Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

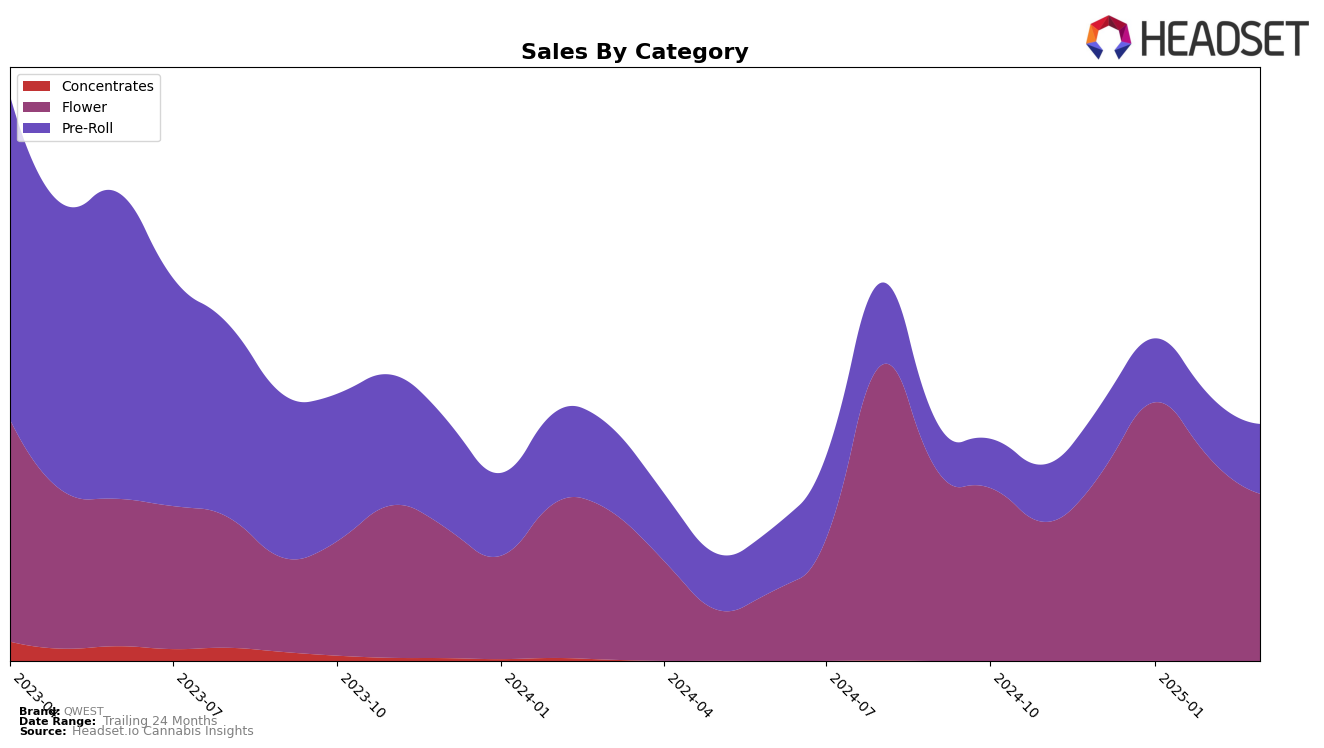

In the Canadian cannabis market, QWEST has shown varied performance across different provinces and product categories. In Alberta, QWEST's presence in the Flower category was notably strong, with a significant jump from 21st place in December 2024 to 10th place in January 2025, although it slightly dipped to 14th by March 2025. This suggests a solid performance, possibly driven by seasonal demand or effective marketing strategies. However, the Pre-Roll category in Alberta did not fare as well, with rankings fluctuating outside the top 30, indicating a potential area for improvement. Meanwhile, in British Columbia, QWEST maintained a relatively stable position in the Flower category, though it did not break into the top 30 for Pre-Rolls in February 2025, which might be a concern for the brand's market penetration in this category.

In Ontario, QWEST's performance in the Flower category remained consistent but did not reach the top 30, highlighting a competitive market landscape that the brand may need to navigate more strategically. The Pre-Roll category in Ontario, however, showed improvement, with QWEST climbing to 73rd place in February 2025 from being outside the top 30 in December 2024, suggesting a positive trend that could be leveraged for further growth. Interestingly, in Saskatchewan, QWEST's rankings were only available for December 2024, with the Flower and Pre-Roll categories at 41st and 47th, respectively, implying either a lack of data or a minimal presence in subsequent months. This absence from the rankings could indicate a strategic withdrawal or a need for increased focus in these regions.

Competitive Landscape

In the competitive landscape of the Alberta flower category, QWEST has demonstrated notable fluctuations in rank and sales over the past few months. Starting from a position outside the top 20 in December 2024, QWEST surged to the 10th rank by January 2025, indicating a significant upward trend. However, this momentum slightly waned as it slipped to the 11th and then 14th positions in February and March 2025, respectively. Despite this, QWEST's sales in January 2025 were notably higher than those of competitors like Shred and Divvy, although it remained behind Bake Sale, which consistently maintained a higher rank. This dynamic indicates that while QWEST has the potential to climb the ranks, it faces stiff competition from established brands, necessitating strategic marketing efforts to sustain and enhance its market position.

Notable Products

In March 2025, the top-performing product for QWEST was Grandi Guava (7g) in the Flower category, which climbed to the number one rank from its consistent second place in January and February, achieving sales of 3,499 units. Morning Sun (7g), also in the Flower category, rose to second place from its previous fourth position, indicating a positive trend in consumer preference. Bubble Bath Pre-Roll 10-Pack (3.5g) experienced a drop to third place after leading in February, with sales slightly decreasing to 2,842 units. The 35s- Grape Cream Cake Pre-Roll 10-Pack (3.5g) entered the rankings for the first time in March, securing the fourth spot. Grape Cream Cake (7g) saw a decline in its ranking, moving from third in February to fifth in March, reflecting a decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.