Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

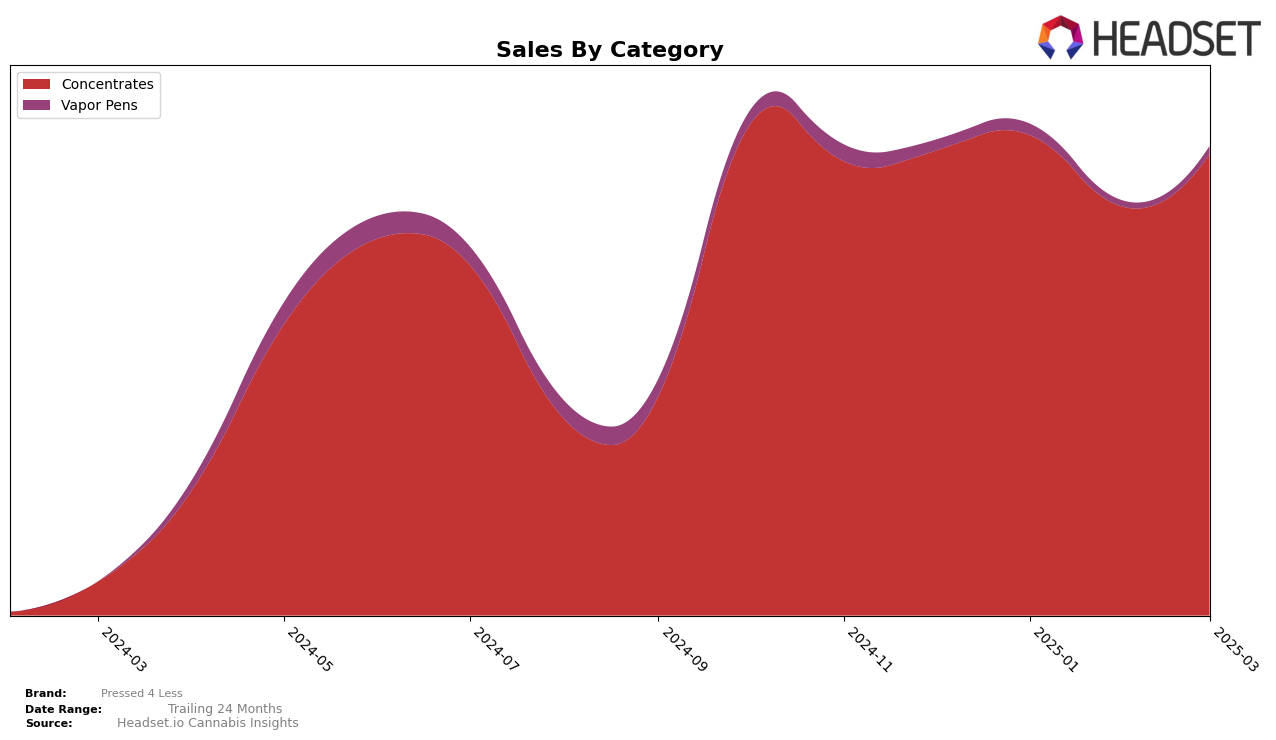

Pressed 4 Less has shown a dynamic performance in the Concentrates category across various states, with notable fluctuations in their rankings. In Washington, the brand maintained a presence within the top 20, starting at the 16th position in December 2024, moving up to 14th in January 2025, before dropping back to 16th in February, and then to 18th in March. This movement indicates a competitive landscape where Pressed 4 Less is striving to maintain its foothold. Despite the rank fluctuations, the brand's sales figures in Washington reveal resilience, with a dip in February but a recovery in March, suggesting potential seasonal influences or promotional activities impacting consumer purchase behavior.

The absence of Pressed 4 Less in the top 30 brands for certain states or categories could be a point of concern or an opportunity for growth, depending on their strategic goals. As they continue to navigate the competitive market landscape, their ability to adapt and innovate will be crucial for sustaining and improving their ranking. Understanding the broader trends and consumer preferences in each state will be vital for Pressed 4 Less to capitalize on emerging opportunities and address challenges. While Washington shows a consistent presence, analyzing performance in other regions could provide insights into potential areas for expansion or increased market penetration.

Competitive Landscape

In the competitive landscape of the Washington concentrates market, Pressed 4 Less has shown a dynamic performance from December 2024 to March 2025. Initially ranked 16th in December, Pressed 4 Less improved to 14th in January, reflecting a positive reception in the market. However, by February and March, the brand experienced a slight decline, settling at 16th and 18th, respectively. This fluctuation in rank can be attributed to the competitive pressure from brands like Crystal Clear, which climbed from 18th in December to 13th in February, and Skagit Organics, which maintained a relatively stable presence despite a gradual decline in sales. Meanwhile, Slab Mechanix and Hitz Cannabis also presented challenges, with both brands experiencing rank fluctuations that indicate a volatile market environment. For Pressed 4 Less, maintaining its market position will require strategic adjustments to counteract these competitive pressures and capitalize on its early 2025 momentum.

Notable Products

In March 2025, the top-performing product for Pressed 4 Less was Super Buff Cherry Rosin (1g) in the Concentrates category, which ascended to the first position with sales amounting to 807 units. Sub Zero Rosin (1g) experienced a slight drop, moving from the top spot in previous months to second place. Coffee Cake Rosin (1g) made its debut in March, securing the third rank with notable sales of 634 units. MAC Daddy Hash Rosin (1g) also entered the rankings, taking the fourth position. Peach Pie Rosin (1g) saw a decline from first place in February to fifth place in March, indicating a shift in consumer preferences within the category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.