Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

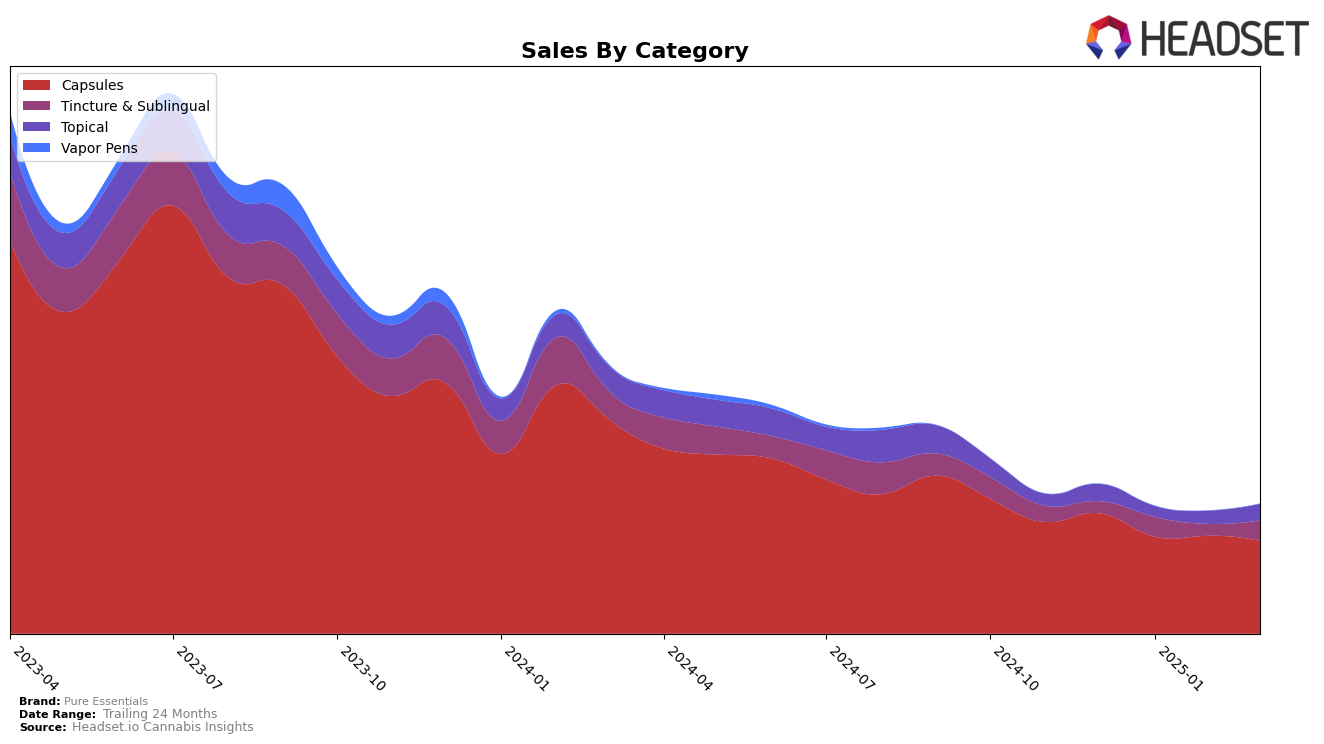

In Illinois, Pure Essentials has demonstrated consistent performance in the Capsules category, maintaining a solid third place ranking from December 2024 through March 2025. However, despite this stable ranking, there is a noticeable downward trend in sales figures, with a decrease from December's $93,886 to March's $72,212. This suggests a potential challenge in sustaining consumer interest or competitive pressures within the market. In the Tincture & Sublingual category, Pure Essentials experienced fluctuations in their ranking, being absent from the top 30 in December and February, but achieving fifth place in January and March. This inconsistency could indicate sporadic consumer demand or the impact of seasonal factors.

The Topical category in Illinois shows a similar pattern of volatility for Pure Essentials, where the brand was ranked fifth in December, absent in January, and then returned to fifth place in February and March. This irregular ranking, combined with varying sales figures, reflects a potential challenge in maintaining a steady market presence in this category. The absence from the top 30 in certain months highlights the competitive nature of the market and suggests that Pure Essentials may need to evaluate its strategy to capture a more consistent share. These movements across different categories in Illinois provide insights into the brand's strengths and areas for potential growth, offering a glimpse into the dynamics of the cannabis market in the state.

Competitive Landscape

In the Illinois capsules category, Pure Essentials consistently holds the third rank from December 2024 to March 2025, indicating a stable position in the market. Despite this consistent ranking, Pure Essentials faces significant competition from brands like 1906 and Avexia, which occupy the first and second positions, respectively. The sales figures for Pure Essentials show a slight downward trend, contrasting with the relatively higher sales of 1906, which maintains a strong lead in sales volume. Meanwhile, Breez and Kalm Fusion (K Fusion) remain stable in the fourth and fifth positions, respectively, with lower sales figures compared to Pure Essentials. This competitive landscape suggests that while Pure Essentials maintains a solid rank, there is room for growth in sales to close the gap with the leading brands.

Notable Products

In March 2025, Sativa Momentum Capsules 10-Pack (100mg) maintained its position as the top-performing product for Pure Essentials, leading the sales with 832 units sold. Indica Deep Sleep Night Capsules 10-Pack (100mg) rose to the second spot from an unranked position in February, highlighting a resurgence in popularity. Cronuts #4 Capsules 10-Pack (100mg) consistently held the third rank, showing stable performance over the months. Relax Hybrid Chill Pill Capsule 10-Pack (100mg) improved its position from fifth in February to fourth in March, indicating growing consumer interest. CBD/THC 2:1 Body Oil (200mg CBD, 100mg THC, 15ml) re-entered the rankings at the fifth spot, showcasing a renewed demand for topical products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.