Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the state of Colorado, Pure Blaze Pre-Rolls have consistently demonstrated a strong presence in the Pre-Roll category. They maintained a solid position at rank 3 in both December 2024 and January 2025. However, in February 2025, there was a slight dip as they moved to rank 5, only to recover back to rank 3 by March 2025. This fluctuation indicates a competitive landscape in the Colorado market, where Pure Blaze Pre-Rolls continue to hold significant ground, despite temporary shifts in their ranking.

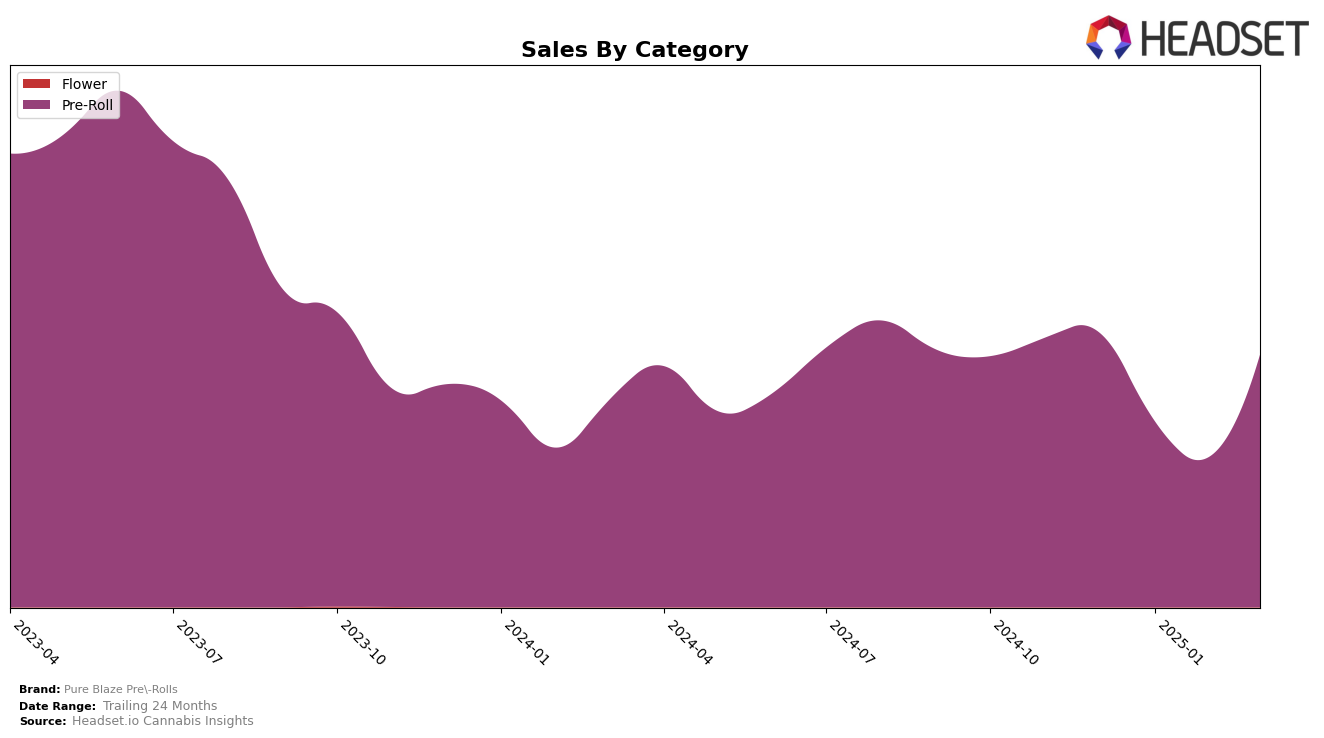

Analyzing the sales trend for Pure Blaze Pre-Rolls in Colorado, there was a noticeable decrease from December 2024 to February 2025, with sales dropping from $526,918 to $289,031. However, March 2025 saw a rebound in sales, reaching $484,236, which suggests a potential seasonal factor or successful promotional strategies that helped recapture market share. This resilience in bouncing back to a strong position underscores the brand's adaptability and appeal in the Colorado market, even though it briefly fell out of the top three rankings.

Competitive Landscape

In the competitive landscape of the pre-roll category in Colorado, Pure Blaze Pre-Rolls has experienced notable fluctuations in its market position over the past few months. Despite a strong start in December 2024, holding the 3rd rank, Pure Blaze saw a dip to the 5th position by February 2025, before recovering to 3rd place in March 2025. This volatility is influenced by the consistent performance of brands like Kaviar, which maintained a top 2 position throughout the period and even claimed the top spot in March 2025, and Cali-Blaze, which dominated the 1st rank until slipping to 2nd in March. Meanwhile, Green Dot Labs remained a steady competitor, consistently ranking around 3rd to 4th, while Seed & Strain Cannabis Co. showed a promising upward trend, climbing from 11th in December to 5th by March. These dynamics suggest that while Pure Blaze Pre-Rolls is a strong contender, it faces intense competition from both established and emerging brands, necessitating strategic efforts to stabilize and enhance its market position.

Notable Products

In March 2025, Mac & Cheese Pre-Roll (1g) maintained its top position as the best-selling product from Pure Blaze Pre-Rolls, achieving impressive sales of 19,767 units. Pachamama Pre-Roll (1g) climbed to the second position, showing a significant increase from its fourth place in February. Blueberry Headband Pre-Roll (1g) made an impressive leap to third place, previously ranked fifth in February. Orange Cookie Kush Pre-Roll (1g) entered the rankings at fourth place, while Golden Strawberry Pre-Roll (1g) rounded out the top five, having reappeared in the rankings after being unlisted in February. This indicates a dynamic shift in consumer preferences within the product line, with notable gains for newcomers like Blueberry Headband Pre-Roll (1g).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.