Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

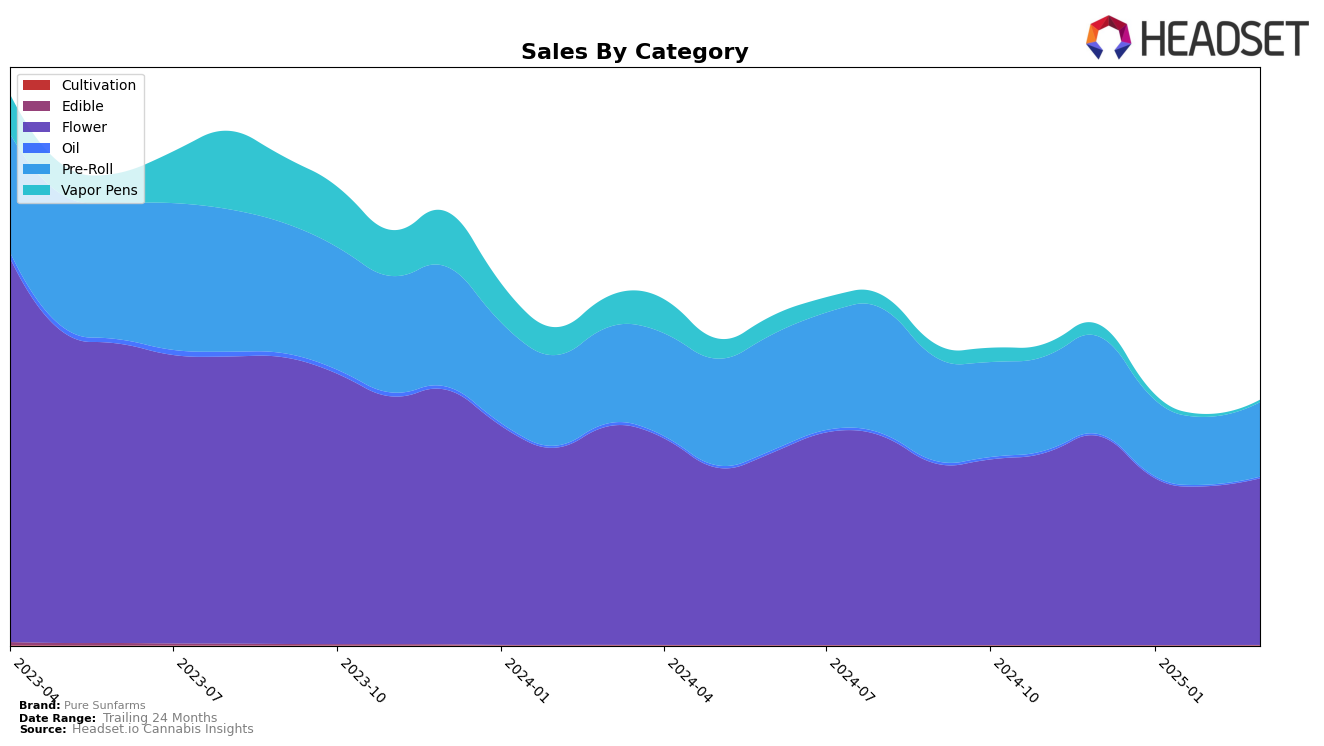

Pure Sunfarms has demonstrated a consistent presence in the Alberta market, particularly in the Flower category, where it maintained a strong position, ranking 5th in December 2024, slightly improving to 4th in January 2025, and then settling back to 5th in February and March 2025. This stability in ranking indicates a solid foothold in the Flower category within Alberta. However, in the Pre-Roll category, the brand saw a downward trend, slipping from 14th position in December 2024 to 21st by March 2025. This suggests a potential area for improvement or a shift in consumer preferences within the Pre-Roll segment in Alberta.

In Ontario, Pure Sunfarms has consistently held the 4th position in the Flower category from December 2024 through March 2025, indicating a strong and stable market presence. The Pre-Roll category saw a slight decline, moving from 10th to 12th over the same period, which might reflect increased competition or changing consumer tastes. Interestingly, Pure Sunfarms did not rank in the top 30 for Vapor Pens in Ontario after December 2024, where it was 36th, highlighting a potential gap in market penetration or consumer engagement in this category. In Saskatchewan, the brand was present in the Flower category, ranking 17th in December 2024 and improving slightly to 16th in January 2025, but it did not maintain a top 30 position in the subsequent months, suggesting challenges in sustaining its market position there.

Competitive Landscape

In the competitive landscape of the Ontario flower market, Pure Sunfarms consistently maintained its position at rank 4 from December 2024 to March 2025. Despite a stable ranking, Pure Sunfarms faces stiff competition from brands like Shred and Spinach, which have consistently held higher ranks, with Shred securing the top position in December 2024 before moving to second place, and Spinach maintaining the third position from January to March 2025. While Pure Sunfarms' sales figures show a slight decline from December 2024 to February 2025, there is a positive uptick in March 2025, indicating potential recovery or strategic adjustments. Meanwhile, Good Supply remains a close competitor, holding the fifth position consistently, suggesting a tight race in sales volume among these brands. The dynamics in this market highlight the importance for Pure Sunfarms to innovate and differentiate to climb the ranks and capture a larger market share.

Notable Products

In March 2025, Pure Sunfarms' top-performing product was Pink Kush Pre-Roll 10-Pack (3g) in the Pre-Roll category, maintaining its position at rank 1 with sales of 27,608 units. Pink Kush (3.5g) and Pink Kush (7g), both in the Flower category, held steady at ranks 2 and 3, respectively. Blue Dream Pre-Roll 10-Pack (3g) remained at rank 4 in the Pre-Roll category, while Pink Kush Pre-Roll 3-Pack (1.5g) consistently occupied the 5th position. Notably, all top products have maintained their rankings from December 2024 through March 2025, indicating stable consumer preferences. The consistent rankings suggest that Pure Sunfarms' Pink Kush variants continue to dominate their respective categories without any significant shifts in consumer demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.