May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

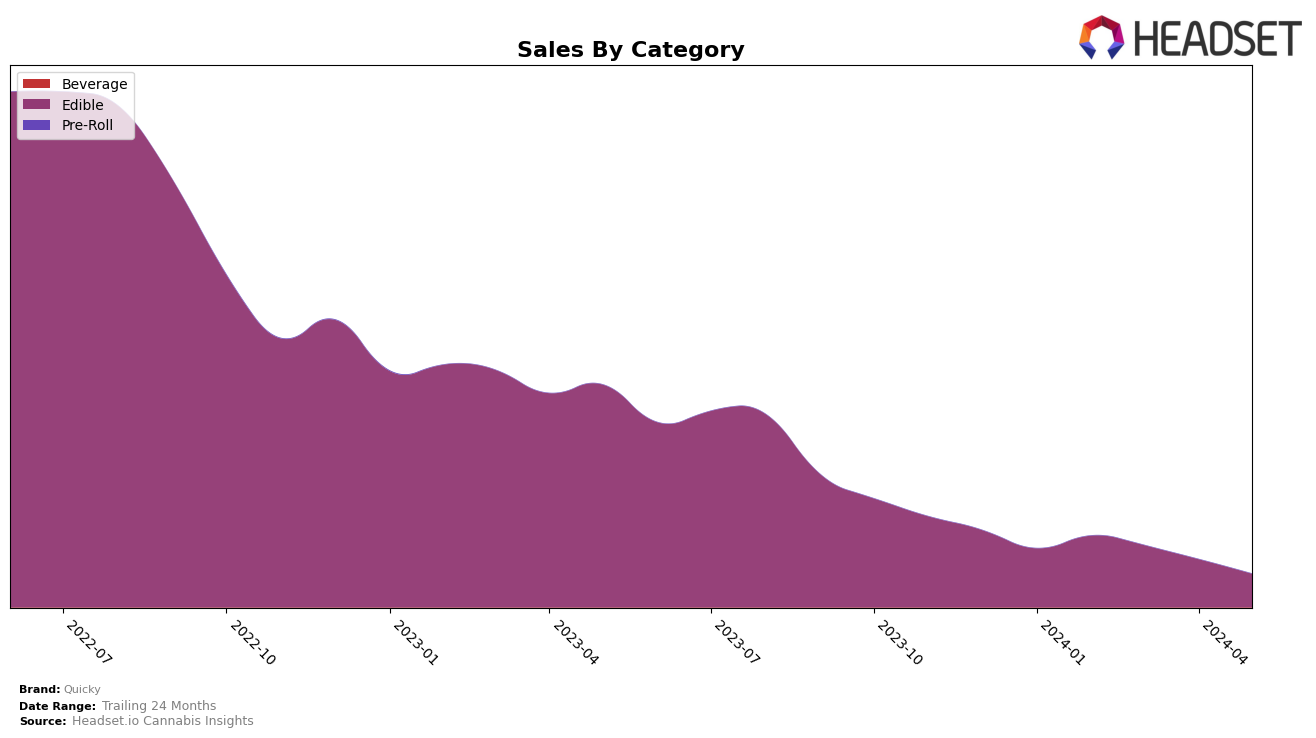

Quicky's performance across different categories and states shows a mixed trend, with notable shifts in rankings and sales figures. In Michigan, the brand's presence in the Edible category has seen a downward trajectory. Starting from the 45th position in February 2024, Quicky slipped to 58th by May 2024. This decline is reflected in their sales, which dropped from $113,530 in February to $52,671 in May. The absence of Quicky in the top 30 rankings during these months indicates a significant challenge in maintaining market share in Michigan's competitive edible market.

On the other hand, Quicky's performance in other states and categories could provide a contrasting picture, but the available data specifically highlights the need for strategic adjustments in Michigan. The consistent fall in rankings and sales points to potential issues such as market saturation, increased competition, or perhaps a need for product innovation. It's crucial for stakeholders to analyze these trends closely and consider targeted marketing or product development efforts to regain momentum. For a more comprehensive understanding of Quicky's performance across other regions and product categories, further detailed analysis would be beneficial.

Competitive Landscape

In the competitive landscape of the Edible category in Michigan, Quicky has experienced notable fluctuations in its rank and sales over the past few months. Despite starting strong in February 2024 with a rank of 45, Quicky's position has gradually declined, reaching 58 by May 2024. This downward trend is mirrored in its sales, which dropped from $113,530 in February to $52,671 in May. In contrast, Redbud Roots saw a more stable performance, improving its rank from 63 to 60 and maintaining relatively higher sales figures. Similarly, Harbor Farmz experienced a significant rank drop from 39 in February to 70 in April, before recovering to 50 in May, with sales showing a similar pattern. Meanwhile, Gold Crown exhibited a consistent rank improvement from 87 to 64, although its sales remained lower than Quicky's. Lastly, Mac Pharms had an inconsistent presence, missing the top 20 in April but rebounding to a rank of 55 in May. These trends suggest that while Quicky is facing challenges in maintaining its market position, competitors like Redbud Roots and Gold Crown are steadily improving, potentially capturing more market share.

Notable Products

In May-2024, the top-performing product from Quicky was Lemon Pop (10mg) in the Edible category, jumping from no rank in April to the first position with sales reaching 3990. Watermelon Pop (10mg) dropped from first place in April to second place in May. Blue Raz Gummies (10mg) climbed up to third place from fifth in April. Cherry Pop (10mg) experienced a significant drop, moving from second in April to fourth in May. Lastly, Cherry Gummy (10mg) re-entered the rankings at fifth place after being unranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.