Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

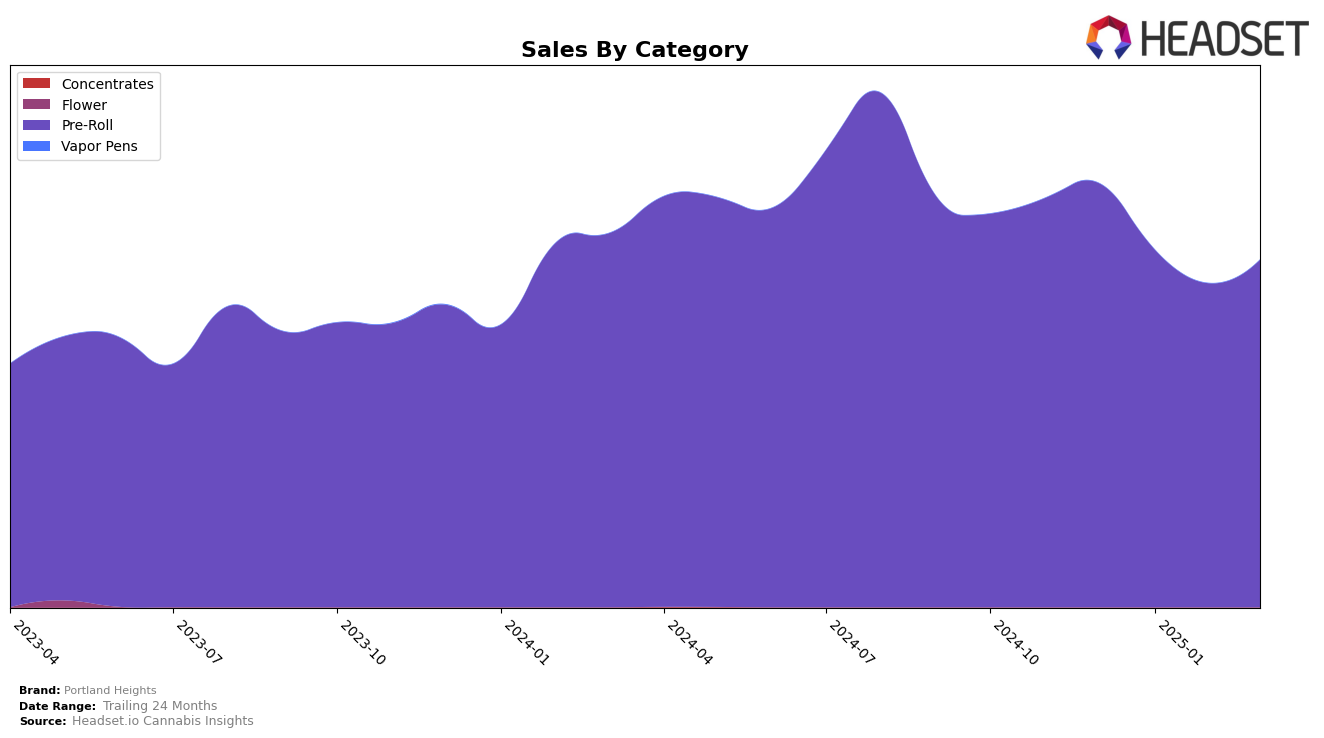

Portland Heights has consistently maintained a strong presence in the Oregon market, particularly in the Pre-Roll category where it has held the top rank from December 2024 through March 2025. Despite a decline in sales from December to February, with a slight recovery in March, the brand's ability to retain its number one position highlights its strong market presence and consumer loyalty in this category. This consistent performance could be indicative of effective brand strategies or a robust customer base that continues to prefer Portland Heights over competitors.

While Portland Heights dominates the Pre-Roll category in Oregon, its absence in the top 30 brands for other states and categories may suggest areas for potential growth or a need for strategic adjustments. The lack of ranking in other states or categories could be seen as a missed opportunity, signaling either a highly competitive market landscape or a focus on maintaining leadership within a specific niche. This positioning raises interesting questions about the brand's strategic priorities and potential for expansion beyond its current stronghold.

Competitive Landscape

In the highly competitive Oregon pre-roll market, Portland Heights has consistently maintained its top position from December 2024 through March 2025. Despite a noticeable decline in sales from December to February, Portland Heights experienced a rebound in March, closing the gap with its December figures. This resilience is particularly significant given the steady performance of competitors like Hellavated and Fire Dept. Cannabis, which have consistently held the second and third ranks, respectively, throughout the same period. Hellavated's sales saw a substantial increase in March, potentially posing a threat to Portland Heights' lead if the trend continues. Meanwhile, Fire Dept. Cannabis experienced a dip in February but recovered in March, indicating a volatile yet competitive landscape. These dynamics suggest that while Portland Heights remains the leader, it must continue to innovate and adapt to maintain its edge in the evolving market.

Notable Products

In March 2025, the top-performing product from Portland Heights is the Key Lime Kush Moonrock Infused Blunt (2g) in the Pre-Roll category, holding the number one rank with sales of 1348. The Sweets - Mango Dream Moonrock Infused Blunt (2g) maintained its position at rank two, showing consistent performance from January and February. The Sweets - Strawberry Cookies Oil Infused Blunt (2g) secured the third position, marking its first appearance in the rankings. Sweets- Guava Gorilla Moonrock Infused Blunt (2g) experienced a drop, moving from the top spot in February to fourth in March. Lastly, the Grand Papaya Moonrock Slims Infused Pre-Roll (1g) debuted at the fifth position, rounding out the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.