Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

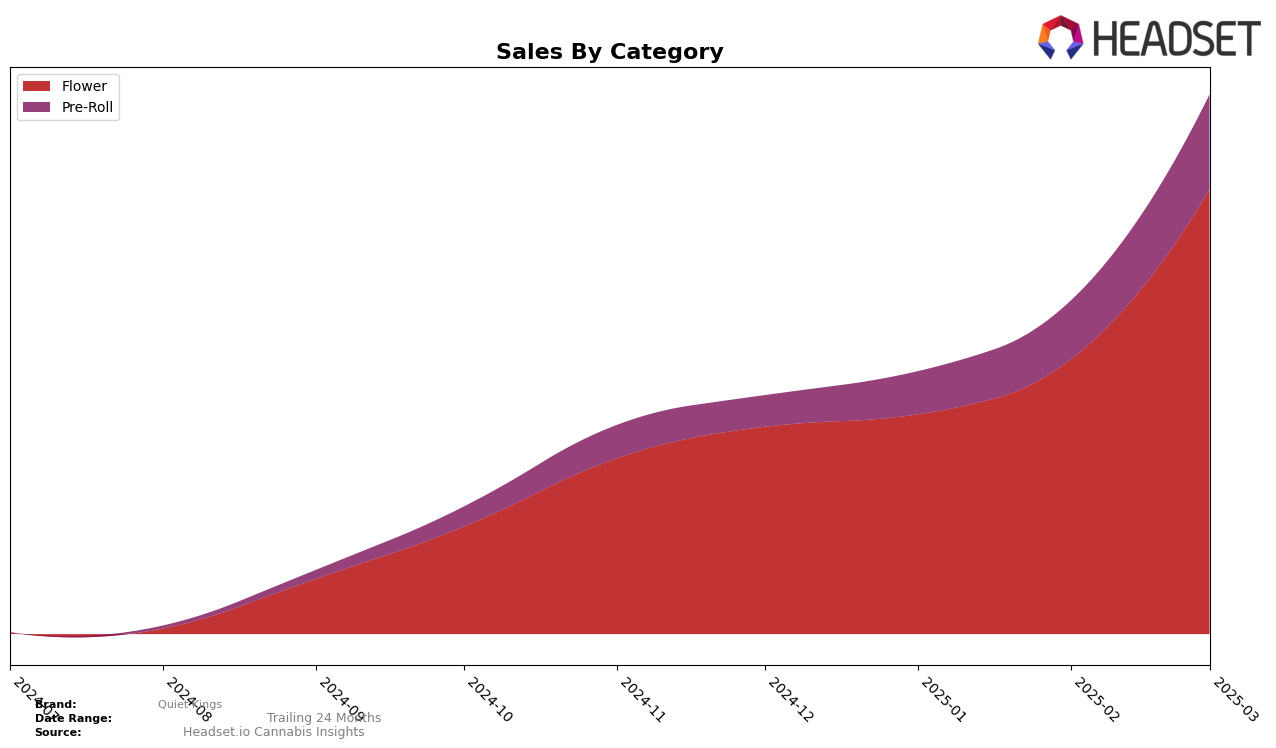

Quiet Kings has shown a promising upward trajectory in the California market, particularly in the Flower category. Starting from a rank of 42 in December 2024, the brand improved its position to 16 by March 2025. This progression indicates a significant increase in market presence and consumer preference, with sales figures reflecting this growth. The brand's ability to break into the top 30 is noteworthy, especially considering the competitive nature of the cannabis market in California. Such a performance suggests that Quiet Kings is effectively leveraging its product offerings to capture consumer interest, although there remain opportunities for further growth and market penetration.

In the Pre-Roll category, Quiet Kings has also made substantial strides, moving from a rank of 88 in December 2024 to 33 by March 2025 in California. While not yet in the top 30, this movement is indicative of a growing foothold in a highly competitive segment. The brand's consistent improvement over the months suggests a strategic focus on enhancing product quality and consumer engagement. However, the absence of Quiet Kings from the top 30 in earlier months highlights areas where the brand could further enhance its market strategy to achieve higher rankings and greater visibility. The trend suggests a positive outlook, but continued efforts will be necessary to maintain and build upon this momentum.

Competitive Landscape

In the competitive landscape of the California flower category, Quiet Kings has demonstrated a remarkable upward trajectory in rank and sales over the past few months. Starting from a rank of 42 in December 2024, Quiet Kings has climbed to 16 by March 2025, indicating a significant rise in market presence. This ascent is particularly notable when compared to competitors such as Dime Bag (CA), which has seen a decline from rank 15 to 18, and Alien Labs, which dropped from rank 8 to 15. Meanwhile, Delighted has experienced a dramatic improvement, moving from rank 27 to 14, surpassing Quiet Kings in March. Despite this, Quiet Kings' sales have shown a consistent upward trend, closing the gap with higher-ranked brands and suggesting a growing consumer preference. This positive momentum positions Quiet Kings as a formidable contender in the California flower market, poised to challenge established brands and capture a larger market share.

Notable Products

In March 2025, Quiet Kings saw Lemon Zest Pre-Roll (1g) leading the sales chart, maintaining its top position from February with impressive sales of 5414 units. Gary Payton Pre-Roll (1g) emerged as a strong contender, securing the second spot with notable sales figures. Fuel OG Pre-Roll (1g) consistently performed well, ranking third, despite a slight drop from its second-place position in February. Jet Fuel Gelato Pre-Roll (1g) and Garlatti Pre-Roll (1g) followed closely, ranking fourth and fifth, respectively. These rankings highlight a dynamic shift from previous months, with new entries like Gary Payton Pre-Roll making a significant impact in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.