Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

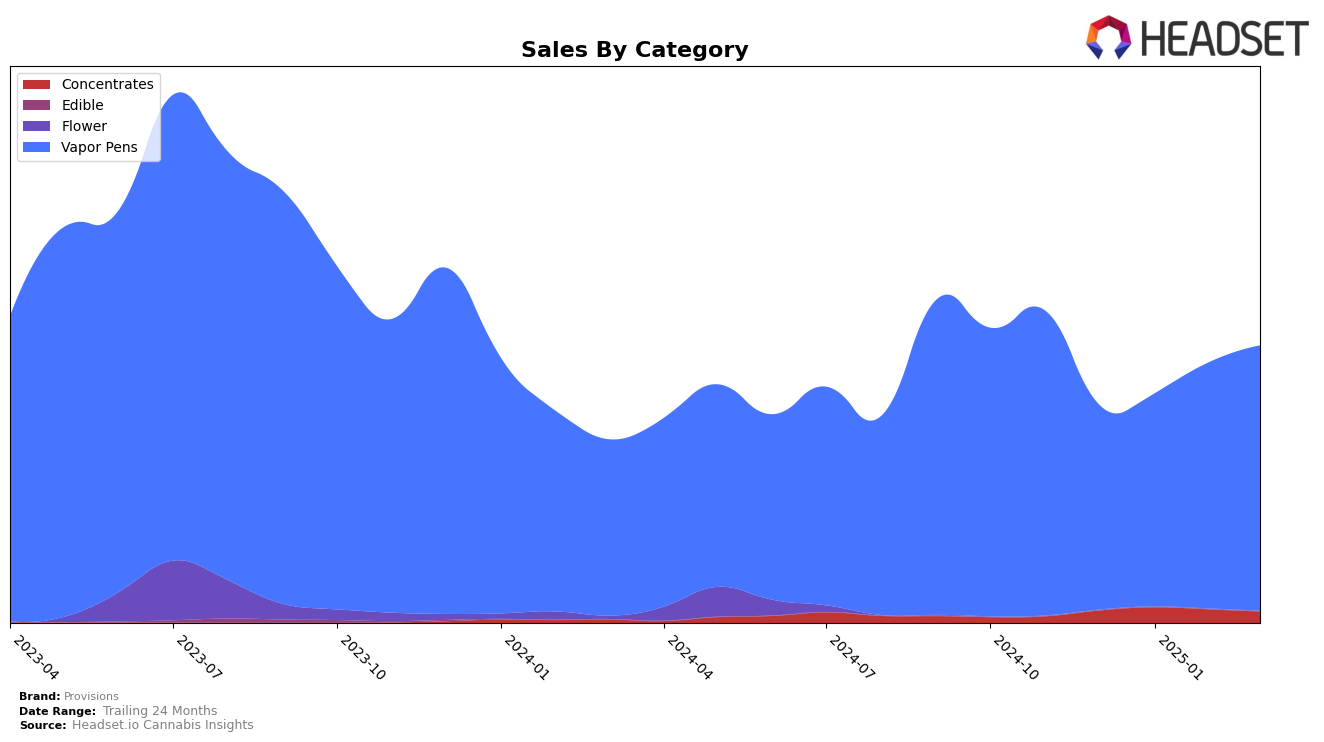

Provisions has demonstrated varied performance across different product categories in Nevada. In the Concentrates category, the brand showed some fluctuations in its ranking over the first quarter of 2025. Starting at 23rd place in December 2024, Provisions improved to 18th in January but then slipped to 21st in February and further to 27th in March. This decline in rank could be indicative of increased competition or shifting consumer preferences within the Concentrates market. Notably, Provisions was still within the top 30, suggesting a presence but perhaps highlighting an area for potential improvement.

In contrast, Provisions experienced a more positive trend in the Vapor Pens category in Nevada. The brand maintained a strong performance, starting at 14th place in December 2024 and gradually climbing to 9th by March 2025. This upward movement indicates a strengthening position in the Vapor Pens market, with sales increasing each month. This consistent improvement suggests that Provisions is gaining traction and possibly expanding its customer base in this category. However, the data does not reveal whether this rise is due to increased consumer demand for Vapor Pens in general or if Provisions is outperforming its competitors in terms of product offerings or marketing strategies.

Competitive Landscape

In the competitive landscape of Vapor Pens in Nevada, Provisions has shown a promising upward trajectory in its rankings over the past few months. Starting from a rank of 14 in December 2024, Provisions improved its position to rank 9 by March 2025. This upward movement indicates a positive reception in the market, especially as competitors like AiroPro and City Trees experienced fluctuations, with AiroPro dropping out of the top 10 by February 2025 and City Trees experiencing a dip in January before recovering slightly. Meanwhile, INDO also saw a notable improvement in March, climbing to rank 7. Despite these shifts, Provisions' consistent rise in rank suggests effective strategies in capturing market share and potentially increasing sales, as evidenced by its steady sales growth from December to March. This trend positions Provisions as a formidable contender in the Nevada Vapor Pens market, challenging established brands like Sauce Essentials, which maintained a strong presence throughout the period.

Notable Products

In March 2025, the top-performing product for Provisions was the Blue Dream Live Resin Cartridge (0.9g) in the Vapor Pens category, securing the number one rank with sales of 2514 units. Following closely was the London Pound Cake Distillate Cartridge (0.9g), which ranked second, and the Papaya Distillate Cartridge (0.9g) in third place. Notably, the GMO Cookies Live Resin Diamonds Cartridge (0.9g) improved its position, climbing from fifth in January to fourth in March. Meanwhile, the Blue Cheese Distillate Cartridge (0.9g) maintained a steady fifth position. These rankings highlight a strong preference for live resin and distillate cartridges among consumers during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.