Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

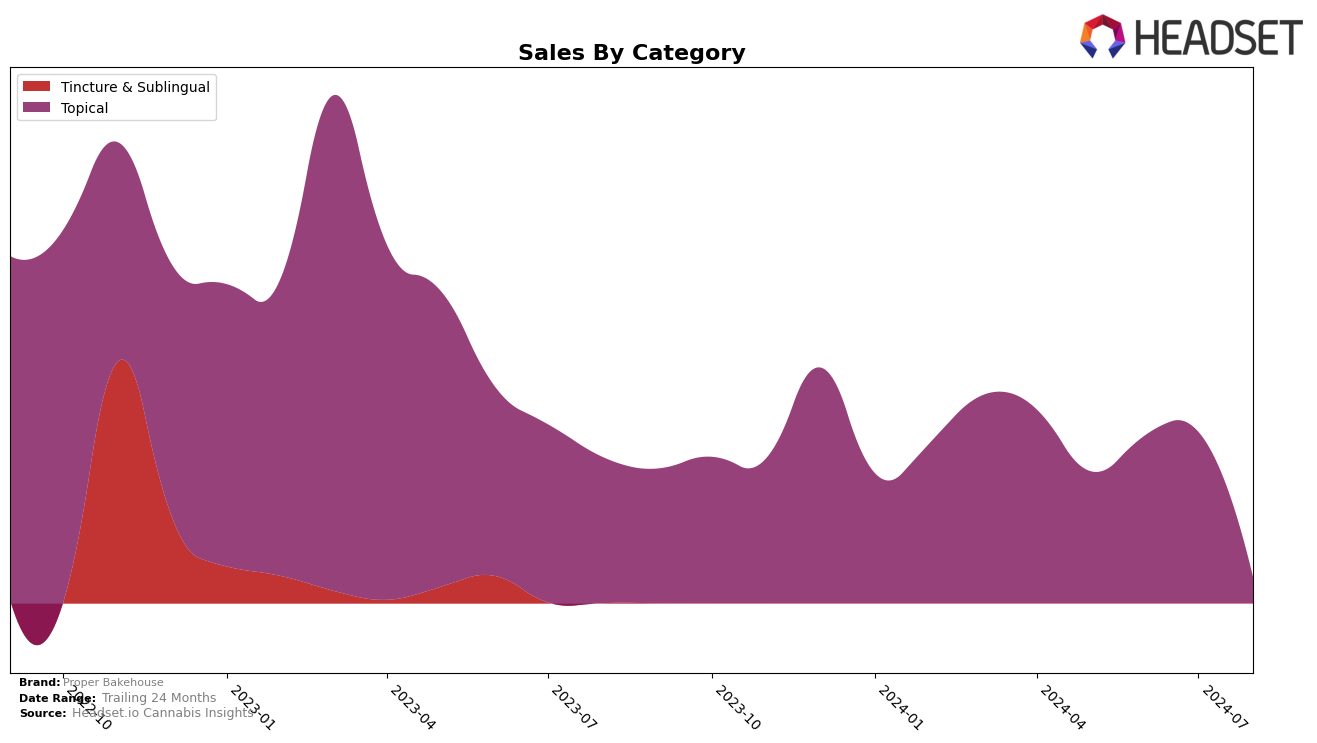

Proper Bakehouse has shown notable performance in the Topical category across several months in Michigan. In May 2024, the brand ranked 9th, improving to 8th place in June and maintaining this position through July. However, by August, Proper Bakehouse did not appear in the top 30 brands, indicating a significant drop in rankings. This suggests either increased competition or a potential dip in consumer interest. The sales figures also reflect a positive trend up until July, with a steady increase from $14,863 in May to $19,294 in July, before the brand's absence from the rankings in August.

The fluctuation in Proper Bakehouse's performance highlights the competitive nature of the Topical category in Michigan. While the brand showed strong growth and maintained a solid presence for three consecutive months, its disappearance from the top 30 in August is concerning. This could be an indicator of market saturation or shifts in consumer preferences. Observing these trends can provide valuable insights into the dynamics of the cannabis market and the challenges brands face in maintaining their position. Further analysis could uncover more detailed reasons behind these movements and provide a clearer picture of Proper Bakehouse's market strategy and execution.

Competitive Landscape

In the competitive landscape of Michigan's topical cannabis market, Proper Bakehouse has demonstrated notable resilience and growth. Over the past few months, Proper Bakehouse has seen an upward trend in its rankings, moving from 9th place in May 2024 to 8th place in June and July 2024. This improvement is significant, especially when compared to competitors like Michigan Organic Rub, which has seen a decline from 6th to 9th place over the same period. Another competitor, Zilla's, showed a fluctuating trend, dropping from 10th to 11th place in June before rising to 7th place in July. Meanwhile, Northern Connections entered the top 20 in June at 7th place but fell to 10th by August. Proper Bakehouse's consistent performance and slight rank improvement suggest a stable and potentially growing market presence, making it a strong contender in Michigan's topical cannabis sector.

Notable Products

In August 2024, Proper Bakehouse's top-performing product was CBD/THC 1:1 Jaguar Mini Travel Balm (100mg CBD, 100mg THC), maintaining its position as the best-seller from June, with notable sales of 41 units. The CBD:THC 1:1 Jaguar Balm (1000mg CBD, 1000mg THC) also climbed to the top rank, sharing the first place, a significant improvement from its third position in July. The CBD/THC 1:1 Lavender Travel Mini Balm (50mg CBD, 50mg THC) secured the second rank, showing a slight decline from its top position in July. CBD/THC 1:1 Lavender Balm (500mg CBD, 500mg THC) dropped to the third position in August, after being the top-seller in May and July. Overall, August saw a reshuffling of ranks with Jaguar-themed balms taking the lead.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.