Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

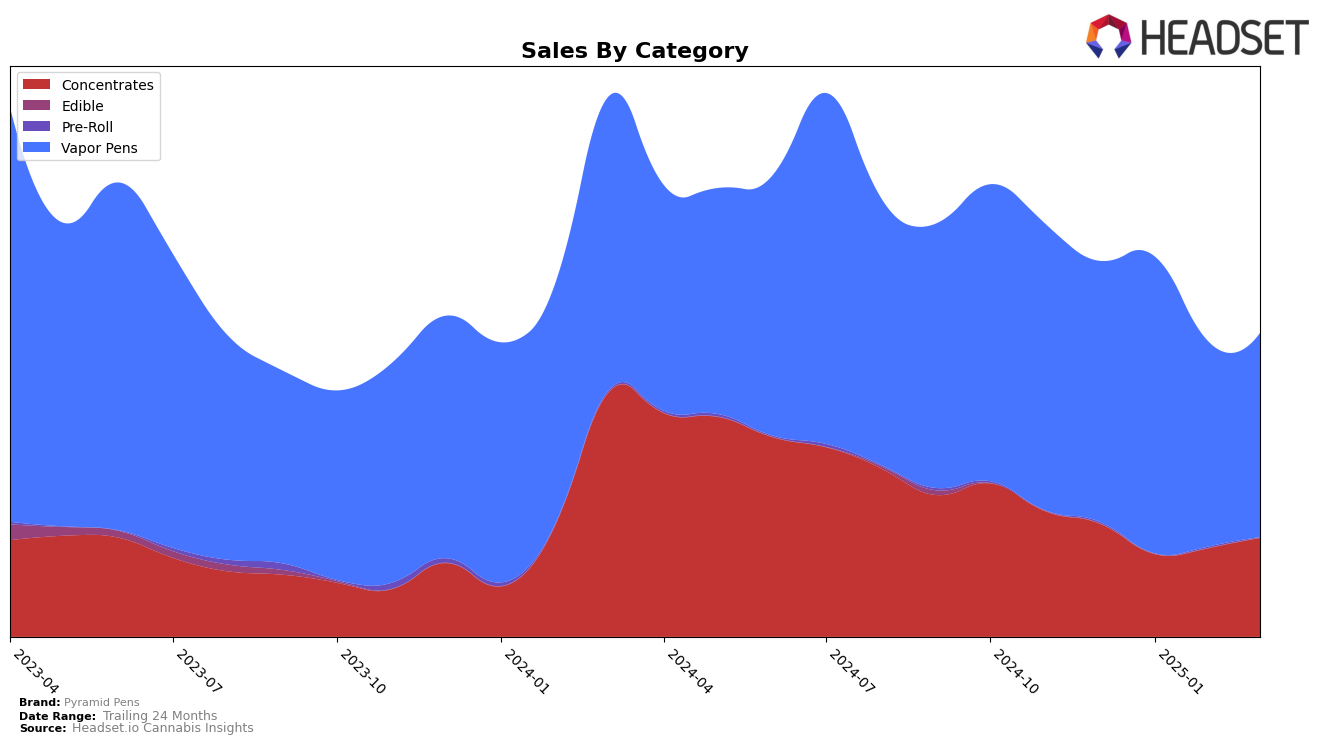

Pyramid Pens has shown varied performance across different states and categories. In the Colorado market, their presence in the Vapor Pens category has been inconsistent, with rankings fluctuating from 38th in December 2024 to 37th by March 2025, never breaking into the top 30. This indicates challenges in gaining a strong foothold in the competitive Colorado market. The sales figures in Colorado also reflect a downward trend from December to March, suggesting a potential need for strategic adjustments to boost their market position and sales performance in this state.

Conversely, in New Jersey, Pyramid Pens has maintained a more stable and noteworthy presence in the Concentrates category, consistently ranking within the top 6 for the given months. This stability is complemented by a positive sales trajectory from January to March 2025, which could be indicative of successful market strategies or strong consumer loyalty. In the Vapor Pens category in New Jersey, the brand experienced a slight dip in rankings in February but managed to recover slightly by March. This suggests a dynamic market environment where Pyramid Pens is actively competing and adapting. Overall, their performance in New Jersey contrasts with their challenges in Colorado, highlighting the importance of tailored strategies for different regional markets.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Pyramid Pens experienced fluctuating rankings and sales from December 2024 to March 2025. Notably, Pyramid Pens improved its rank from 21st in December 2024 to 18th in January 2025, indicating a positive reception during the start of the year. However, by February 2025, it dropped out of the top 20, ranking 25th, before slightly recovering to 22nd in March 2025. This volatility suggests challenges in maintaining consistent market traction. In contrast, Illicit / Illicit Gardens maintained a stronger presence, consistently ranking within the top 20, though it also saw a slight decline from 18th in December to 21st in March. Meanwhile, Entourage showed resilience by rebounding to 20th place in March after a significant drop to 34th in February. The competitive dynamics highlight the need for Pyramid Pens to strategize effectively to stabilize and improve its market position amidst strong contenders like Kind Tree Cannabis and Later Days, which also experienced fluctuations but remained close competitors.

Notable Products

In March 2025, Pyramid Pens' top-performing product was the Super Lit Budder Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 964 units. Following closely, the Prism - Cosmic Cookies Distillate Cartridge (1g) and Prism - Butter Cream Cookies Distillate Cartridge (1g) secured the second and third positions, respectively. The Lemon Shortbread Budder Cartridge (1g) ranked fourth, while the Trop Cookies Distillate Cartridge (1g) rounded out the top five. Compared to previous months, these products have consistently maintained their rankings, indicating stable consumer demand. The consistent performance of these top products suggests a strong brand presence and customer loyalty in the market for Pyramid Pens.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.