Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

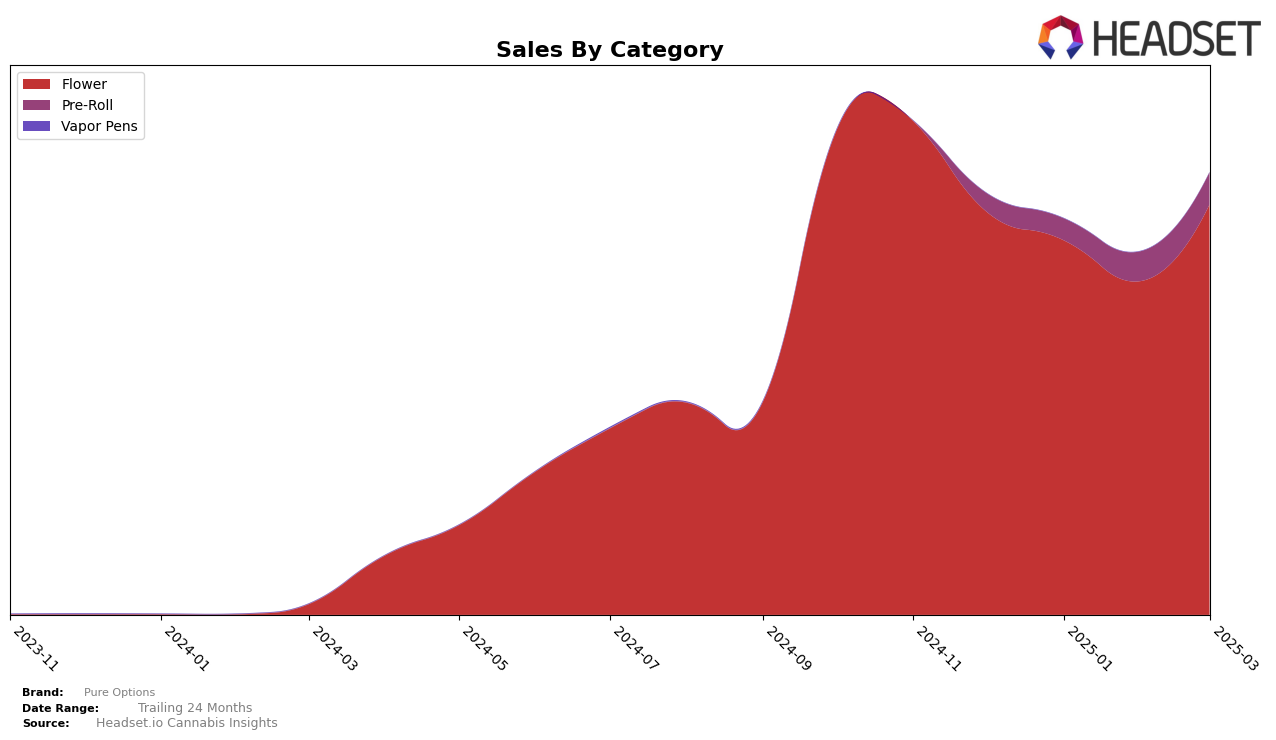

In the state of Michigan, Pure Options has shown a consistent performance in the Flower category over the recent months. The brand maintained a presence within the top 10, although it experienced a slight dip from 7th place in December 2024 to 10th place in February 2025, before rebounding to 9th in March. This fluctuation in rankings corresponds with a notable increase in sales from February to March, indicating a potential recovery or strategic adjustment that positively impacted their market position. Such resilience in a competitive category highlights Pure Options' ability to navigate market dynamics effectively.

In contrast, the Pre-Roll category paints a different picture for Pure Options in Michigan. Initially outside the top 30, the brand made significant strides, climbing to 44th place by February 2025. This upward trajectory suggests an increasing consumer interest or improved distribution strategy, culminating in a steady position at 45th in March. While not yet breaking into the top 30, the continuous improvement in sales figures from December through March is a positive indicator of growth potential within this category. This performance hints at underlying factors that may be driving the brand's expanding footprint in the Pre-Roll segment.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Pure Options has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 7th in December, Pure Options saw a slight decline to 8th in January and further to 10th in February, before recovering to 9th in March. This period of volatility contrasts with the upward trajectory of competitors like Redemption, which climbed from 26th in December to an impressive 8th by March, and Goodlyfe Farms, maintaining a strong position within the top 10 throughout the months. Meanwhile, The Limit showed a similar pattern to Pure Options, peaking at 6th in February before dropping to 11th in March. Despite these challenges, Pure Options' sales figures indicate resilience, with a recovery in March that suggests potential for regaining higher ranks if this positive trend continues. Understanding these dynamics can provide critical insights for stakeholders looking to navigate the competitive Michigan flower market effectively.

Notable Products

In March 2025, Pure Options' top-performing product was the Apple Diesel Pre-Roll (1g) in the Pre-Roll category, leading with sales of $22,393. Blue Cookies Pre-Roll (1g) and Super Silver Haze Pre-Roll (1g) followed closely in second and third positions, respectively. Banana Runtz Pre-Roll (1g) secured the fourth rank, while Black Cherry Punch Pre-Roll (1g) rounded out the top five. Notably, these products were not ranked in the previous months, indicating a significant surge in popularity. This shift suggests a strategic change or an increase in consumer preference for these particular Pre-Roll products in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.