Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

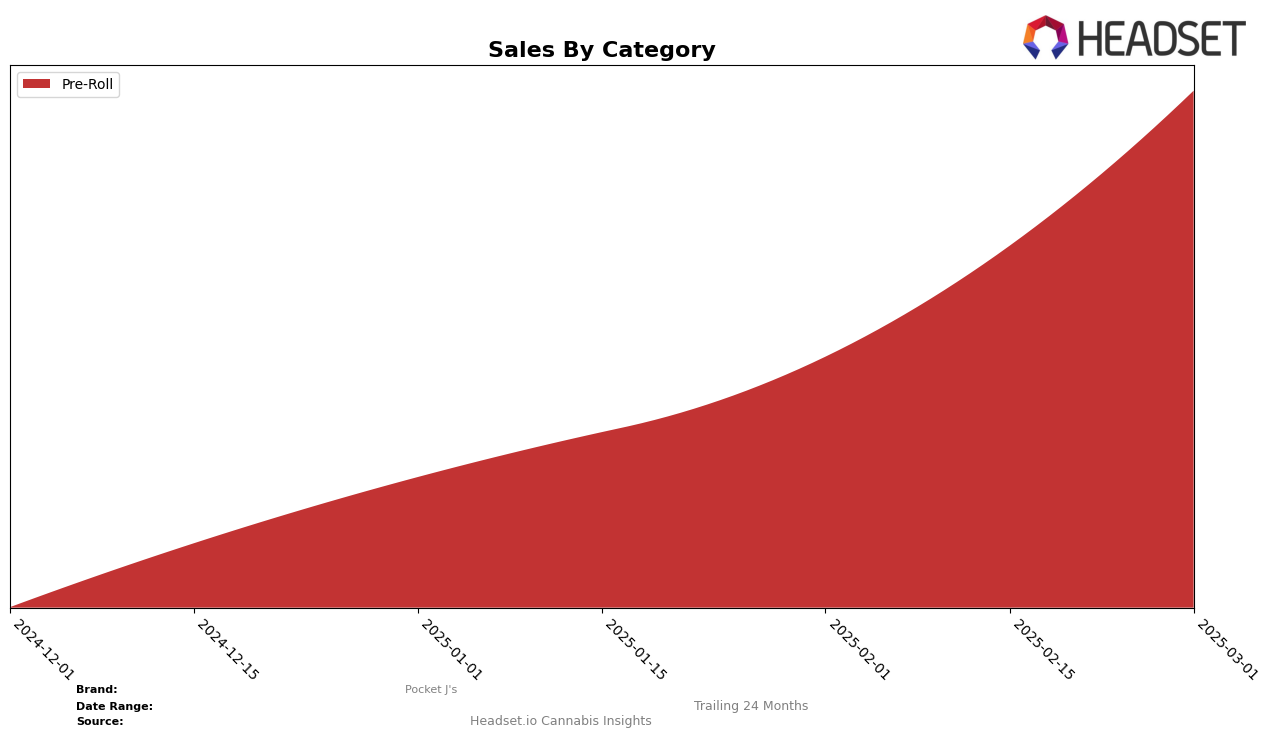

Pocket J's has shown a notable upward trajectory in the Missouri pre-roll category over the past few months. Starting from a rank of 42 in December 2024, the brand has climbed steadily, reaching the 21st position by March 2025. This consistent improvement is indicative of growing consumer preference and market penetration in the state. The brand's sales figures also reflect this positive trend, with a marked increase from December to March, suggesting a strong demand for their products. However, it is important to note that despite this progress, Pocket J's was not among the top 30 brands in December, highlighting the competitive nature of the market.

While the data from Missouri paints a promising picture, the absence of Pocket J's in the top 30 rankings in other states or provinces may suggest regional challenges or a focus on localized market strategies. The brand's movement in Missouri could be a strategic foothold to leverage further expansion or an indicator of targeted marketing efforts resonating with local consumers. Such insights could be valuable for stakeholders looking to understand the dynamics of Pocket J's growth and the broader competitive landscape in the cannabis industry. Exploring these trends further could offer a deeper understanding of Pocket J's positioning and potential future performance across different markets.

Competitive Landscape

In the competitive landscape of the Missouri pre-roll category, Pocket J's has demonstrated a remarkable upward trajectory in rank from December 2024 to March 2025, moving from 42nd to 21st place. This ascent is particularly notable when compared to competitors such as Capital City Cannabis Company and CLOVR, both of which experienced fluctuating ranks and sales during the same period. For instance, Capital City Cannabis Company dropped out of the top 20 in January and February 2025, while CLOVR's rank varied, peaking at 17th in December 2024 but falling to 24th in January 2025. Meanwhile, TWAX maintained a relatively stable position, consistently ranking around 20th, and Safe Bet showed improvement but remained slightly behind Pocket J's by March 2025. Pocket J's impressive climb in rank is indicative of its growing market presence and increasing consumer preference, positioning it as a formidable contender in the Missouri pre-roll market.

Notable Products

In March 2025, the top-performing product for Pocket J's was Lemon Royale Infused Pre-Roll 5-Pack (2.5g) in the Pre-Roll category, securing the number one rank with notable sales of 1,040 units. Pineapple Burst Infused Pre-Roll 5-Pack (2.5g) followed closely in second place, demonstrating strong market performance. Tropical Chem Pre-Roll 5-Pack (2.5g) experienced a slight drop from its top position in February to third place in March. Black Maple Wax Infused Pre-Roll 5-Pack (2.5g) entered the rankings in fourth place, indicating a growing interest. Lastly, Gorilla Glue #4 Wax Infused Pre-Roll 5-Pack (2.5g) maintained its presence in the top five, though it slipped from third in January to fifth by March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.