Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

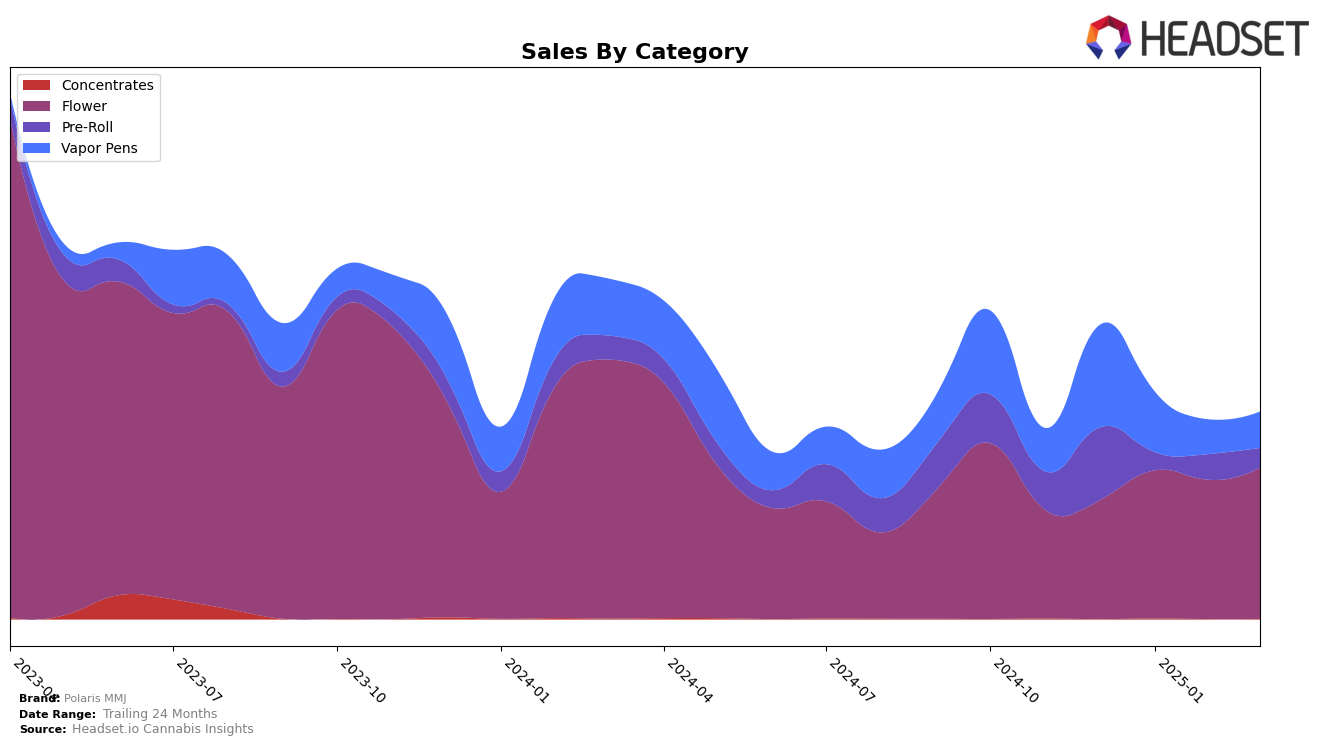

Polaris MMJ has shown notable performance variations across different categories in Nevada. In the Flower category, the brand has consistently improved its ranking, moving from 30th place in December 2024 to 20th by March 2025. This upward trajectory is complemented by a steady increase in sales, indicating a growing consumer preference for their Flower products. Conversely, the Vapor Pens category has seen a decline in rankings, slipping from 21st to 35th over the same period. This drop suggests a potential need for strategic adjustments to regain market share in this segment.

The Pre-Roll category presents an interesting case for Polaris MMJ in Nevada. After starting strong in December 2024 with a 13th place ranking, the brand experienced a significant dip, falling out of the top 30 in January 2025 and then fluctuating between 30th and 42nd place in subsequent months. Although sales in this category have not mirrored the ranking volatility as dramatically, the inconsistency highlights potential challenges in maintaining a stable market position. These dynamics across categories underscore the importance of targeted strategies to capitalize on strengths and address weaknesses within specific segments.

Competitive Landscape

In the competitive landscape of the Flower category in Nevada, Polaris MMJ has demonstrated a notable upward trajectory in rank and sales over the past few months. Starting from a rank of 30 in December 2024, Polaris MMJ improved to rank 20 by March 2025, indicating a positive trend in market presence. This improvement is significant when compared to competitors like Prime Cannabis, which fluctuated but ultimately ranked slightly higher at 19 in March 2025, and Vegas Valley Growers, which made a dramatic leap from being outside the top 20 in February to rank 21 in March. Meanwhile, CAMP (NV) experienced a decline from a top 10 position in February to rank 22 in March, which may have opened opportunities for Polaris MMJ to capture more market share. Additionally, Hippies surged to rank 17 in March, showcasing the dynamic nature of this market. Overall, Polaris MMJ's consistent rise in rank and sales amidst these fluctuations highlights its growing influence and competitive edge in Nevada's Flower category.

Notable Products

In March 2025, Polaris MMJ's top-performing product was Head Cheese (3.5g) in the Flower category, maintaining its first-place ranking for four consecutive months with sales reaching 5895 units. The New York City Diesel Pre-Roll (1g) consistently held the second position since its introduction in February 2025. Head Cheese Live Resin Disposable (1g) in the Vapor Pens category rose to the third position, showcasing a noticeable improvement from its absence in February. Head Cheese Pre-Roll (1g) saw a decline to fourth place, despite being consistently ranked third in previous months. Blue Maui Live Resin Cartridge (0.5g) remained steady in fifth place, indicating stable demand within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.