Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

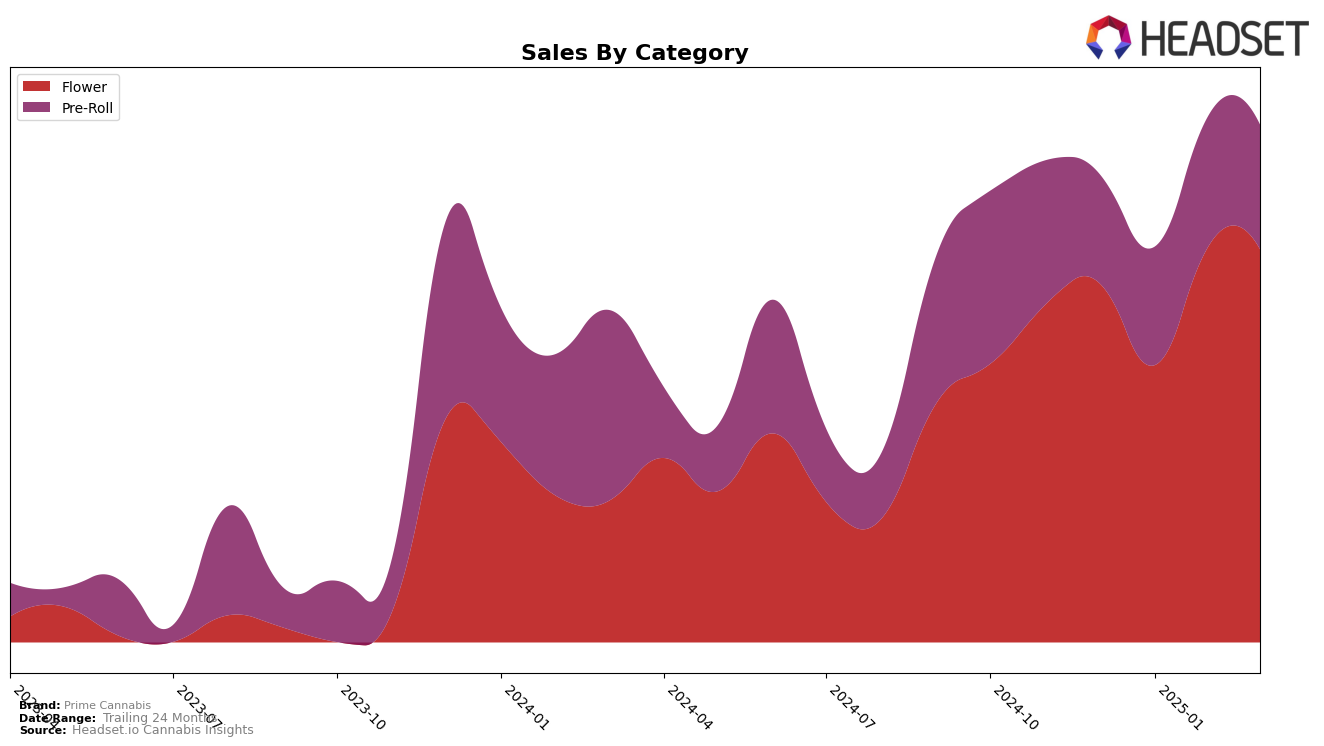

Prime Cannabis has shown notable performance trends across different categories in the state of Nevada. In the Flower category, Prime Cannabis has made a significant upward movement, improving its rank from 25th in December 2024 to 19th by March 2025. This improvement is accompanied by a substantial increase in sales from December to February, although there is a slight dip in March. In contrast, the Pre-Roll category exhibits more volatility. While Prime Cannabis improved its ranking from 24th to 15th between December and February, it slipped back to 20th in March. Despite this fluctuation, sales figures in the Pre-Roll category indicate a generally positive trend, with a peak in February.

However, it's important to note that Prime Cannabis was not ranked in the top 30 brands in any other state or province across these categories, which could suggest either an opportunity for growth or a challenging competitive landscape outside of Nevada. The absence of rankings in other regions might be seen as a gap in their market presence, potentially indicating areas where the brand could focus on expansion or improvement. This performance analysis highlights Prime Cannabis's strong foothold in Nevada, particularly in the Flower category, while also pointing to the need for strategic efforts to improve their standing in other markets and categories.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Prime Cannabis has shown a notable upward trajectory in rankings over the first quarter of 2025. Starting from a rank of 28 in January, Prime Cannabis climbed to 19 by March, indicating a positive trend in market presence. This improvement is significant when compared to competitors like Polaris MMJ, which also improved but remained at rank 20 in March. Meanwhile, Vegas Valley Growers experienced a dramatic leap from rank 64 in February to 21 in March, suggesting a volatile yet competitive environment. However, Firestar maintained a strong position, consistently ranking higher than Prime Cannabis, though its rank fluctuated slightly. Additionally, Hippies made a remarkable jump from rank 45 in February to 17 in March, surpassing Prime Cannabis. These dynamics highlight Prime Cannabis's resilience and potential for growth amidst a competitive field, suggesting strategic opportunities for further market penetration and sales enhancement.

Notable Products

In March 2025, Purple Goats Shake (14g) emerged as the top-performing product for Prime Cannabis, climbing from the third position in previous months to first place, with sales reaching 1756 units. Following closely, Purple Goats Pre-Roll (1g) dropped from its consistent first place in previous months to second, with sales at 1579 units. Gelato Glue Pre-Roll (1g) showed significant improvement, rising from fourth place in February to third in March, recording sales of 1544 units. Purple Goats (3.5g) experienced a decline, falling from second place to fourth. Green Crack Pre-Roll (1g) re-entered the rankings at fifth place after being absent in February, indicating a resurgence in interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.