Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

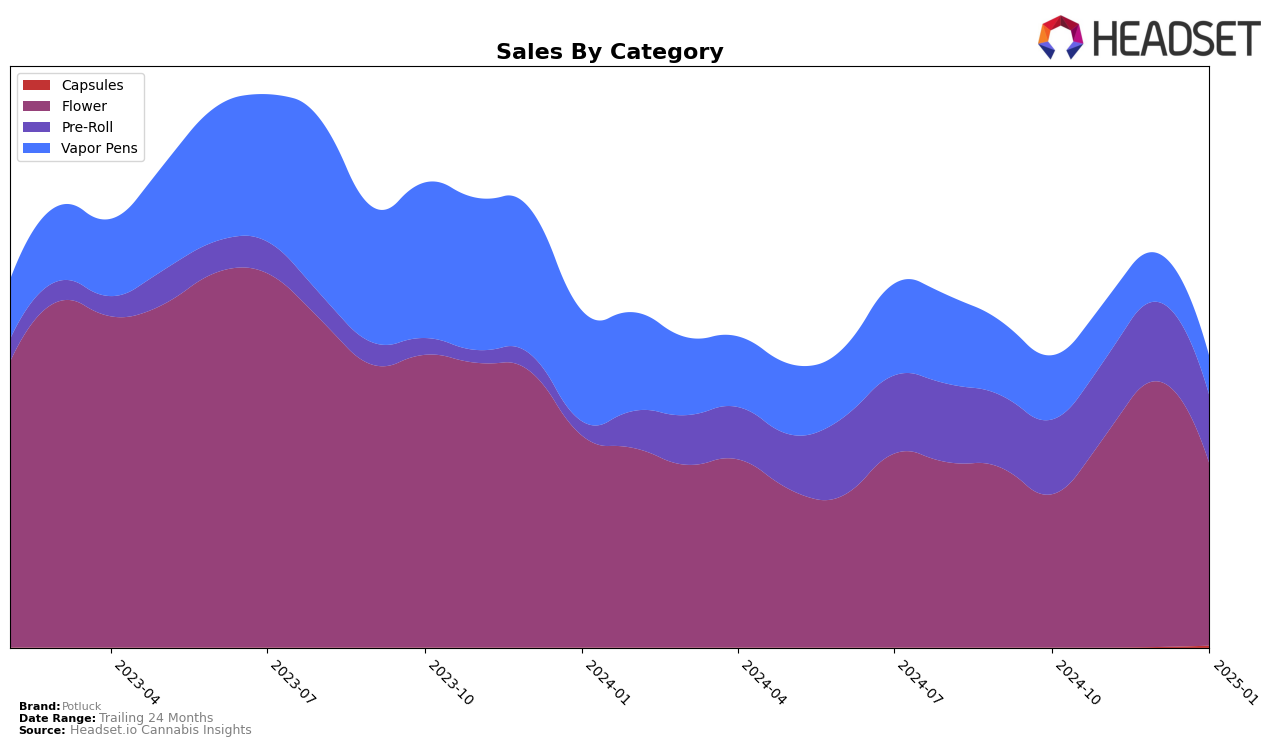

Potluck's performance across various categories and provinces indicates a dynamic presence, especially in the Flower category. In Alberta, Potluck moved from being ranked 86th in October 2024 to 34th in December 2024, showcasing a significant upward trajectory before slightly declining to 52nd in January 2025. This suggests a fluctuating but generally positive trend in the Flower category within the province. Meanwhile, in Ontario, Potluck consistently maintained a strong position, ranking in the top 31 across all months in the Flower category, indicating stable consumer demand and market presence. However, Potluck did not make it to the top 30 in the Flower category in Saskatchewan until December 2024, pointing to potential growth opportunities in that region.

The Pre-Roll category presents a different picture, with Potluck appearing to face challenges in maintaining a high ranking. In British Columbia, Potluck's ranking hovered around the 70s, indicating a struggle to break into the top 30, which could suggest competitive pressures or shifting consumer preferences. A similar pattern is observed in Ontario, where Potluck's ranking remained in the mid-60s, showing consistency but lacking significant upward movement. On the other hand, in the Vapor Pens category, Potluck's performance in Alberta saw a decline from the 42nd position in October 2024 to 59th in January 2025, which might indicate a need to reassess their strategy in this category to regain momentum.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Potluck has demonstrated notable resilience and growth in its market positioning. Over the months from October 2024 to January 2025, Potluck's rank improved from 31st to 27th in December before settling back to 31st in January. This fluctuation indicates a competitive environment, with Potluck showing potential for upward mobility. Notably, Muskoka Grown and Endgame have maintained relatively stable positions, with Muskoka Grown consistently ranking around 30th and Endgame showing a slight dip from 27th to 30th. Meanwhile, Carmel has experienced more volatility, dropping from 21st in November to 29th in January, which could present an opportunity for Potluck to capture more market share. Despite these fluctuations, Potluck's sales trajectory has been positive, peaking in December, which suggests a growing consumer base and effective sales strategies in place. This dynamic environment underscores the importance of strategic positioning and adaptability for Potluck to continue its upward trend in the Ontario Flower market.

Notable Products

In January 2025, Pineapple Express Pre-Roll (0.5g) maintained its position as the top-performing product for Potluck, with sales reaching 19,954 units. Maple Pancakes Pre-Roll (0.5g) consistently held the second spot, although its sales showed a noticeable decline compared to previous months. Pineapple Express (7g) improved its ranking slightly, moving from fourth to third place, indicating a steady increase in its popularity. Frosted Cherry Pre-Roll (0.5g) reappeared in the rankings at fourth place after being absent in December 2024. Blueberry Tart Pre-Roll (0.5g) retained its fifth position, showing stable performance since its introduction in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.