Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

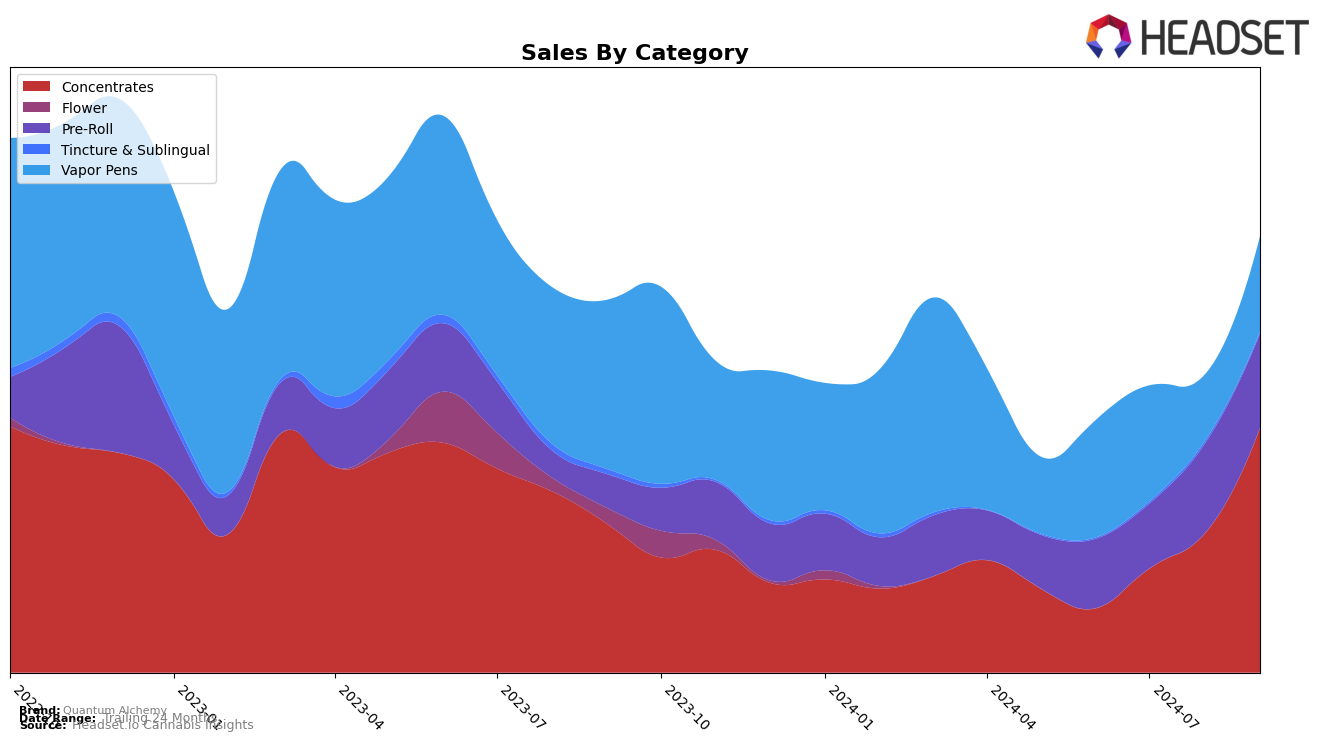

Quantum Alchemy has shown a notable upward trajectory in the Oregon market, particularly in the Concentrates category. Over a span of four months, the brand has climbed from a rank of 54 in June 2024 to an impressive 18 by September 2024. This rise in ranking is accompanied by a significant increase in sales, indicating a growing consumer preference for their concentrates. However, in the Pre-Roll category, Quantum Alchemy has not yet broken into the top 30, with rankings remaining relatively stagnant, hovering in the 60s and 70s range. This suggests that while their concentrates are gaining traction, other product lines may need strategic adjustments to improve their market standing.

In the Vapor Pens category, Quantum Alchemy's performance in Oregon has been less consistent. The brand's ranking fluctuated over the months, dropping to 70 in August before recovering to 55 in September. This volatility might indicate a competitive landscape or varying consumer preferences within this segment. Despite these challenges, the brand's sales figures for vapor pens show some resilience, suggesting potential for future growth if they can stabilize their market position. Overall, Quantum Alchemy's performance in Oregon presents a mixed picture, with clear strengths in concentrates but room for growth in other categories.

Competitive Landscape

In the Oregon concentrates market, Quantum Alchemy has shown a remarkable upward trajectory over the past few months, climbing from a rank of 54 in June 2024 to 18 by September 2024. This significant improvement in rank indicates a strong increase in market presence and consumer preference, likely driven by strategic marketing or product innovation. In contrast, Oregrown, which started at rank 7 in June, has seen a decline to rank 16 by September, suggesting a potential shift in consumer loyalty or competitive pressure. Meanwhile, Beehive Extracts has maintained a relatively stable position around rank 17, indicating steady performance without significant growth or decline. Happy Cabbage Farms and Calyx Crafts have also shown upward movement, but not as pronounced as Quantum Alchemy, which suggests that Quantum Alchemy's strategies might be more effective in capturing market share. This competitive landscape highlights Quantum Alchemy's potential to continue its growth trajectory if it maintains its current momentum and strategic initiatives.

Notable Products

In September 2024, the top-performing product for Quantum Alchemy was Memory Loss RSO (1g) in the Concentrates category, maintaining its number one rank from the previous months with sales reaching 3,257 units. Hella Nasty Live Resin (1g), also in Concentrates, debuted impressively in the rankings at the second position. Alaskan Blackberry Pre-Roll 2-Pack (1g) advanced to third place in the Pre-Roll category, showing a significant increase from its fourth position in June and August. Glizzystick - Durban Dawg Infused Blunt (1.7g) entered the top five, securing the fourth spot in the Pre-Roll category. Wappa Shatter (1g) completed the top five list in the Concentrates category, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.