Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

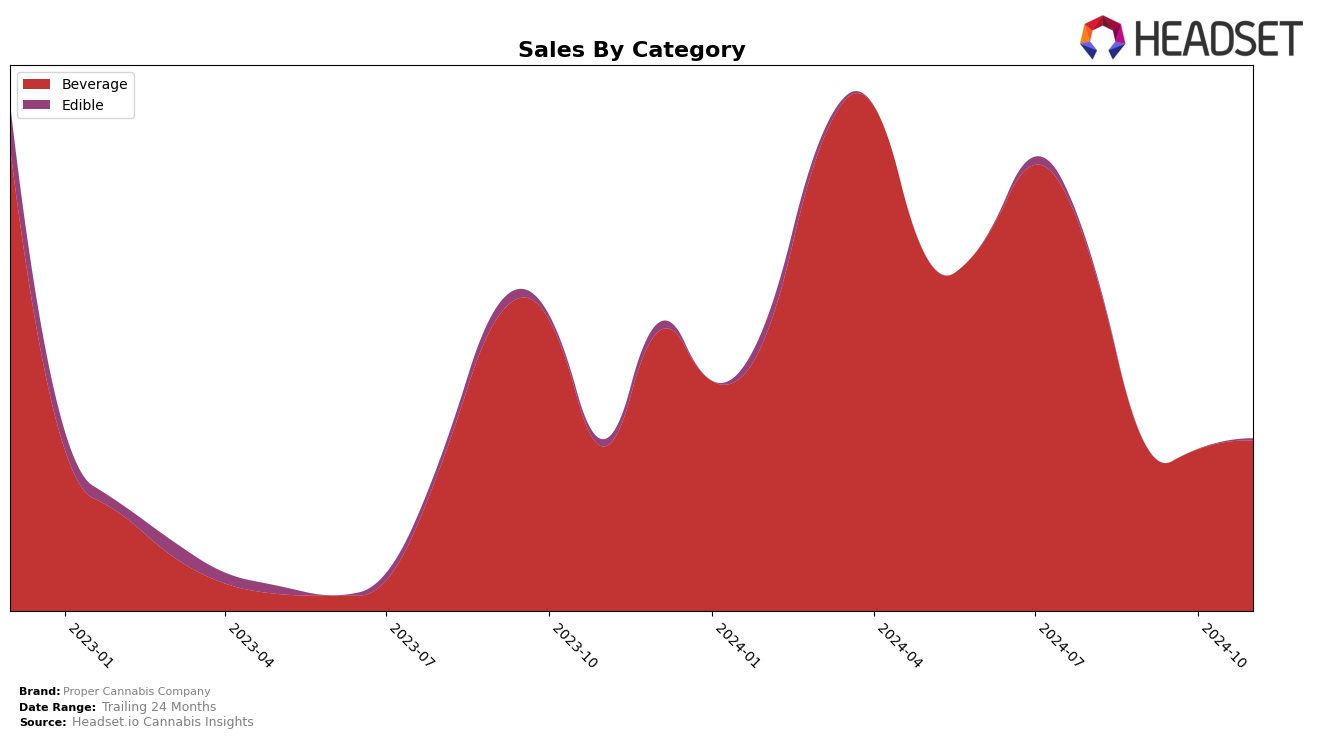

Proper Cannabis Company has shown a varied performance across different categories and states, with notable movements in the beverage category within Ontario. In August 2024, the company was ranked 33rd in the beverage category, indicating a presence just outside the top tier brands. However, the absence of rankings in subsequent months suggests that the company did not maintain a position within the top 30, which could be interpreted as a decline in market competitiveness in this category within Ontario. This might highlight challenges the brand is facing in maintaining its standing in a competitive market space.

The sales figures for August 2024 in Ontario reveal that Proper Cannabis Company generated $10,159 in revenue from the beverage category, but the lack of subsequent sales data might imply a stagnation or decrease in market engagement. This could be due to various factors such as increased competition, changes in consumer preferences, or strategic shifts within the company. While the initial rank shows potential, the absence of continued presence in the top rankings suggests areas where the brand could potentially focus its efforts to regain or improve its market position. Further analysis would be beneficial to understand the underlying causes of these movements and to identify opportunities for growth and improvement.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Proper Cannabis Company has faced significant challenges in maintaining a strong market presence. As of the latest data, Proper Cannabis Company has not ranked in the top 20 brands since August 2024, indicating a struggle to compete with more established brands. In contrast, Tweed has consistently maintained a position within the top 20, albeit with a slight decline from rank 14 in August to rank 15 in October, before dropping out of the top 20 in November. Meanwhile, Sense & Purpose Beverages has shown resilience, maintaining a presence in the rankings and experiencing a notable sales increase in October. Additionally, Seeker also did not rank in the top 20 beyond August, similar to Proper Cannabis Company, suggesting a competitive bottleneck for emerging brands. These dynamics highlight the competitive pressure Proper Cannabis Company faces, emphasizing the need for strategic initiatives to enhance brand visibility and sales performance in the Ontario beverage market.

Notable Products

In November 2024, the top-performing product for Proper Cannabis Company was Blueberry Pomegranate Infused Sparkling Water (10mg THC, 355ml) in the Beverage category, maintaining its number one rank for four consecutive months with sales of 410 units. Lemon Lime Sparkling Water (10mg THC, 355ml) also held steady at the second position, showing a notable increase in sales from previous months. Blackberry Peach Hash Rosin Gummies 2-Pack (10mg), an Edible, reappeared in the rankings at the third position, after not being ranked for two months. Compared to previous months, the rankings for these products remained consistent, indicating strong and stable consumer demand. The sales figures suggest that the Beverage category is a key performer for Proper Cannabis Company, with both top products belonging to this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.