Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

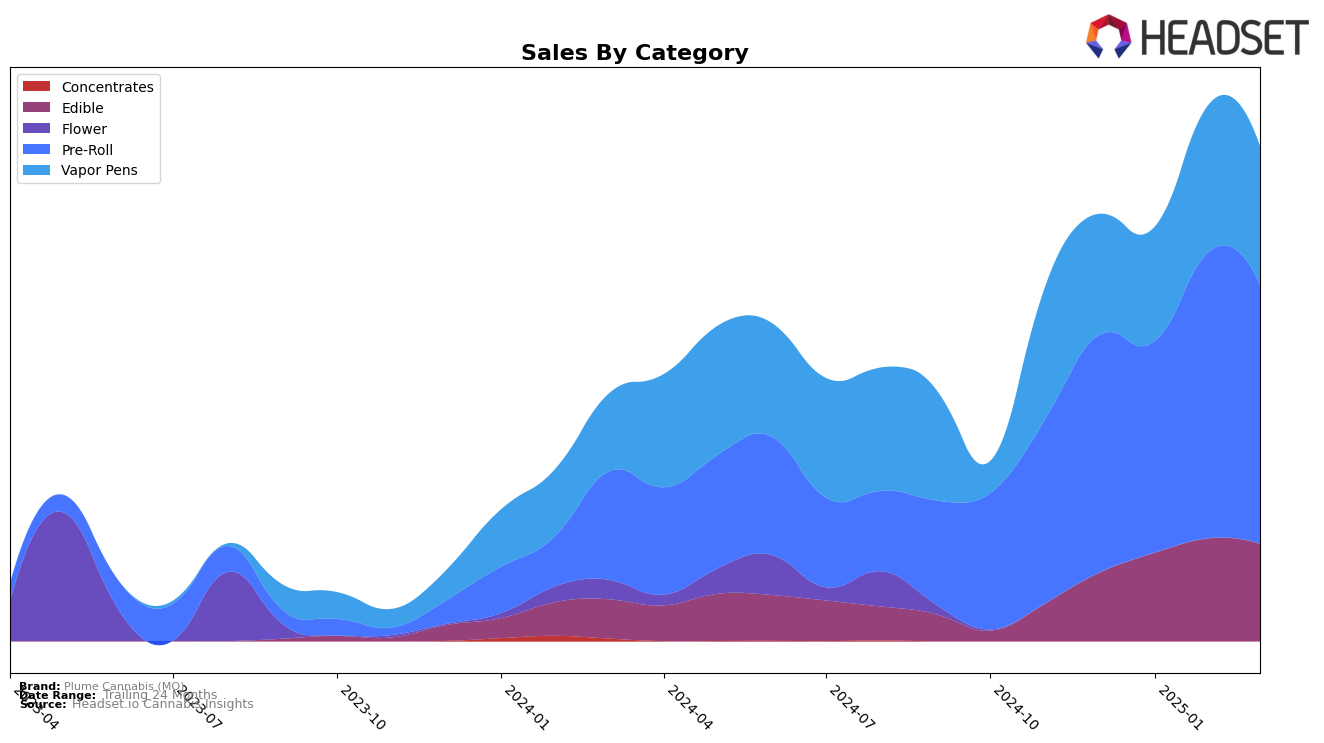

Plume Cannabis (MO) has shown varied performance across different categories in Missouri. In the Edible category, Plume Cannabis has experienced a steady climb in rankings, moving from 27th place in December 2024 to 22nd place by February 2025, before slightly slipping to 23rd in March 2025. This upward trajectory, despite the slight dip, reflects a positive trend in consumer acceptance and market share. The Pre-Roll category tells a similar story, where the brand maintained a strong presence, consistently ranking in the top 10, peaking at 7th place in February 2025. This consistent high ranking suggests a robust consumer preference for their pre-roll products, which could be attributed to quality or unique offerings that resonate well with customers in Missouri.

However, in the Vapor Pens category, Plume Cannabis (MO) faced challenges in maintaining a top 30 position, initially ranking 37th in December 2024. Despite improving to 28th place in February 2025, they fell slightly to 32nd in March 2025. This fluctuation indicates a competitive environment in the Vapor Pens category, where Plume Cannabis must strategize to enhance its market position. The absence from the top 30 in earlier months underscores the need for potential product innovation or marketing adjustments to capture a larger share of the vapor pen market. Overall, while Plume Cannabis shows strength in certain categories, there is room for growth and improvement, particularly in the Vapor Pens category.

Competitive Landscape

In the competitive landscape of the Missouri pre-roll category, Plume Cannabis (MO) has shown a consistent presence, maintaining a top 10 rank from December 2024 to March 2025. Despite a slight drop from 7th to 9th place in March 2025, Plume Cannabis (MO) has demonstrated robust sales growth, particularly in February 2025, where it surpassed competitors like Rove and Vivid (MO). However, it faces stiff competition from Proper Cannabis, which has climbed to 8th place by February 2025, and Jelly Roll, which has consistently ranked higher, peaking at 7th in March 2025. The dynamic shifts in rankings and sales figures highlight the competitive pressures and opportunities for Plume Cannabis (MO) to strategize for sustained growth and market share in the evolving Missouri pre-roll market.

Notable Products

In March 2025, Lake Water Pre-Roll (1g) maintained its position as the top-performing product for Plume Cannabis (MO), with impressive sales reaching 18,029 units. Consistently holding the second spot, Lake Water Trim Pre-Roll (1g) also showed stable performance across the months. Blueberry Cream Infused Pre-Roll 2-Pack (1g) and Watermelon Sugar Infused Pre-Roll 2-Pack (1g) remained in third and fourth place, respectively, showing no change in their rankings from previous months. The Plumeberry Boom Gummy (100mg) reappeared in the rankings in March 2025, securing the fifth position, similar to its rank in January 2025. Overall, the top products for Plume Cannabis (MO) demonstrated consistent sales performance with little fluctuation in their rankings over the months leading to March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.