Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

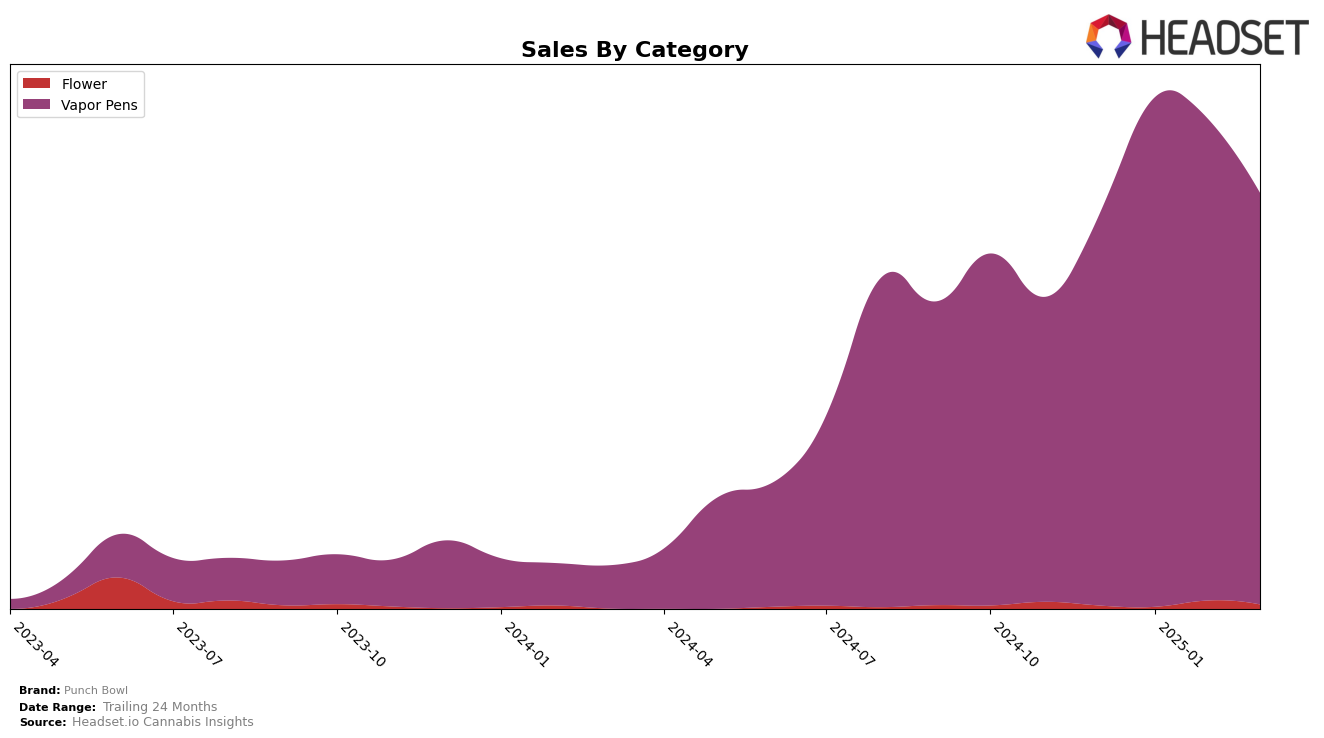

Punch Bowl has shown some interesting dynamics in the Vapor Pens category in Oregon. Their rank improved slightly from 25th in December 2024 to 23rd in both January and February 2025, before slipping back to 27th in March 2025. This fluctuation indicates a competitive market environment where Punch Bowl is managing to maintain a presence, albeit with some challenges in sustaining higher rankings. Despite the rank drop in March, the brand's sales trajectory was positive from December to January, suggesting a strong start to the year. However, the decline in sales by March could be a point of concern for maintaining their standing in the top 30.

It is noteworthy that Punch Bowl did not appear in the top 30 rankings outside of Oregon, which could either highlight a strategic focus on this specific market or suggest untapped potential in other states. The absence from other states' rankings might indicate either a lack of distribution or competitive pressure that limits their expansion. The brand's performance in Oregon serves as a valuable case study for understanding their market strategy and competitive positioning within the Vapor Pens category, offering insights into their operational focus and market challenges.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Punch Bowl has experienced notable fluctuations in its ranking over the past few months. Starting at rank 25 in December 2024, Punch Bowl improved to rank 23 in January and February 2025, before slipping to rank 27 in March 2025. This decline in rank coincides with a decrease in sales from February to March. In contrast, competitors like Willamette Valley Alchemy and Kaprikorn have shown upward trends, with Willamette Valley Alchemy moving from rank 26 to 25 and Kaprikorn improving from 31 to 26 over the same period. Meanwhile, Sessions Supply Co. (CA) has made significant strides, climbing from rank 41 in December to 29 in March, indicating a strong upward trajectory in sales. These shifts suggest a competitive pressure on Punch Bowl, highlighting the need for strategic adjustments to regain its standing in the Oregon vapor pen market.

Notable Products

In March 2025, the top-performing product from Punch Bowl was the Maui Wowie Flavored Distillate Cartridge (1g) in the Vapor Pens category, maintaining its leading position from January and reclaiming it after a dip in February. The Pineapple Express Flavored Distillate Cartridge (1g) secured the second rank, a consistent position since January, following a brief peak at the top in February. Peaches and Cream Flavored Distillate Cartridge (1g) ranked third, dropping from its second-place position the previous month. Notably, the Raspberry Crave Distillate Cartridge (1g) re-entered the rankings at fourth position, having not been in the top ranks in January and February. The Strawberry Jam Flavored Distillate Cartridge (1g) debuted in the rankings at fifth place, contributing to an overall diverse product performance for Punch Bowl in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.