising to 4th in March. Meanwhile, Drip (MI) has maintained a relatively stable position, fluctuating between 5th and 6th place. Despite these changes, Platinum Vape's sales figures have shown resilience, with a peak in January 2025, indicating a robust brand presence amidst the competition. The brand's ability to regain its 4th place ranking in early 2025 suggests potential for further growth and a strong competitive edge in the Michigan vapor pen market.

Notable Products

In March 2025, Platinum Vape's top-performing product was the Lemon Berry Tart Distillate Cartridge in the Vapor Pens category, climbing to the number one rank with sales of 10,783 units. The Pink Lemonade Distillate Cartridge maintained its strong position at rank two, although its sales decreased compared to February. The Strawberry Banana Gummy Coins 10-Pack emerged as a new contender, securing the third rank in the Edible category. Honeydew Boba Distillate Cartridge held steady at rank four, experiencing a slight drop in sales. Elephant Ear Distillate Cartridge made its debut in the rankings at position five, indicating a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.