Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

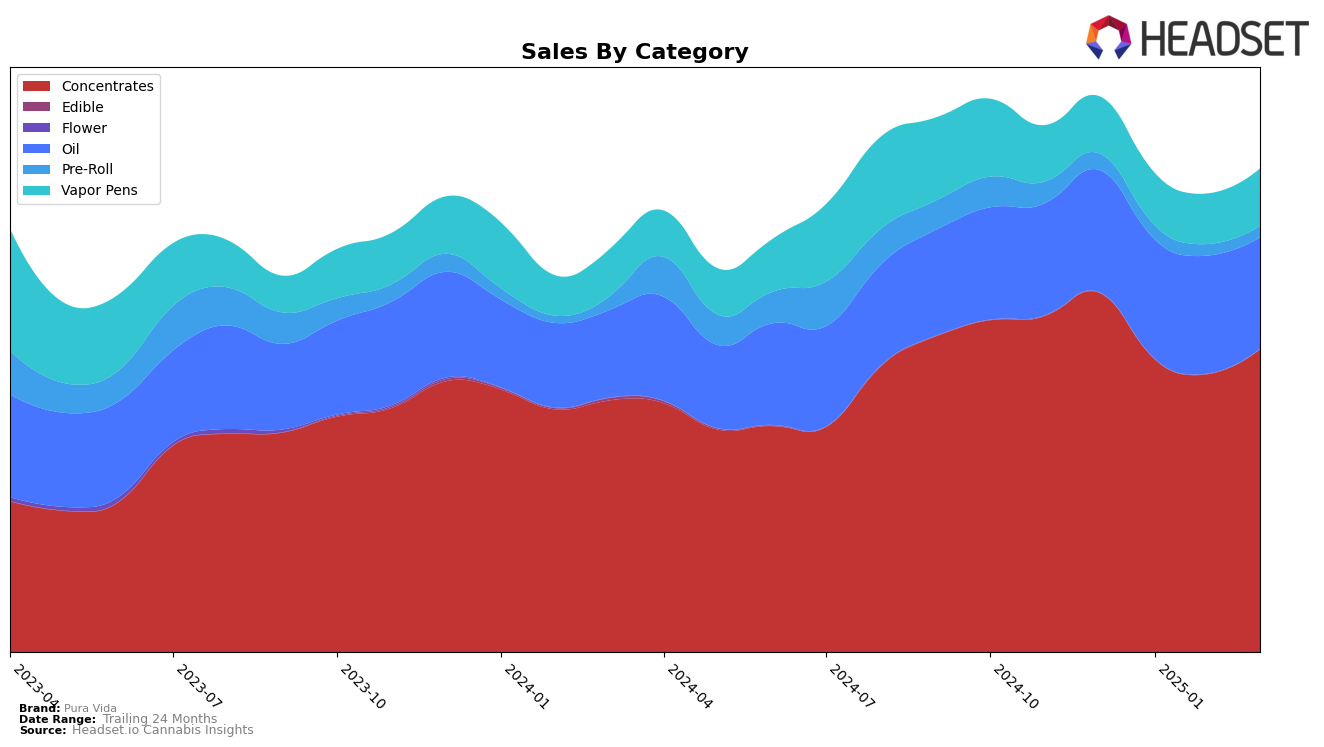

Pura Vida's performance in the Concentrates category shows varied trends across different provinces. In Alberta, the brand maintained a steady presence in the top 10, although it experienced a slight decline from 7th to 10th place over the four-month period. Conversely, in British Columbia, Pura Vida saw fluctuations, with ranks oscillating between 5th and 9th place. The consistency in Ontario is noteworthy, as the brand held onto the 4th position throughout the months, indicating a stable market presence in this region. However, the absence of Pura Vida from the top 30 in the Vapor Pens category in Ontario highlights a significant challenge, as it suggests a need for strategic adjustments to improve their standing in this category.

In the Oil category, Pura Vida demonstrates strong performance, particularly in British Columbia and Saskatchewan. The brand consistently ranked 1st or 2nd in these provinces, reflecting a robust consumer preference and brand loyalty. Despite a slight dip in sales in Saskatchewan from January to March, Pura Vida maintained its 2nd place ranking, suggesting resilience in the face of market fluctuations. This performance contrasts with their Vapor Pens category in Ontario, where the brand did not make it into the top 30 rankings, indicating a potential area for growth and increased market penetration.

Competitive Landscape

In the competitive landscape of the concentrates category in Ontario, Pura Vida consistently maintained its rank at 4th place from December 2024 through March 2025. Despite a steady rank, Pura Vida experienced a notable fluctuation in sales, with a decrease from December to February followed by a rebound in March. This pattern suggests potential seasonal influences or promotional strategies that could be impacting sales. In contrast, Nugz, which consistently held the 3rd rank, showed a more stable sales trajectory, maintaining a higher sales volume than Pura Vida throughout the period. Meanwhile, MTL Cannabis remained in the 5th position, trailing behind Pura Vida in both rank and sales, indicating a competitive edge for Pura Vida over MTL Cannabis. The data highlights the importance for Pura Vida to explore strategies to close the gap with higher-ranked competitors like Nugz and Endgame, which dominated the 2nd rank with significantly higher sales figures.

Notable Products

In March 2025, Pura Vida's top-performing product was the Indica Nightfall Honey Oil Drops (30ml) from the Oil category, maintaining its number one rank for four consecutive months with sales of 3,776 units. The Sativa Honey Oil Dispenser (1g) ranked second, consistent with its performance in January and February, although its sales saw a slight increase compared to the previous month. The Indica Honey Oil Dispenser (1g) held steady at the third position, showing a gradual recovery in sales figures from February. Pineapple Express Live Resin Jumbo (1.2g) remained in fourth place, continuing its stable trend across the months. Lastly, the Zombie Kush Cured Resin (1.2g) maintained its fifth position, with sales slightly improving in March compared to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.