Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

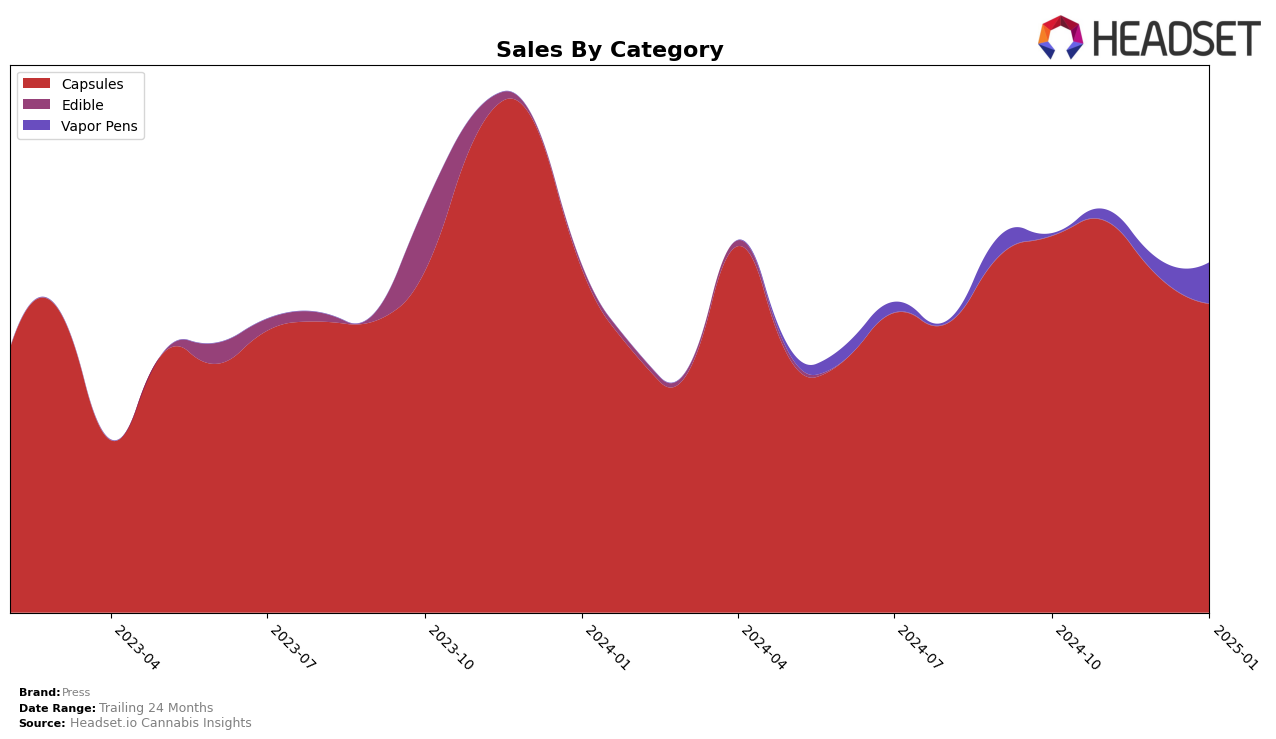

Press has demonstrated a consistent performance in the Capsules category across different states, maintaining its position over several months. In Arizona, the brand has consistently held the third position from October 2024 to January 2025, indicating a strong foothold in this market. This stability suggests a loyal customer base or effective market strategies that keep Press securely within the top ranks. Meanwhile, in California, Press has maintained the 14th position in the same category over the same period. Although not as dominant as in Arizona, holding a steady rank in a competitive market like California indicates a respectable presence. However, the lack of movement in rankings might also suggest challenges in gaining further market share or increasing brand visibility in California.

Interestingly, the sales figures for Press show some fluctuations that could be worth exploring. In Arizona, while the brand retained its third position, sales saw a decline from October to December 2024, followed by a slight recovery in January 2025. This trend might suggest seasonal variations or market dynamics impacting consumer purchasing behavior. In contrast, California experienced a sales peak in November 2024 before seeing a decrease in the following months. This peak could hint at successful promotional activities or market events during that period. The absence of Press in the top 30 brands in other states or categories is noteworthy, as it highlights potential areas for growth or the need for strategic adjustments to expand their market presence.

Competitive Landscape

In the competitive landscape of the Arizona capsules category, Press consistently held the 3rd rank from October 2024 to January 2025. Despite maintaining its position, Press faces significant competition from Sweet Science, which consistently ranked 2nd and demonstrated higher sales figures across the months. The leading brand, Life Is Chill, dominated the market with the highest sales, indicating a strong consumer preference and brand loyalty. Press's stable rank suggests a dedicated customer base but highlights the need for strategic initiatives to close the sales gap with its competitors. Understanding these dynamics is crucial for Press to enhance its market share and potentially climb the ranks in the Arizona capsules market.

Notable Products

In January 2025, the top-performing product from Press was the THC Hard Pressed Tablets 20-Pack (1000mg) in the Capsules category, maintaining its number one rank for three consecutive months with sales reaching 402 units. The THC/THCv 1:1 Rally Tablets 20-Pack (100mg THC, 100mg THCV) moved up to the second position, showing a notable increase from its third place in December 2024. The CBD/THC 1:1 Doze Tablets 20-Pack (100mg THC, 100mg CBN) held steady in the third position, reflecting consistent performance across the months. The CBD/THC 1:1 Shine Tablets 20-Pack (100mg CBD, 100mg THC) remained in fourth place, while the CBD/THC 2:1 Shine Tablets 20-Pack (100mg CBD, 50mg THC) continued to rank fifth since November 2024. These rankings highlight a stable preference for these top products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.