Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

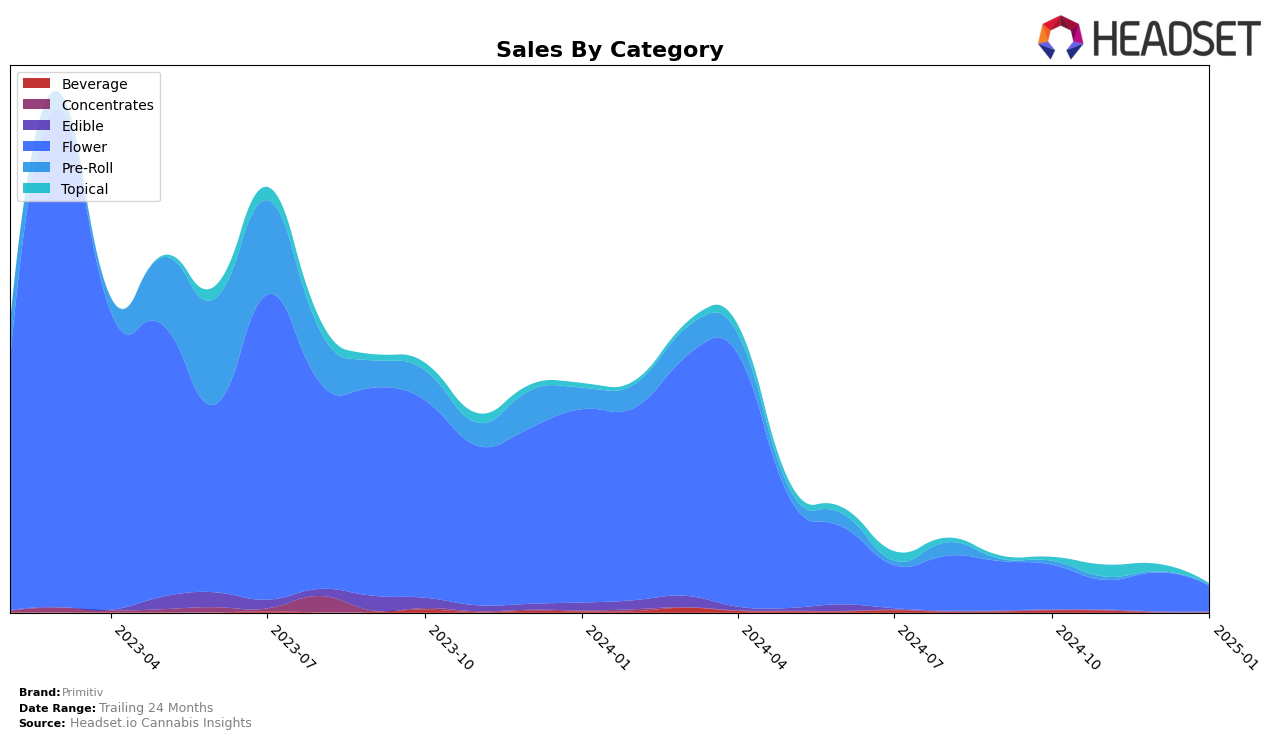

Primitiv has shown a notable performance in the Michigan market, particularly in the Topical category. In November 2024, Primitiv achieved a rank of 7th, marking its presence in the top 10 brands for that category. However, the absence of a ranking in October 2024 and the following months suggests that the brand either did not maintain its position or fell out of the top 30 entirely. This fluctuation could indicate a temporary surge in popularity or a strategic push during that specific month, which might not have been sustained over the subsequent months.

The lack of continuous ranking data for Primitiv beyond November 2024 in Michigan's Topical category could be seen as a potential area of concern or an opportunity for growth, depending on the brand's strategic goals. It raises questions about market dynamics and consumer preferences that might have influenced these rankings. Despite this, Primitiv's ability to break into the top 10, even if briefly, highlights its potential to compete with other leading brands in the region. Insights into consumer behavior and competitive analysis could provide further understanding of these movements, though such details are beyond the scope of this analysis.

```Competitive Landscape

In the competitive landscape of the Michigan topical cannabis market, Primitiv has experienced notable fluctuations in its ranking and sales performance. After not being in the top 20 in October 2024, Primitiv emerged in November 2024 at the 7th position, indicating a positive shift in market presence. However, this rank was not sustained in December 2024 and January 2025, suggesting challenges in maintaining momentum. In contrast, Escape Artists consistently held a strong position, ranking 3rd in October 2024 and maintaining a steady 5th place from November 2024 through January 2025, showcasing resilience and stable consumer demand. Meanwhile, Neno's Naturals maintained a stable 6th rank from October through December 2024, before dropping out of the top 20 in January 2025. The entry of Made By A Farmer into the 7th position in December 2024 further intensified competition, potentially impacting Primitiv's ability to reclaim its rank. These dynamics highlight the competitive pressures Primitiv faces in sustaining its market position amidst established and emerging brands.

Notable Products

In January 2025, Snow Queen (3.5g) from Primitiv maintained its top position in the Flower category with notable sales of 531 units, continuing its lead from December 2024. Turf - Sour Punch Pre-Roll (1g) rose to second place in the Pre-Roll category, despite a drop in sales to 227 units from previous months. Jack (3.5g) made a significant entry into the rankings, securing the third spot in the Flower category after being unranked in prior months. Gelato (3.5g) appeared for the first time in fourth place, while Runtz (3.5g) followed closely in fifth, both marking their debut in the rankings. This shift indicates a strong performance for new Flower products, suggesting a changing preference among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.