Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

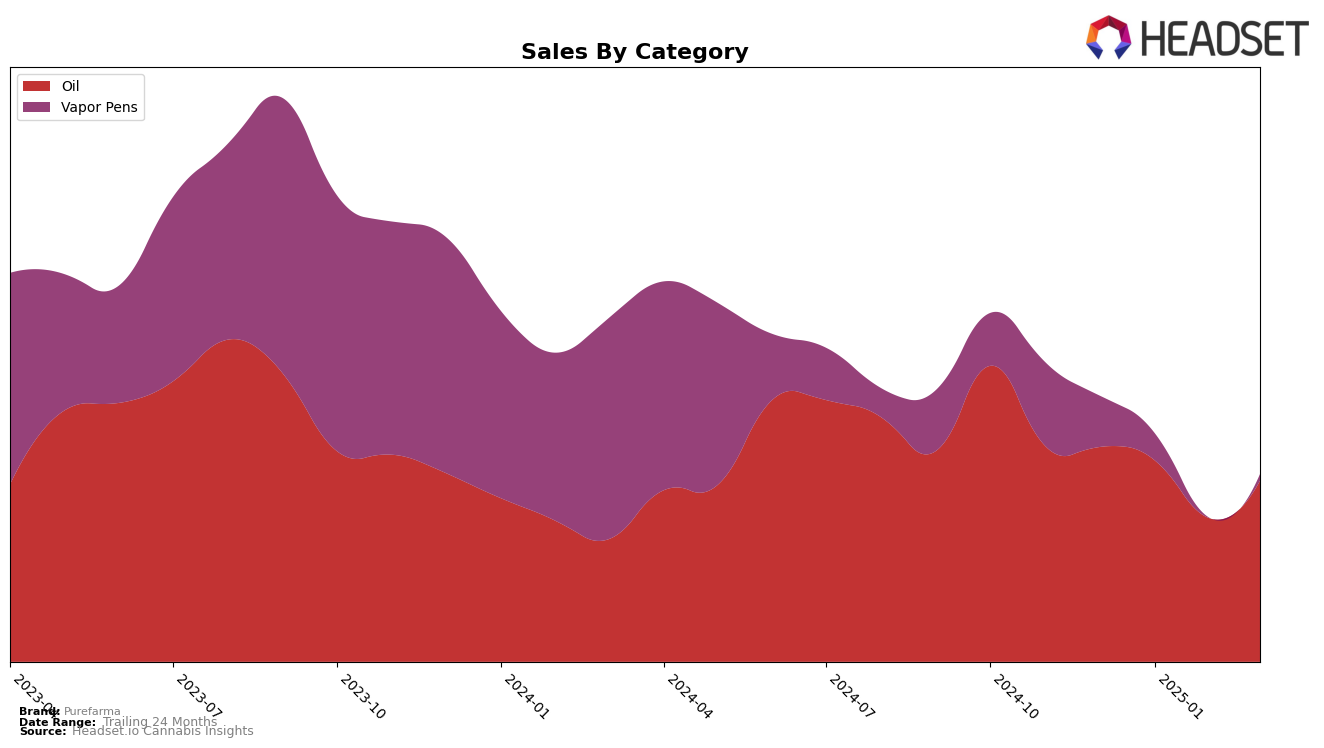

Purefarma has shown a consistent presence in the British Columbia market within the Oil category. Over the months from December 2024 to March 2025, the brand has maintained a steady position, ranking 7th in both December 2024 and February 2025, while slightly dropping to 8th in January and March 2025. This minor fluctuation in rankings indicates a relatively stable performance, suggesting that Purefarma has a solid foothold in the British Columbia oil segment. However, the decrease in sales from December 2024 to February 2025, followed by a recovery in March, could point to seasonal demand variations or competitive pressures in the market.

Despite the fluctuations, Purefarma's ability to remain in the top 10 brands within the oil category in British Columbia is noteworthy. The absence of rankings outside the top 30 signifies that the brand maintains a competitive edge in this region, even amidst minor rank changes. This performance underscores the brand's resilience and potential for growth in the British Columbia market, although there are areas for improvement to regain and sustain higher rankings consistently. Observing these trends can provide insights into the brand's strategies and market positioning, yet there remains more to uncover about their competitive tactics and consumer engagement practices.

Competitive Landscape

In the competitive landscape of the oil category in British Columbia, Purefarma has demonstrated resilience and consistency, maintaining a steady rank between 7th and 8th from December 2024 to March 2025. Despite facing fierce competition, Purefarma's sales trajectory shows a notable recovery in March 2025, rebounding to 42,356 from a dip in February. Frank consistently outperformed Purefarma, holding a solid 6th place throughout the period, with significantly higher sales figures. Meanwhile, LoFi Cannabis closely rivals Purefarma, frequently swapping ranks, but ultimately ending March 2025 slightly ahead in sales. Emprise Canada and DayDay trail behind, with Emprise Canada not breaking into the top 10 until January 2025 and DayDay slipping to 10th by March. This competitive environment underscores the importance for Purefarma to leverage its sales momentum and strategic positioning to climb higher in the rankings.

Notable Products

In March 2025, Purefarma's top-performing product was CBD Hemplixir 30 Oil (30ml), maintaining its position as the number one ranked product since December 2024, with a sales figure of 1496 units. The CBD Earth Full Spectrum Cartridge (1g) held steady at the second rank throughout the same period, indicating consistent demand. Similarly, the CBD Earth Full Spectrum Disposable (1g) remained in third place, showing a stable but lower sales volume. Notably, Hemplixir 100 CBD Oil (30ml), which was ranked fourth in December 2024 and January 2025, did not appear in the rankings for February and March 2025, suggesting a potential discontinuation or stock issue. Overall, the rankings for March 2025 reflect a stable product performance for Purefarma, with their oils and vapor pens consistently leading in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.