Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

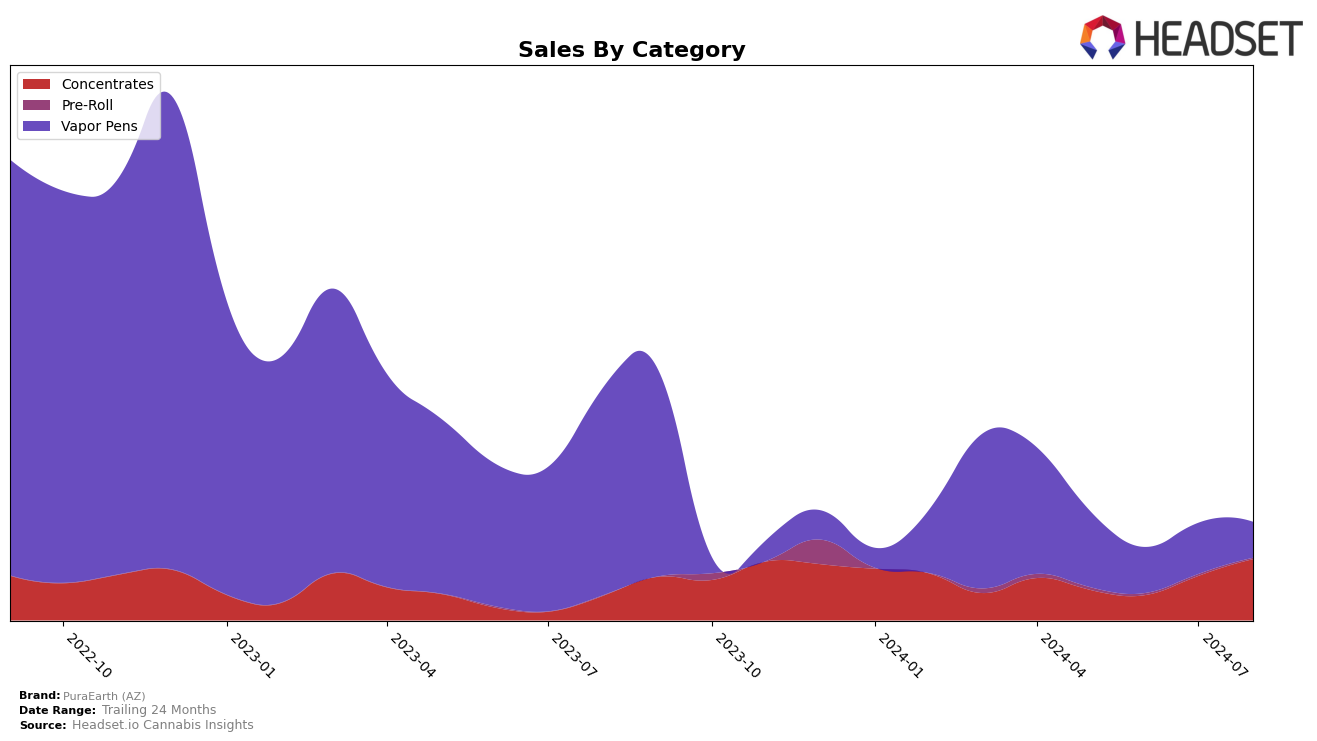

PuraEarth (AZ) has shown notable progress in the Concentrates category within Arizona. Starting from a rank of 40 in both May and June 2024, the brand improved to 34 in July and made a significant leap to 24 in August. This upward trajectory suggests that PuraEarth (AZ) is gaining traction and consumer preference in the Concentrates market, with the sales figures reflecting a substantial increase from $19,363 in June to $47,350 in August. The consistent climb in rankings indicates a positive reception and growing market share in this category.

Conversely, PuraEarth (AZ) has faced challenges in the Vapor Pens category in Arizona. The brand's ranking has fluctuated, starting at 44 in May, dropping to 50 in June, slightly improving to 49 in July, and then returning to 50 in August. Despite these fluctuations, the sales figures show a decline overall from $58,885 in May to $27,444 in August, highlighting potential issues in maintaining a competitive edge in the Vapor Pens market. The brand's struggle to break into the top 30 in this category suggests that there is significant room for improvement in both market strategy and consumer engagement.

Competitive Landscape

In the competitive landscape of the Arizona concentrates market, PuraEarth (AZ) has shown a notable upward trajectory in recent months. Starting from a rank of 40 in May 2024, PuraEarth (AZ) climbed to rank 24 by August 2024, indicating a significant improvement in its market position. This upward movement contrasts with competitors like Curaleaf, which fluctuated between ranks 11 and 22 during the same period, and HOLOH, which saw a decline from rank 15 in May to rank 26 in August. Additionally, Sweet Science and Pressd experienced more stable but less dramatic changes in rank. PuraEarth's (AZ) sales also increased significantly from $19,363 in June to $47,350 in August, suggesting a growing consumer preference and effective market strategies. This positive trend positions PuraEarth (AZ) as a rising player in the Arizona concentrates market, potentially attracting more customers and increasing its market share.

Notable Products

In August 2024, DJ Short Blueberry RSO (1g) maintained its top position as the best-selling product for PuraEarth (AZ), with sales reaching 643 units. Maui Wowie RSO Syringe (1g) held steady at the second rank, showing significant growth from previous months. Gelato RSO (1g) debuted strongly at the third position. Blackberry Kush Distillate Disposable (1g) re-entered the rankings, securing the fourth spot, while CBD/THC 1:1 Hybrid RSO Syringe (1g) dropped to fifth place from its previous third position in July. Overall, the concentrates category dominated the top ranks, reflecting a consistent preference among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.