Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

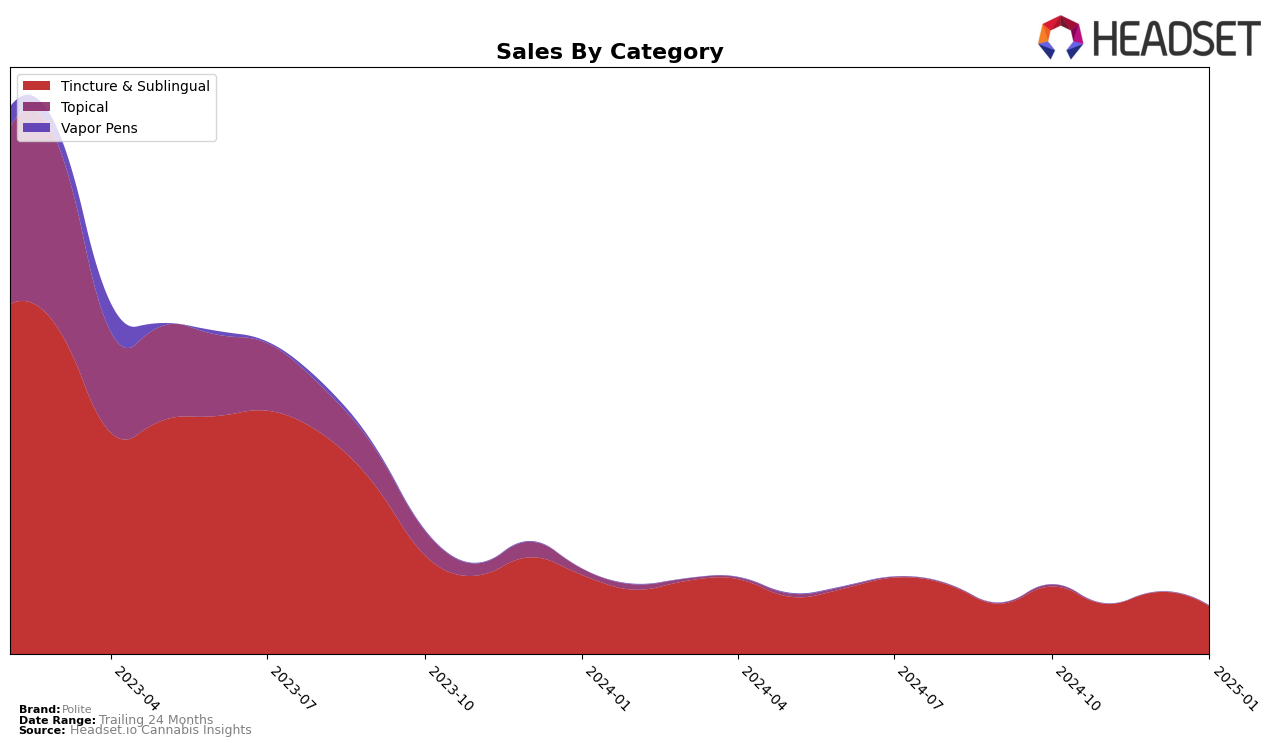

Polite has demonstrated a consistent performance in the Tincture & Sublingual category in Washington, maintaining a steady fourth-place ranking from October to December 2024. However, it's noteworthy that Polite did not appear in the top 30 brands for January 2025, indicating a significant drop in their market presence during that month. This decline comes after a fluctuating sales trend, where they saw a decrease from October to November, followed by a rebound in December. The absence from the top ranks in January could suggest competitive pressures or shifts in consumer preferences that Polite might need to address to regain its standing.

The performance of Polite across other states and categories remains less transparent, as no additional data is available for comparison. The lack of rankings in other regions or categories could imply that Polite is either not present or not competitive enough to make it into the top 30, which can be a critical insight for understanding their market penetration and brand strategy. Observing how Polite adjusts its approach in Washington and potentially expands its footprint could provide valuable insights into their strategic priorities and adaptability in a competitive landscape.

Competitive Landscape

In the Washington market for the Tincture & Sublingual category, Polite has consistently held the 4th rank from October to December 2024, but notably dropped out of the top 20 by January 2025. This decline in rank suggests a potential decrease in market presence or competitive pressure from other brands. Despite this, Polite's sales trajectory from October to December 2024 showed some resilience, with a dip in November but a recovery in December. In contrast, Green Revolution maintained a strong and steady 2nd rank throughout the same period, indicating a robust market position with consistently high sales. Similarly, Ceres held the 3rd rank, demonstrating stable performance. The competitive landscape suggests that while Polite has been a notable player, it faces significant challenges from well-established brands, emphasizing the need for strategic adjustments to regain its competitive edge in the market.

Notable Products

In January 2025, the top-performing product for Polite was the CBD/THC/CBG Relief Aid Tincture (1500mg CBD, 85mg THC, 150mg CBG, 15mg Minor, 1oz), which maintained its first-place ranking from the previous months, with sales reaching 178 units. The CBD/THC/CBN Rest Well Tincture (770mg CBD, 85mg THC, 250mg CBN, 15mg Minor, 30ml) also held steady in the second position, showcasing consistent demand. The CBD/THC/CBG/CBN Cooling Recovery Muscle Topical Stick (875mg CBD, 250mg THC, 100mg CBG, 25mg CBN) re-entered the rankings at third place, marking its first appearance since October 2024. Meanwhile, the CBD/CBG/THC Daily Defense Tincture (600mg CBD, 600mg CBG, 85mg THC, 15mg Minors,1oz) did not rank in January 2025, having previously been third in December 2024. Overall, Polite's top products have shown stable performance, with minor shifts in rankings indicating steady consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.