Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

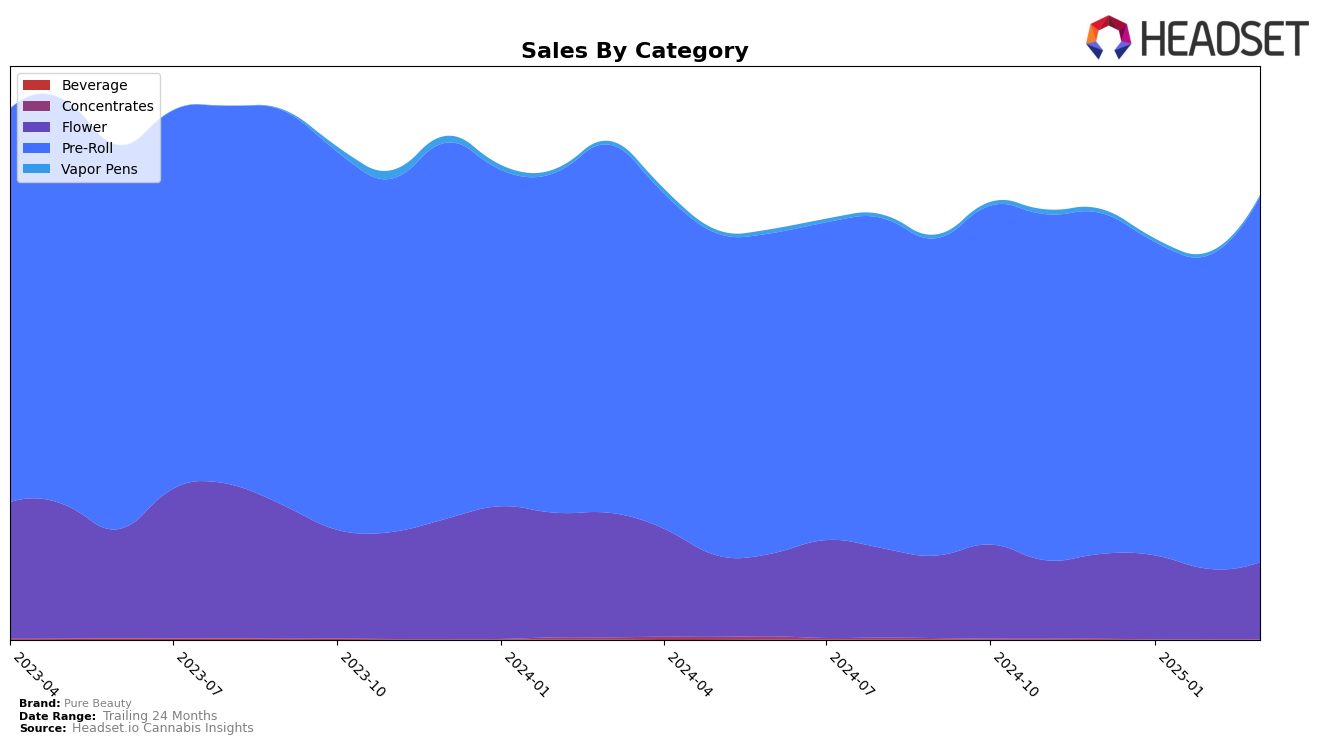

In the California market, Pure Beauty has shown varying performance across different product categories. In the Flower category, the brand's ranking has fluctuated slightly, remaining outside the top 30 throughout the observed months, with ranks of 65 in December 2024 and 67 in March 2025. This indicates a challenge in gaining significant traction in this competitive category. However, Pure Beauty's sales figures in the Flower category show some resilience, with a dip in February 2025 followed by a recovery in March. This suggests potential for improvement if strategic adjustments are made.

Conversely, Pure Beauty has maintained a strong presence in the Pre-Roll category within California, consistently ranking in the top 6 throughout the observed months. This stability is underscored by a notable increase in sales from February to March 2025, indicating a positive trend and strong consumer demand for their Pre-Roll products. The brand's ability to maintain and slightly improve its position in this category is a testament to its strong market appeal and effective product offerings. The contrast between the Flower and Pre-Roll categories highlights the brand's strengths and opportunities for growth in different segments of the market.

Competitive Landscape

In the competitive landscape of the California pre-roll market, Pure Beauty has shown a consistent and commendable performance from December 2024 to March 2025. Maintaining a steady rank of 6th in December and January, Pure Beauty improved to 5th place by February and held this position through March. This upward trend in rank is indicative of its growing market presence, despite the fierce competition. Notably, Presidential consistently held the 3rd position, showcasing a strong foothold with higher sales figures. Meanwhile, Kingpen experienced fluctuations, dropping to 9th in February before recovering to 7th in March, which suggests volatility that Pure Beauty has managed to avoid. Additionally, Pacific Stone improved its rank from 8th to 6th by March, closely trailing Pure Beauty. The consistent 4th position of Claybourne Co. further highlights the competitive environment Pure Beauty operates in, making its rank improvement all the more notable. These insights underscore Pure Beauty's strategic positioning and potential for continued growth in the California pre-roll market.

Notable Products

In March 2025, the top-performing product from Pure Beauty was the Yellow Box Babies - Sativa Blend Mini Pre-Roll 10-Pack, maintaining its number one ranking from the previous two months with impressive sales of 13,074 units. The Black Box Babies - Hybrid Blend Mini Pre-Roll 10-Pack held steady at the second position, showing a consistent performance despite a slight dip earlier in January. The Pink Box Babies - Indica Blend Mini Pre-Roll 10-Pack remained in third place throughout the period, demonstrating stable demand. The Yellow Box - Sativa Blend Pre-Roll 5-Pack retained its fourth position, with a modest increase in sales compared to February. Finally, the White Box - Pure Beauty Babies - CBD Blend Mini Pre-Roll 10-Pack consistently ranked fifth, indicating a steady, albeit smaller, customer base.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.